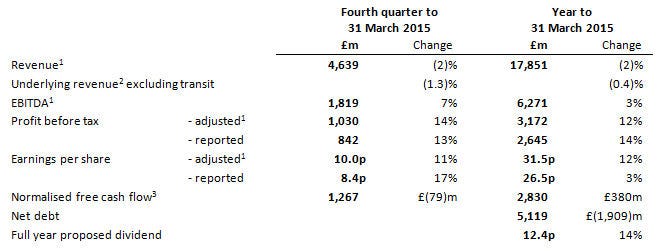

UK fixed line giant BT revealed a 2% annual decline in its quarterly earnings announcement, but managed to extract a 12% increase in profit thanks to solid growth in the consumer business and continued streamlining.

May 7, 2015

UK fixed line giant BT revealed a 2% annual decline in its quarterly earnings announcement, but managed to extract a 12% increase in profit thanks to solid growth in the consumer business and continued streamlining.

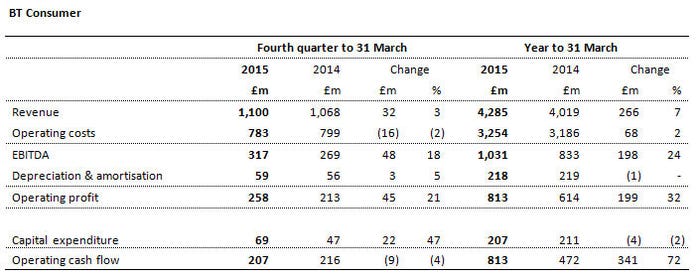

BT’s consumer business increased revenues by 7% year-on-year and its EBITDA jumped by 24%, with a record 266,000 retail net additions of fibre broadband the highlight. While Openreach was flat on both metrics, Global Services, Business and Wholesale all saw annual revenue declines.

“Our superfast broadband network now passes more than three-quarters of the UK and we’ve announced plans to upgrade to ultrafast,” said BT Chief Exec Gavin Patterson. “This will be another multi-year investment by Openreach and is the right thing for both BT and the UK, providing even faster speeds in an already competitive market.

“Our BT Sport TV channels are now in more than 5.2 million homes, with the customer base growing again in the quarter. We’re pleased to have secured FA Premier League football rights for a further three years, and an extension with Aviva Premiership Rugby for four more years. With exclusive live football from the UEFA Champions League and UEFA Europa League, we’ll be showing even more top sporting action from this summer.

“We made further progress with transforming our costs, contributing to a 6% decline in operating costs in the fourth quarter. We’ve reorganised our business, increased productivity and streamlined our processes.”

There are clear signs that BT is increasingly focused on its consumer operations. They accounted for 24% of total group revenues in the 2015 financial, up from 22% a year earlier. The EE acquisition is primarily a consumer play, with BT hoping to dominate the UK market in the multiplay era, and the continued investments in content serve to reinforce that impression.

“BT Consumer continues to be the rising star within BT, with these latest results underline the phenomenal growth and demand for fibre across the UK,” said Paolo Pescatore, analyst at CCS Insight. “The company has also seen a strong and encouraging start to its mobile offering; more than 50k have signed up already.

“However, we expect to see a strong marketing push for its mobile service later in the year. This will be tied in with the new Premier League season, as consumers look to renew their broadband subscriptions to continue receiving BT Sport for free. And, of course, BT will try to up sell users to its Champions League offering.

“As the telecoms industry continues to evolve, BT is now very well placed to succeed given its existing assets such as fibre, sports rights, extensive Wi-Fi network and in mobile through the acquisition of EE. We believe that competition will intensify as Sky launches mobile next year and others including Vodafone launch their own multiplay offers.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)