Giant Taiwanese tech manufacturer, which counts the Apple iPhone among its responsibilities, has finally concluded its prolonged courtship of Japanese consumer electronics company Sharp.

March 31, 2016

Giant Taiwanese tech manufacturer, which counts the Apple iPhone among its responsibilities, has finally concluded its prolonged courtship of Japanese consumer electronics company Sharp.

Having first invested in Sharp back in 2012, Foxconn finally made an honest company of Sharp with the acquisition of two thirds of its shares for roughly $3.5 billion. While this is being positioned as a relatively generic acquisition – getting a struggling company on the cheap with the aim of turning it around – most commentators are viewing this as a strategic display move, designed primarily to please Apple which is expected to switch iPhones to OLED tech soon.

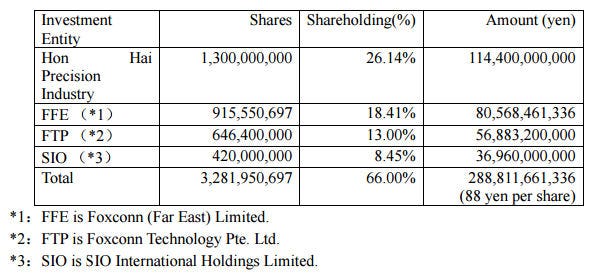

Foxconn, otherwise known as Hon Hai, saw fit to use a bunch of investment vehicles to complete the deal, as shown below.

“I am thrilled by the prospects for this strategic alliance and I look forward to working with everyone at Sharp,” said Terry Gou, Founder and CEO of Foxconn. “We have much that we want to achieve and I am confident that we will unlock Sharp’s true potential and together reach great heights.”

“I am pleased with our decision today to form a strategic alliance and merge both forces between Sharp and Foxconn to accelerate innovation with the “creativity and entrepreneurial spirit” of both our companies,” said Kozo Takahashi, President and CEO of Sharp.

There seems to be a general consensus that this deal is all about Apple, but also a fair bit of scepticism that it’s likely to deliver much ROI. According to a Reuters report Sharp has yet to manufacture OLED displays commercially and one analyst reckons Chinese rivals may have already got there by the time it does, and the big Korean tech companies already are.

Meanwhile the NY Times reckons big manufacturers are under pressure to own more of the component supply chain themselves to defend their positions. However Foxconn has not only paid a lot of money up-front for the privilege, it has also acquired most of a company that currently makes a loss.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)