Many famous faces have decorated our notes over the years, but just like the cheque, cold, hard cash is living on borrowed time.

August 14, 2017

Many famous faces have decorated our notes over the years, but just like the cheque, cold, hard cash is living on borrowed time.

That is of course a prediction from those in the industry who have a vested interest in the digital economy. Bias will be present and propaganda flying, but the statistics are difficult to argue with. Globally, in-app advertising is predicted to reach $201 billion by 2021, and in Europe, 88% have used a mobile device to make a payment. On both the consumer and vendor side, there is a genuine appetite for the digital economy.

The need here is for speed. Mobile payments are faster, while online shopping is quicker. We’re now too important to do things like wander around shops, but in some cases, it is the only option. After all, who has the time to sit at home during the hours of 6-10pm to wait for the Sainsbury’s delivery, we’re too important to do things like waiting.

Enter Ubamarket.

This is a nice little app which we’re surprised we haven’t seen more of. It’s a simple idea which most people who are reading this article will probably think, neat. But imagine an app which can create the most efficient route around the supermarket aisles for you. You’ll never get to the checkout and remember about that tin of chick peas, before turning around and spending what seems like hours searching the same aisle.

The process is simple. You enter your shopping list at home. Go to the shops and follow the route which the app has mapped out for you. Once you find the items, you scan them into the app, before heading to the checkout and scan a code into the cashiers register. Not only does this remove the painful experience of unloading everything onto the conveyor belt and then back into your trolley, but it also takes the payment from your mobile. What could be more simple.

Of course this is still in the early days, and there aren’t many shops which can offer such an experience, but it is an interesting idea. The app does actually connect to a shops inventory system, so it knows when something is out of stock, and in the future, there is the potential for dynamic pricing to save some money as well. Loyalty cards are another way which the app could work for you.

In the second phase of the app’s development, the Ubamarket team has also promised little reminders for your shop. Once you have uploaded your list, the app might notice you’ve not added eggs like you have over the last couple of trips, so it will tell you.

There are a couple of potential downsides though. In-app advertising is always a threat. You won’t be pummelled with promotional offers as your wandering the lonely aisles currently, but it is certainly an option to make money in the long-run. We also were able to locate the apps terms and conditions, so we’re not 100% sure what the policies are on reselling your data. Such apps have to make money of course, so selling your shopping preferences onto third parties seems like a logical way to do so.

This might come across as a negative, but this is the way the digital economy works. The sooner people realise that nothing comes for free, the sooner we can move forward.

The final downside is that of childish games. When your correspondent was younger, he and his brothers used to add a ‘new’ brand of biscuits or cereal to the weekly shopping trip. Mr Davies used to stomp up and down the aisles looking for such a product, sometimes for quite a period of time. As many will know, finding a product in the supermarket becomes a thing of frustration and pride, but occasionally he used to ask for help, before being told by a member of staff that Mr BoneBags Crunchies was not a real brand. Such an app would remove delightful games.

Overall, it probably will save you money, and it probably will save you time, which is what the digital economy is all about. But at the same time, consumers will have to accept they are using their data to finance such an app. This might not sit well with some, but most have to accept there is always small print. Either you pay for something, or hand over data to fuel the digital economy. You can’t have it both ways.

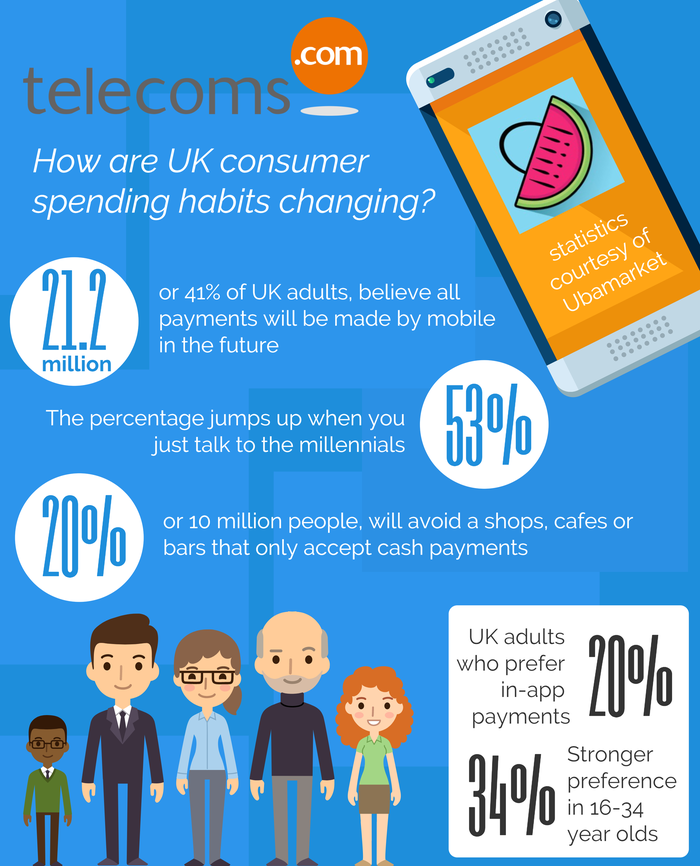

Here’s an infographic as well:

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)