The awkward courtship continues but it’s getting more difficult for Qualcomm to refuse Broadcom’s advances.

February 9, 2018

The awkward courtship continues but it’s getting more difficult for Qualcomm to refuse Broadcom’s advances.

When Broadcom offered an unsolicited $70 per share for Qualcomm back in November last year we were unconvinced by the move, not least because it seemed far too low. Earlier this week Broadcom upped its bid to $82 per share, which we had previously speculated might be a tempting level for Qualcomm investors.

Nonetheless the Qualcomm board has rejected the revised bid on the grounds that it still undervalues the company and also that it fails to offer enough protection in the likely event that even if Qualcomm accepted the bid, it would fail to get regulatory approval. But in apparent acknowledgement of how much more tempting some investors might find this new bid, the Qualcomm board has offered to meet Broadcom to see if an agreement can be reached.

It’s hard to work out precisely where the balance of power is in this process now. The Qualcomm board clearly doesn’t fancy working under Broadcom but, as a public company, it has to put the financial interests of its shareholders ahead of its personal preferences. This essentially comes down to persuading investors that they’re likely to get a better return if they allow Qualcomm to go about its business independently.

Qualcomm’s shares are currently trading at around $63 which, considering there’s an $82 per share offer on the table, gives an indication of how likely people think Broadcom’s hostile takeover strategy is to succeed. Nonetheless it’s incumbent on Qualcomm to show how it’s going to go about increasing the share price by twenty buck or so in the mid-term future.

Ultimately this comes down to two things: 5G and diversification. Qualcomm reckons it’s a year or two ahead of the chasing pack when it comes to 5G modem tech. Earlier this week it hosted a big 5G event for journalists, analysts, etc at its HQ in San Diego with the precise aim of emphasising how much its kicking ass at 5G.

Telecoms.com attended and got a distinct sense of how quietly confident Qualcomm is that, initially at least, it will be the only game in town for 5G-enabled devices. They expect the first of these to arrive around this time next year and, while there will be minimal network support for such things, the associated publicity is likely to offer a nice bit of momentum for all involved.

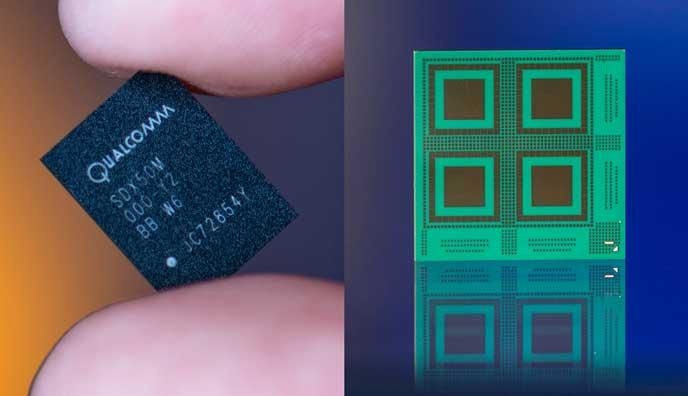

With that in mind Qualcomm made a couple of announcements at the event regarding industry support for its X50 5G modem, which will be the what connects these first 5G devices. A bunch of operators, covering most of the biggies, have all said they’re using the X50 for over-the-air trials on various 5G spectrum. Additionally a bunch of device OEMs (all of them bar Apple, Samsung and Huawei) have committed to make 5G devices running the X50. There was also an announcement earlier in the week about Nokia and Qualcomm enjoying 5G frolics together.

Talking of Apple, one of the significant downside risks to Qualcomm stock highlighted in this Seeking Alpha analysis is the prospect of Apple ditching Qualcomm entirely as a supplier, as rumoured earlier this week. Whether Apple will feel that way in a few years, when 5G is fully underway, remains to be seen, but that remains a significant threat in the short term. Apple is, of course, in the middle of fraught negotiations with Qualcomm and it’s probably not a coincidence that this story was leaked at such a sensitive time for Qualcomm.

There is some speculation, in fact, that Apple would be pretty happy if Broadcom did acquire Qualcomm since that would significantly reduce the number of component suppliers it has to deal with and increase the prospect of bulk discounts and other bits of supply-chain fun. The supply-chain is Apple CEO Tim Cook’s forte and he’s shown himself to be pretty ruthless when it comes to protecting Apple’s hefty margins.

In the long term, the best way for Qualcomm to protect itself from the likes of Apple is to diversify its product offering away from smartphone modems. Over in San Diego we were shown some of the other stuff Qualcomm is up to in areas such as audio, gaming, AI and Windows laptops. The clear aim was to demonstrate that there’s a lot more to Qualcomm chips than just iPhones.

What this all comes down to is Qualcomm saying to its shareholders that it has a bright future as an independent chip giant, but that might take a few years to play out and you’ll never know if you allow us to be bought by Broadcom. Of course Broadcom might to a great job of allowing Qualcomm to realise all this potential as a semi-autonomous business unit, but you just never know. We’ve copied the recent M&A correspondence between the two companies below.

