With Amazon taking further strides into the content business, the question of whether there is a viable business model for the telcos is becoming louder; can the telcos compete with the OTTs?

August 3, 2017

With Amazon taking further strides into the content business, the question of whether there is a viable business model for the telcos is becoming louder; can the telcos compete with the OTTs?

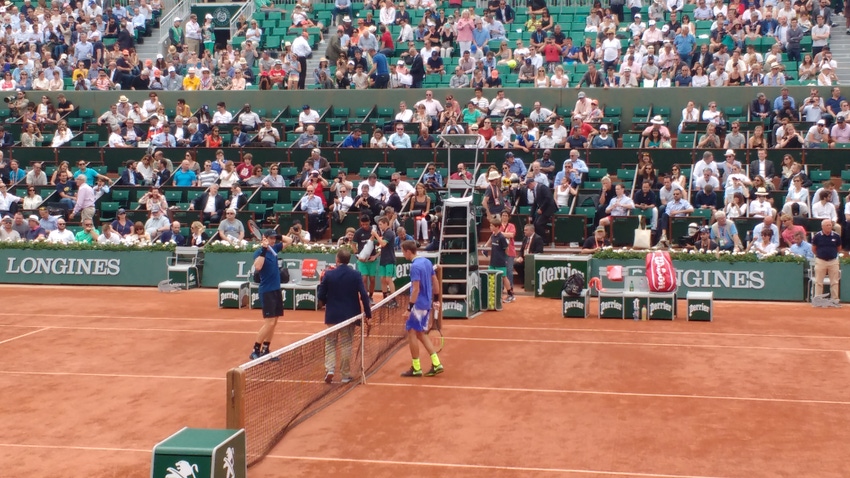

By securing the rights for the ATP World Tour, rumoured to be in the region of $10 million, Amazon has beat off competition from Sky and a host of other suitors. The deal includes all the games from the Masters 1000 and Masters 500 events for five years, which will be available to viewers through its Prime subscription product.

The move itself is yet another move from the OTTs in stealing viewers away from traditional broadcasters, but also the telcos who are trying hard to compete in this cut-throat world. The convergent business model is the holy grail for many, due to the ‘stickiness’ of the brand to customers, but the content area is starting to get very congested. Sports is an obvious one for most telcos, due to the emotional connection many fans have, but its becoming expensive.

“For sure the cost of rights is clearly heading in one direction and showing no signs of slowly down,” said Paolo Pescatore of CCS Insight. “For a company like Sky who solely rely on content, escalating cost of content rights is a big issue and has the most to lose. The greater scale a provider has, better chances of surviving.”

Sky has changed its strategy in recent years, choosing to focus more acutely on what it deems are the most important sports as opposed to the shotgun effect of previous years. It has the English Premier League, as well as Formula One and some rugby as well, but the sports content space is becoming very fragmented.

Whether this becomes a frustrating one for the viewer, who can no longer access a wide variety of sports in one place, remains to be seen. There is potential that some content propositions with sit in the halfway house, not really satisfying anyone. But there might be hope.

“The more platforms you have to distribute, far greater reach and revenue is feasible (again Sky excel in this area with DTH and Now TV),” said Pescatore. “I’ve always said it and will say it again, telcos are well placed with their network assets and especially those with pan European assets; so many eyeballs for content and media owners. Moving forward pureplay providers for any segment will struggle to survive.

“There are plentiful opportunities for telcos to differentiate in the content world. Let’s not forget there are many genres and options as to whether invest in acquiring premium content rights, invest in original programming or partner with OTT providers.

“We’ve seen telcos differentiate in all of these areas whether that be in sport, entertainment or movies. BT Sport with sport, Orange with movies and entertainment, AT&T has taken a far more aggressive approach. Cable providers (generally) and Deutsche Telekom look like they are preferring to take a more aggregated approach.”

The aggregated approach is an interesting one as it leans more into the services business model, as opposed to the ARPU focus which has served the telco space for years. DT for instance, recognises that it has a massive audience, which it can essentially ‘lease’ to third parties. The rewards will not be as large, but the risks and initial financial outlay is drastically reduced. It also offers a lot more flexibility, allowing the telco to focus on several areas or genres.

It’s a more similar to the way OTTs generate cash. Building a dedicated following and offering access to that audience to other companies. It’s very transactional, and a tricky one to nail, though it is proven. Just look at Facebook. But which is more suited to the content game? APRU or services?

“Arguably both,” said Pescatore. “OTT is a great strategy for content and media owners but lack a relationship directly with consumers. This is where telcos come in; a very good tie-up. Telcos should also consider making some of their TV assets as an OTT service.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)