After years of dramatic sales growth the global smartphone market is slowing down, according to new data from analysts CCS Insight. The firm is forecasting global smartphone sales growth of 25% in 2014, down from 40% last year and slowing further to 15% in 2015.

October 15, 2014

After years of dramatic sales growth the global smartphone market is slowing down, according to new data from analysts CCS Insight. The firm is forecasting global smartphone sales growth of 25% in 2014, down from 40% last year and slowing further to 15% in 2015.

The main driver of smartphone sales growth in recent years has been people converting from feature phones, rather than completely new entrants to the mobile phone market. Western markets have had a high level of smartphone penetration for some time now, so the main growth driver in the past couple of years has been developing markets, especially China. Now that they too are nearing smartphone saturation the growth is dropping off.

In contrast, CCS forecasts, the total global mobile phone market will only grow by 6% due to the continued rapid decline in feature phone sales, which are forecasted to account for just 17% of sales by 2018. Of the 1.9 billion smartphones CCS reckons will be sold in 2018, over a billion will be 4G and a third of those will be accounted for by China alone.

Another consequence of the shift in smartphone volumes to developing markets is a fall in their average selling price. “Over the last four years we saw sustained growth in the average selling price of mobile phones as consumers in developed markets embraced smartphones, in many cases fuelled by Apple’s ascendency,” said Marina Koytcheva, Director of Forecasting at CCS Insight. “This transition is almost complete and the biggest volumes have shifted to growth markets where lower priced smartphones dominate, and driving average prices down.”

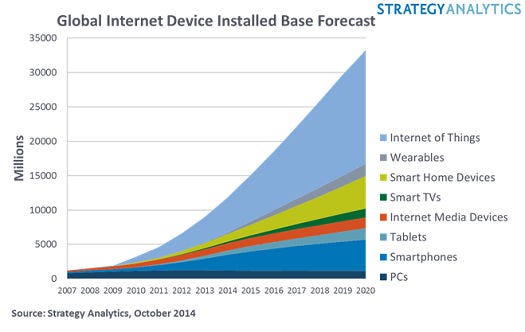

Fellow analyst firm Strategy Analytics also has its forecasting hat on, claiming 33 billion connected devices will be in use globally by 2020, which will amount to 4.3 per person. This expanded category includes smartphones, PCs, tablets, smart TVs, internet media devices, wearable devices, smart home and anything else that can be incorporated into the IoT category.

“Back in 2007 PCs accounted for two thirds of internet devices – now it’s only 10 per cent,” said David Mercer, Principal Analyst at SA. “The impact of the internet on daily lives has increased rapidly in recent years. Huge growth potential still lies ahead, in terms of both the number of devices relying on internet connectivity and its geographic reach.”

“The Internet of Things has already connected five billion devices and we are only at the beginning of this revolution”, said Andrew Brown, Executive Director at SA. “Smart cities and smart grid are just two of the ways in which the internet of things will touch everyone’s lives over the coming years and decades.”

Here’s SA’s chart showing forecasted global connected device growth by category.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)