Disruptive Indian operator Reliance Jio Infocomm has revealed its losses for the last six months were three times greater than the same period a year ago.

April 24, 2017

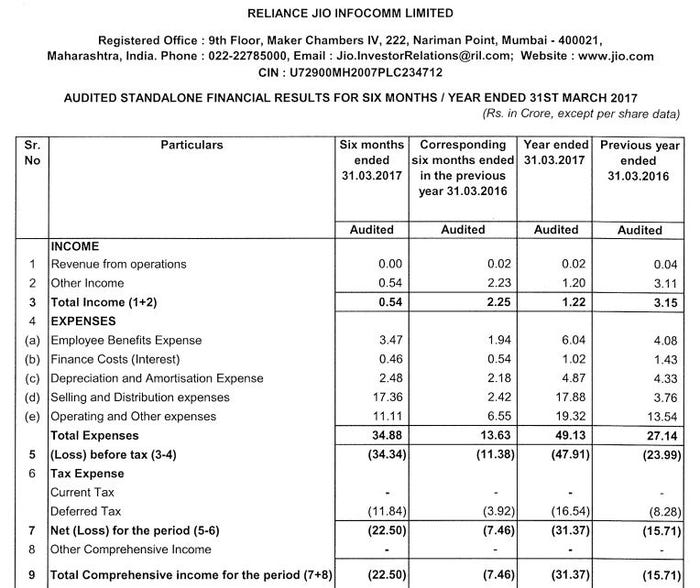

Disruptive Indian operator Reliance Jio Infocomm has revealed its losses for the last six months were three times greater than the same period a year ago.

This is hardly surprising as, since its launch last September, Jio has been giving most of its service away with a classic ‘freemium’ strategy aimed at creating a massive installed-base first and then worrying about how to monetize it later. This resulted in Jio taking just 170 days to acquire 100 million subscribers, 72 million of which it claimed to have converted to paying customers by the end of March.

More remarkable is how little all this bribing of the market has cost Jio. Net losses for the six months to the end of March 2017 were 22.5 crore rupees, which equates to around $3.6 million. This means each new paying customer has cost Jio around five bucks – pretty good value, especially when you consider that’s the amount (300 rupees) each of them had to pay to continue using the service.

Furthermore all of this is a drop in the ocean for the parent company Reliance Industries, which booked a net profit in excess of $2 billion over the same time period, so there’s little chance of CEO Mukesh Ambani losing his stomach for the fight.

In digital services, the Jio movement is set to transform India,” said Ambani, commenting on the results. “Jio is witnessing the largest migration from free to paid services in history. Jio is committed to provide its customers the highest quality and the world’s most affordable data and voice services.”

You can see the full Reliance Jio numbers below. With millions of subscribers starting to actually pay for stuff the next set of numbers we see are likely to have a much healthier picture on row 1 and hence row 9.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)