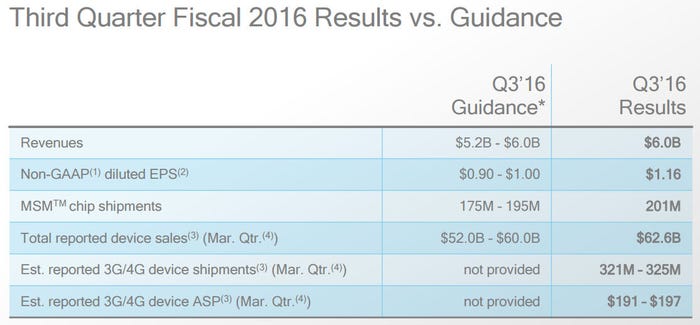

US mobile chip giant Qualcomm has announced quarterly numbers that were at the upper end of its guidance thanks to strong revenues from China in both chips and licensing.

July 21, 2016

US mobile chip giant Qualcomm has announced quarterly numbers that were at the upper end of its guidance thanks to strong revenues from China in both chips and licensing.

Qualcomm was investigated and fined by Chinese antitrust authorities in early 2015, but one consequence of the settlement was that it was given greater power to pursue licensing fees from Chinese companies. Qualcomm recently took action against Chinese smartphone maker Meizu for alleged patent infringements and it looks like plenty of others are already paying up.

“We delivered strong results this quarter, with EPS well ahead of our guidance based on meaningful progress with licensees in China,” said Steve Mollenkopf, CEO of Qualcomm. “Our chipset business is also benefiting from a strong new product ramp across tiers, particularly with fast growing OEMs in China. We are executing well on our strategic priorities, and we remain confident that our focused investments in 5G and other advanced technologies will create a strong foundation for long-term earnings growth.”

In the subsequent analyst call Mollenkopf expanded on his earlier statement, with continued reference to 5G. “Our gigabit LTE leadership with the Snapdragon X16 modem will pave the way to 5G,” he said. “Many of the technologies enabling gigabit LTE will be common to 5G, use of more antennas, use of multiple types of spectrum simultaneously, more sophisticated signal processing et cetera. And the mastery of these features in 4G will be essential to leadership in 5G. Many of these features are already being trialed or commercially deployed in phones using our Snapdragon 820 processor X12 LTE.

“Qualcomm also pioneered 802.11ad operating at 60 gigahertz, which is shipping into access points and computing devices today. The design and commercialization of this technology into smartphones is enabling the company to build leadership and expertise in the high-band known as millimeter wave to be deployed broadly in 5G.

“We are also designing a new OFDM based 5G air interface that will not only enhance mobile broadband services but also enable connectivity and management for the Internet of Things and new types of mission critical services. Our 5G design is intended to get the most out of the wide array of spectrum available across regulatory paradigms in bands from low bands below 1-gigahertz to mid bands from 1-gigahertz to 6-gigahertz to millimeter wave.

In the Q&A session Mollenkopf was asked about the timing of 5G, especially regarding the finalization of the standard. “I think in general, if you’d have asked me that question, a year ago, I would have said that it would have happened closer to 2020,” he said. “Certainly over the last year and accelerating here over the last quarter there has been a real pull to push that in or to pull that in closer to 2018/2019 timeframe depending on what the deployment is.”

Qualcomm has been getting more 5G-centric with each earnings season and it’s understandably keen to have as big a stake as possible in the standard and in the subsequent sale of chipsets. It’s clear that unlicensed spectrum is going to have an unprecedented role in the new standard and Qualcomm reckons it’s got that side of things nicely covered.

China is helping its numbers in the short term, and although on the chipset side that business seems to be mainly in cheaper smartphones, Qualcomm’s shares were up 8% in pre-market trading. But if Mollenkopf reckons his company could be selling 5G chipsets as soon as 2018 it’s not surprising to hear him focusing on it now.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)