Device giant Apple wants to stop licensing GPU designs from Imagination Technology and use its own instead, but the snubbed UK chip designer doesn’t fancy its chances.

April 3, 2017

Device giant Apple wants to stop licensing GPU designs from Imagination Technology and use its own instead, but the snubbed UK chip designer doesn’t fancy its chances.

Apple wants to move from using Imagination intellectual property in the graphics processing unit (GPU) parts of the chips that run iPhones, iPads, etc. Apple has been using Imagination GPUs in its mobile chips since at least the launch of the first iPhone and started designing its own chips, also featuring Imagination GPU designs, in 2010, following its acquisition of PA Semi.

After all those years of SoC designing Apple seems to have become a bit cocky and decided it doesn’t need anyone else’s help with GPU design. An announcement from Imagination says Apple has given notice that it will end the current deal in 15 months to two years’ time, having already commenced working on its own design.

“Apple has not presented any evidence to substantiate its assertion that it will no longer require Imagination’s technology, without violating Imagination’s patents, intellectual property and confidential information,” said the Imagination announcement. “This evidence has been requested by Imagination but Apple has declined to provide it.

“Further, Imagination believes that it would be extremely challenging to design a brand new GPU architecture from basics without infringing its intellectual property rights, accordingly Imagination does not accept Apple’s assertions.”

Imagination’s business model is very similar to ARM’s; it doesn’t make the chips but it designs their microarchitecture so other companies don’t have to. It then licenses these designs and also claims small royalties from every chip containing its designs that is sold. The main Imagination GPU brand is PowerVR.

The reason Imagination and ARM – which used to work in partnership until ARM became a GPU competitor with the introduction of its Mali designs – are successful businesses is that chip design is very difficult. Intel’s struggles in the mobile space illustrate this well. If even Intel has had difficulty designing competitive mobile chip (it has also been an Imagination licensee and significant shareholder) then it’s easy to see why Imagination doesn’t fancy Apple’s chances.

Additionally the contracts set up by chip designers are bound to feature extensive protections against customers using any of their IP in subsequent attempts to go it alone. So if Apple goes ahead with this move it will somehow have to design a GPU from the ground up, using its own microarchitecture, or get seriously sued.

Alternatively Apple could merely be looking to strengthen its negotiating position ahead of a review of what it pays Imagination to use its designs. Imagination shares were down 60% at time of writing and even if it does have a strong legal case Apple has enough lawyers to drag any subsequent litigation out indefinitely, as it seems prepared to do with Qualcomm.

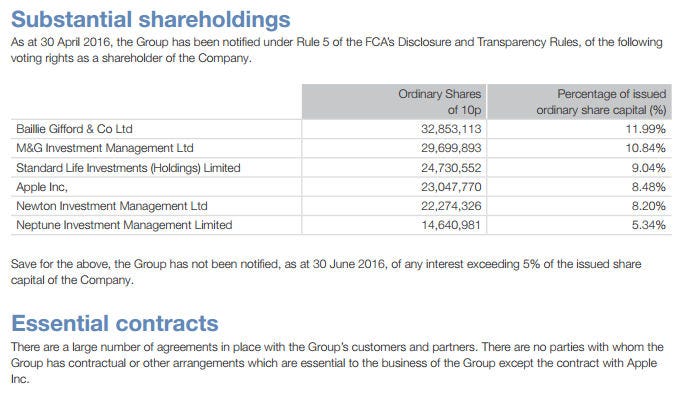

As a significant shareholder (see screen grab from Imagination 2016 annual report below), Apple presumably has a good sense of Imagination’s financial position and thus its ability to fund such an action. “Apple license fees and royalties…represented revenue of £60.7 million for the year ended 30 April 2016 and are expected to be approximately £65 million for the year ending 30 April 2017,” said the Imagination announcement.

What Apple can’t afford is to have rubbish GPUs in future generations of it’s A-series SoCs. If the iPhones launched in 2019 have poor graphics benchmarking compared to the leading Android phones, expect reviewers to join the dots and punish Apple accordingly. Any resulting dip in iPhone sales will surely make the money saved on Imagination royalties pale into insignificance.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)