February 5, 2018

Board of Directors

Qualcomm Incorporated

5775 Morehouse Drive

San Diego, CA 92121

Dear Members of the Board of Directors:

Broadcom remains committed to acquiring Qualcomm, and we write to present to you our best and final offer.

Broadcom is prepared to acquire Qualcomm for an aggregate of $82.00 per Qualcomm share, consisting of $60.00 in cash and the remainder in Broadcom shares.

Broadcom is prepared to pay a “ticking fee” providing for an increase in the cash consideration payable to Qualcomm stockholders if the transaction is not consummated by the one-year anniversary of entering into a definitive agreement.

Broadcom is prepared to pay to Qualcomm a significant “reverse termination fee” in an amount appropriate for a transaction of this size in the unlikely event we are unable to obtain required regulatory approvals.

Broadcom is willing to agree to a regulatory efforts provision that is at least as favorable as the one Qualcomm provided to NXP.

Broadcom has fully negotiated commitment papers with its financing sources in an amount sufficient to fully fund the transaction.

The Broadcom Board is prepared to invite Paul Jacobs and one other current Qualcomm director to join the combined company’s board upon completion of the transaction.

Our offer is premised on the following conditions:

Either Qualcomm acquiring NXP on the currently disclosed terms of $110 per NXP share or the transaction being terminated.

Qualcomm not delaying or adjourning its annual meeting past March 6, 2018.

Broadcom’s offer represents a 50% premium over the closing price of Qualcomm common stock on November 2, 2017, the last unaffected trading day prior to media speculation regarding a potential transaction, and a premium of 56% to Qualcomm’s unaffected 30-day volume-weighted average price.

Our proposal includes substantially more Broadcom stock, which will allow Qualcomm stockholders a greater opportunity to participate in the upside created by the combined company’s strategic and operational advantages. Broadcom’s track record demonstrates our ability to consistently accelerate share price appreciation following acquisitions and indicates a substantial likelihood that we will exceed our synergies expectations.

This proposal to acquire Qualcomm is extremely compelling compared to any other alternative available to Qualcomm, with or without the acquisition of NXP, and we believe any responsible board would engage with us, without further delay, to turn this proposal into an executed definitive agreement. We continue to hope you choose to engage with us for the benefit of your stockholders. However, we will withdraw this proposal and cease our pursuit of Qualcomm immediately following your upcoming annual meeting unless we have entered into a definitive agreement or the Broadcom-nominated slate is elected.

This letter does not constitute a binding obligation or commitment of either company to proceed with any transaction. No such obligations will in any event be imposed on either party unless and until a mutually acceptable definitive agreement is formally entered into by both parties.

Sincerely,

Hock Tan

President and Chief Executive Officer

February 8, 2018

Mr. Hock Tan

President and Chief Executive Officer

Broadcom Limited

1 Yishun Avenue 7

Singapore 768923

Dear Mr. Tan:

I am writing on behalf of the Board of Directors of Qualcomm Incorporated. The Board has reviewed your February 5, 2018 letter proposing to acquire Qualcomm for a combination of $60.00 in cash and $22.00 in Broadcom shares per Qualcomm share, as well as the materials filed publicly in connection with that letter. As presented, your proposal raises more questions than it answers.

The Board has unanimously determined that your amended offer materially undervalues Qualcomm and falls well short of the firm regulatory commitment the Board would demand given the significant downside risk of a failed transaction. However, the Board is committed to exploring all options for maximizing shareholder value, and so we would be prepared to meet with you to allow you to explain how you would attempt to bridge these gaps in both value and deal certainty and to better understand the significant issues that remain unaddressed in your proposal.

In the meeting, we would expect that you will be prepared to provide clear, specific and detailed answers to the questions below.

What is the true highest price at which you would be prepared to acquire Qualcomm? Is it $82 per share or is it higher? Your current proposal is inadequate as it materially undervalues Qualcomm. Your proposal ascribes no value to our accretive NXP acquisition, no value for the expected resolution of our current licensing disputes and no value for the significant opportunity in 5G. Your proposal is inferior relative to our prospects as an independent company and is significantly below both trading and transaction multiples in our sector.

Is Broadcom willing to commit to take whatever actions are necessary to ensure the proposed transaction closes? This is extremely important to value preservation for our shareholders. The differences in our business models expose the Company to significant customer and licensee risk between signing and closing an agreement. It is indisputable that there are significant regulatory hurdles in your proposed transaction. It is also indisputable that if Qualcomm entered into a merger agreement and, after an extended regulatory review period the transaction did not close, Qualcomm would be enormously and irreparably damaged. If you are not willing to agree to do whatever is necessary to ensure a transaction closes, we will need you to be extremely clear and specific about exactly what actions you would refuse to take, so that we can properly evaluate the risk to Qualcomm’s shareholders.

We have a number of other important questions, which we can discuss at our meeting. We will reach out to you to schedule the meeting.

Sincerely,

Paul E. Jacobs

Chairman of the Board

cc: Steve Mollenkopf

Chief Executive Officer

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)