HTC has accepted $1.1 billion to hand over much of its smartphone engineering talent to Google.

September 21, 2017

HTC has accepted $1.1 billion to hand over much of its smartphone engineering talent to Google.

Some kind of M&A involving the two has been on the grapevine for some time but the assumption was that Google would simply buy HTC with the kind of cash Larry Page routinely finds down the back of his primary-coloured beanbag-sofa. In the end Google was able to just pluck out only the parts of the company it wanted.

The main acquisition is a reported 2,000 smartphone engineers, many of whom are already working on the Google Pixel phones, which are white-labelled by HTC. On top of that Google gets a non-exclusive license to a bunch of HTC smartphone IP. For this Google is shelling out $1.1 billion which, at first glance, seems like a good deal for HTC, especially when you consider that the IP seems to involve extra payment.

HTC’s total headcount is currently around 10,000 and its market cap is around $1.9 billion, so Google is handing over cash that’s equivalent to 58% of the company for just 20% of its people and no outright ownership of any of its assets. HTC is spinning this as enabling it to reduce overheads and redouble its efforts on its own flagging smartphone operations as well as future bets such as VR.

Another way of looking at this move, however, is that HTC is mortgaging the future for an immediate cash injection. HTC has been running at a loss for ages and while losing 2,000 of its best engineers will reduce overheads, it must surely also cripple its smartphone R&D efforts.

In a masterpiece of doublespeak, HTC made the following statement at the top of its announcement: “Transaction Reinforces HTC’s Commitment to Innovation and Its Branded Smartphone Business.” It’s very hard to believe how getting rid of the cream of your smartphone engineers can achieve anything but the opposite of that.

For Google the big question is: How come you’re doing this after the Motorola acquisition went so wrong? The answer is probably two-fold. Firstly the main purpose of the Moto buy was probably to stockpile smartphone patents at a time when predatory patent litigation from the likes of Microsoft, Oracle and Apple threatened the whole Android ecosystem. Google messed around with phones for a bit but then flogged all but the patent parts to Lenovo.

Secondly Google has since decided to take making its own smartphones a bit more seriously; looking to take the lead in the premium Android segment with the Pixel range as Samsung continues to try to develop its own ecosystem. Google seems to have learned from the Moto move that it’s better to pay a premium for just the bits you want than aquire a bunch of superfluous stuff at a bargain, the disposal of which ends up costing more in the long term anyway.

“This agreement is a brilliant next step in our longstanding partnership, enabling Google to supercharge their hardware business while ensuring continued innovation within our HTC smartphone and VIVE virtual reality businesses,” said Cher Wang, Chairwoman and CEO of HTC. “We believe HTC is well positioned to maintain our rich legacy of innovation and realize the potential of a new generation of connected products and services.”

“HTC has been a longtime partner of Google and has created some of the most beautiful, premium devices on the market,” said Rick Osterloh, SVP of Hardware at Google (pictured above with Wang and a veteran of the Motorola acquisition). “We’re excited and can’t wait to welcome members of the HTC team who will be joining Google to fuel further innovation and future product development in consumer hardware.”

Superficially this looks like a win-win, but scratch under the surface and it seems likely that HTC gratefully accepted whatever Google offered. That offer was probably more generous than it needed to be, perhaps partly because Google genuinely doesn’t want HTC, which was its very first OEM partner for the Nexus 1, to die.

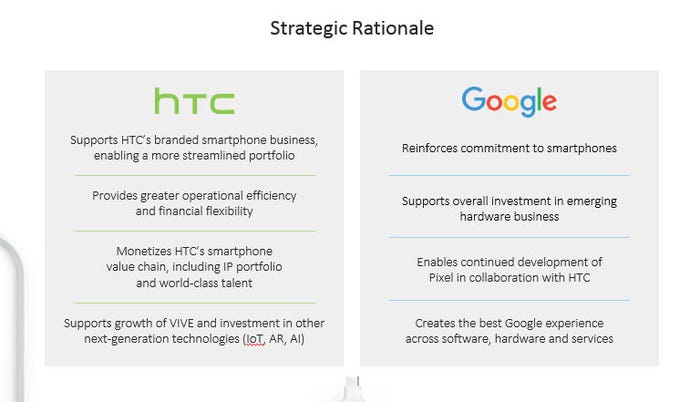

But as this excellent Bloomerg analysis shows, HTC is unlikely to turn the corner without shedding a lot more overhead, especially in manufacturing capacity, which it over expanded after a couple of strong years at the start of the decade. What seems more likely is that HTC will gradually phase out its smartphone brand and focus entirely on things like VR, but it’s not about to shout that from the rooftops. Here’s the official rationale.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)