Qualcomm’s numbers took a hit from its dispute with Apple, while Facebook says investing in security to prevent abuse will impact profits.

November 2, 2017

Qualcomm’s numbers took a hit from its dispute with Apple, while Facebook says investing in security to prevent abuse will impact profits.

The ongoing aggro between Qualcomm and Apple was bound to feature prominently in the former’s earnings announcement. The analyst call was dominated by the issue as the equity world tried to get a better sense of how the matter was going to play out, not only with Apple but with Qualcomm’s entire licensing business model.

This was made all the more inevitable by Qualcomm’s refusal to directly mention the matter in its headline canned comments. “We continue to see strong growth trends for global 3G/4G device shipments and are focused on protecting the established value of our technologies and inventions,” said Steve Mollenkopf, CEO of Qualcomm. “We are leading the industry to 5G and are well positioned with our product and technology leadership to continue our expansion into many exciting new product categories, such as automotive, mobile computing, networking and the Internet of Things.”

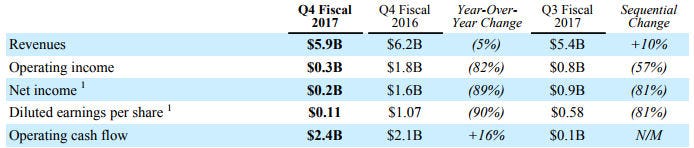

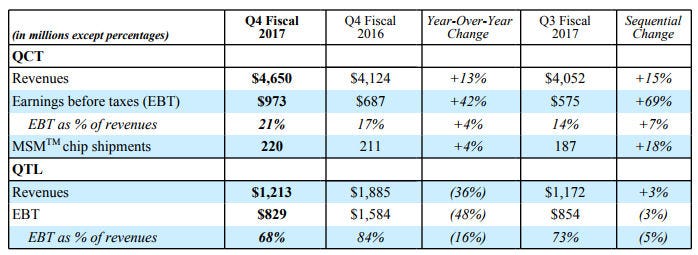

As you can see from the first table below, all Qualcomm’s headline numbers were all down year-on-year, with profits especially going down the toilet. It should be noted that Qualcomm booked a $778 million charge for its Korean fine in this quarter. The second table indicates that while the main tech business (QCT) is still doing well, the licensing business (QTL) is letting the team down somewhat.

Over at Facebook it’s all about abuse of the platform, especially by those with a hidden political agenda, these days. The tech news has been dominated by stories of shady Russian interests buying social media ads first to influence the last US general election, then stoking FUD about the President, with the apparent aim of dicking about with the US electoral system just for a laugh.

By far the most influential social media platform is, of course, Facebook, and it has come under a lot of pressure to take ownership of this problem, as well as contemporary ill-defined social media offenses like fake news and hate speech. It looks like the defence that it’s a platform rather than a publisher isn’t holding water anymore, so Facebook is sensibly trying to be seen to be more proactive.

“Our community continues to grow and our business is doing well,” said Mark Zuckerberg, Facebook CEO. “But none of that matters if our services are used in ways that don’t bring people closer together. We’re serious about preventing abuse on our platforms. We’re investing so much in security that it will impact our profitability. Protecting our community is more important than maximizing our profits.”

It’s a shame that Zuck decided to end on such a false dichotomy as Facebook’s profits are clearly derived from its community. It is the unfortunate nature of the shareholder system that most companies feel they have to constantly increase profits for fear of their share price declining if they don’t. But sometimes short term profits have to take a hit in order to safeguard the long-term prosperity of the company.

Amazon is a great example of this strategy paying enormous dividends (only metaphorically). The fact that both Qualcomm’s and Facebook’s shares were up at close of play indicates that the markets are being grown up about exceptional challenges faced by both of these companies. After all, they are still making loads of money, with Facebook almost doubling its net income for the quarter to $4.7 billion.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)