The Q4 2015 smartphone shipment numbers point to an industry at an advanced stage of maturity struggling to find its next growth driver.

January 28, 2016

The Q4 2015 smartphone shipment numbers point to an industry at an advanced stage of maturity struggling to find its next growth driver.

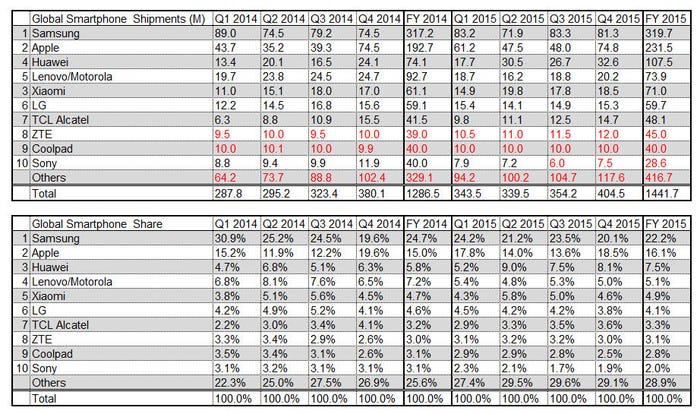

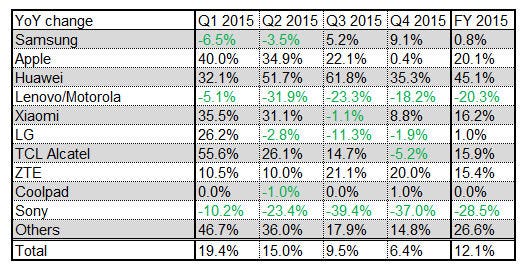

Samsung remains the number one smartphone vendor, but in spite of the Galaxy S6 performing a bit better than its predecessor, Samsung’s full-year smartphone shipments barely grew. Second placed Apple did manage healthy annual growth but there was a clear trend of this slowing over the course of the year.

Huawei had a great year, growing its smartphone shipments by 45% and grabbing a couple of percentage points of global market share in the process. Lenovo/Motorola is struggling, thanks mainly to domestic competition in China, and needs to find some way to turn things around. Xiaomi did manage decent growth but missed its own annual shipment target thanks to a pronounced slowdown in the second half of the year.

Underpinning all of this is the overall market, which slowed every quarter in 2015 and seems set to register negative growth at some time in 2016. If we say the modern smartphone market started with the launch of the iPhone and Android, the first phase of growth was fuelled by western consumers upgrading from feature phones and the second phase relied on developing markets – especially China – buying mainly cheaper devices. Both those growth drivers are now exhausted and it remains to be seen what will define phase three.

“Global smartphone shipments grew just 6 percent annually from 380.1 million units in Q4 2014 to 404.5 million in Q4 2015,” said Linda Sui of Strategy Analytics. “This quarter was the smartphone industry’s slowest growth rate of all time. Smartphone growth is slowing due to increasing penetration maturity in major markets like China and consumer worries about the future of the world economy.”

The general feeling is that smartphone design has matured to a point that it’s very difficult to differentiate on hardware, while entry-level prices are already so low that there’s little room to compete on price. Apple has the high end totally sewn up and it has done a great job of appealing to the Chinese consumer, but it seems to have now exhausted that source of growth.

In mature markets pretty much everyone who wants and can afford a smartphone already has one so the industry will continue to look to relatively untapped countries such as India, Indonesia and Brazil for its 2016 growth. But it’s unlikely that any of them will deliver China-like growth so, in terms of global shipments, we could be nearing ‘peak smartphone’.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)