The latest Kantar data for the quarter up to the end of May 2015 revealed Samsung reclaimed the number one smartphone vendor spot from Apple in that time.

July 1, 2015

The latest Kantar data for the quarter up to the end of May 2015 revealed Samsung reclaimed the number one smartphone vendor spot from Apple in that time.

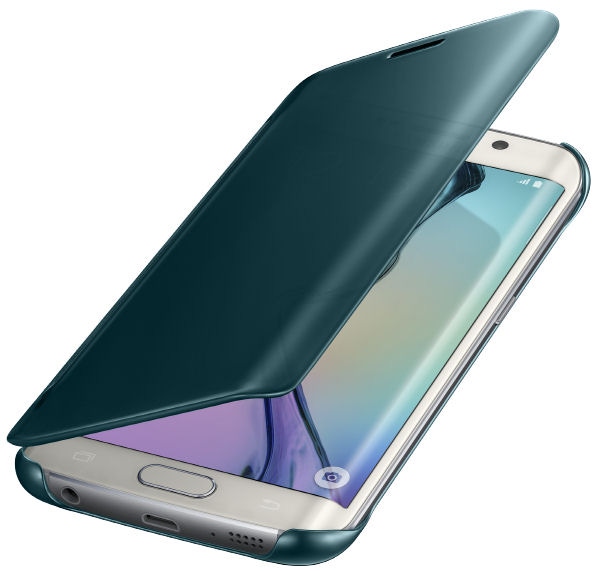

To a certain degree this was cyclically inevitable, with the Galaxy S6 having been first made available in April, while the new iPhones were launched late last year. Kantar reckons the S6 is selling well, but that it was still only the third most popular model behind the iPhone 6 and the Galaxy S5. The latter will have been subject to aggressive price cuts from Samsung once the S6 came on the market, while the iPhone 6+ was only in fifth place.

“The first full month of sales of the Galaxy S6 allowed Samsung to regain the market lead in the US and grow its share of Android sales from 52% in the three months ending in April to 55% for the three months ending in May,” said Carolina Milanesi of Kantar, noting that LG also doubled its US smartphone market share year-on-year.

“Samsung’s share of the US smartphone market grew period-over-period, as the Galaxy S6 became the third best-selling smartphone in the US, after the iPhone 6 and the Galaxy S5. Samsung’s year-over-year performance also improved, with its US market share now down only 0.5 percentage point compared to 1.6 percentage points in the three months ending in April.”

Apple is the number one vendor in urban China, but is struggling to fend off local players. “In urban China, the two-horse race became a three-horse race, as the market leader Apple, followed by Huawei now at number two, and Xiaomi in the third spot, are all within a 0.5 percentage point share of one another,” said Tamsin Timpson of Kantar.

“While share might be close, each vendor’s customer base is quite different. Xiaomi and Apple capture the more affluent users, with 39% of Huawei’s sales falling among consumers with a monthly income of less than 2000 RMBs. Geographically, close to 7% of Apple’s sales come from the top four cities in China – Beijing, Guangzhou, Shanghai, and Shenzhen – while for Xiaomi, that number is 2%.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)