Operator Vodafone has made a major play for the UK consumer fixed line market by announcing the abolition of line rental charges on its fibre broadband service.

August 9, 2016

Operator Vodafone has made a major play for the UK consumer fixed line market by announcing the abolition of line rental charges on its fibre broadband service.

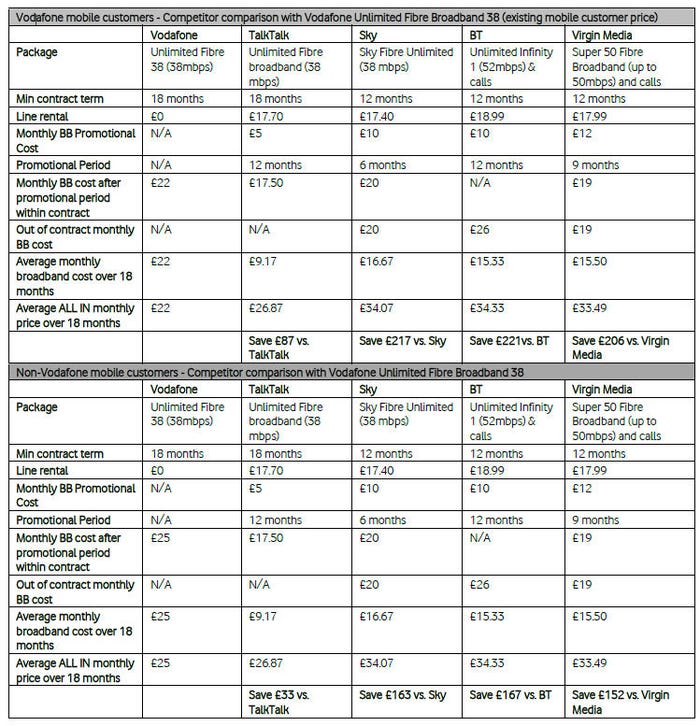

UK fixed line subscribers typically pay around £18 per month in line rental on top of their other service fees, which often accounts for the majority of the total cost. Vodafone is, in effect, introducing aggressive price competition to the UK broadband market, arguably the main strategy available to it as it tries to take market share from dominant fixed line player BT as well as fibre specialist Virgin Media.

Vodafone’s marketing is likely to focus on how redundant and unfair paying line rental for a voice line is these days, but in practice the charge is just a handy way of making the headline cost of fixed line packages seem cheaper, as well as a great source of revenue for BT from companies that lease its fixed lines such as Sky and TalkTalk.

“Giving our customers the opportunity to break free from hidden line rental charges is our way of letting our customers know that we are listening and that we are serious about providing them with the Unlimited Home Broadband experience that they deserve,” said Glafkos Persianis, Commercial Director at Vodafone UK.

“We started our journey into fibre optic home broadband just over a year ago and are delighted to show that we are a truly innovative and customer focused provider. We know our customers depend on us to stay connected, and now we can satisfy their needs both at home and on the go whilst also putting an end to line rental charges.”

Paolo Pescatore, Analyst at CCS Insight, thinks this is a significant initiative. “It’s a bold move and one that will help raise awareness of its fibre broadband offerings in a crowded market,” he said. “It represents a great opportunity for Vodafone to steal a march on its rivals, more so given it is a relatively new entrant and faces significant headwinds in the fixed line broadband market.

“While others have tinkered with line rental pricing, we believe this is the first time a provider has decided to ditch it altogether. This move will go some way to provide customers with clear and transparent pricing and lays down the gauntlet for others who will be forced to go down this route. However, Vodafone’s lack of content still represents a huge headache for the company as all of its rivals are bundling entertainment, movies and sports with their broadband deals.�”

Ewan Taylor-Gibson of uSwitch.com found the move a bit gimmicky. “To be clear, Vodafone isn’t really abolishing line rental charges, it’s simply combining the charge into its fibre pricing,” he said. “This is because broadband providers are under pressure from the ASA to change advertised pricing so customers see a cost per month that includes line rental, so Vodafone is stealing a march on its rivals.

“It won’t be long before this way of pricing becomes the norm across the whole broadband market – although Vodafone should get a pat on the back for being the first to take the plunge. Compared to other fibre deals on the market, Unlimited Fibre Broadband 38 is competitive, with the only frustrating thing being that it ties users into an 18-month contract – longer than the current standard.”

When Vodafone launched its consumer fibre products a year ago the line rental was £16.99. The 38Mbps deal for existing Vodafone mobile subscribers was an 18 month contract at £7.50 per month for the first 12 and £15 per month for the remaining six, taking the total cost to £486. As you can see from the Vodafone price comparison table below the new 18 month total is £396 – a reduction of £90, or £5 per month.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)