EE has said it now covers 90% of the UK’s landmass thanks to an additional 105 sites built in the last six months to cover mobile not-spots, but research suggests its losing in the market share exchanges.

March 19, 2018

EE has said it now covers 90% of the UK’s landmass thanks to an additional 105 sites built in the last six months to cover mobile not-spots, but research suggests its losing in the market share exchanges.

Most of the new 4G and 2G coverage built by EE focus on the roads in areas that previously had zero mobile connectivity from any provider, and the plans are to roll out a further 350 new sites, though no timings have been released on these projects. The overall aim is to have 95% geographical coverage by 2020.

“Our customers need a 4G connection wherever they go,” said Marc Allera, CEO at EE. “We’ve added an enormous amount of coverage in the last year, upgrading existing sites and building completely new ones to keep our customers connected in more places than ever before.

“Mobile coverage is critical to consumers and businesses and can provide a lifeline for those in need of support from the emergency services – that’s why we keep focusing on filling in more mobile not-spots across Britain.”

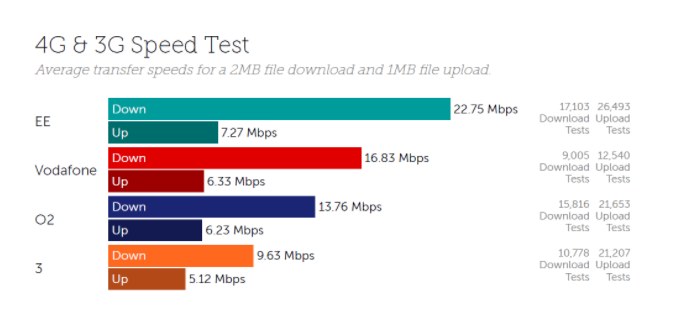

EE has regularly been named as one of the top performing MNOs in the UK over the last couple of quarters, though data from Tutela suggests speed and coverage is not necessarily the biggest factors in user decision making.

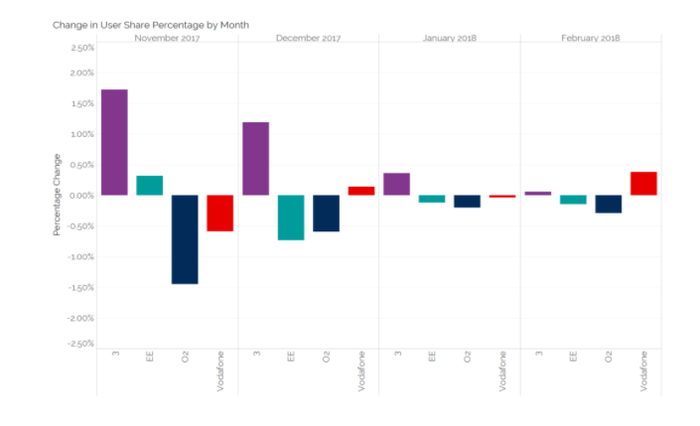

As you can see from the data below, Three has been the biggest beneficiary of customer exchanges in recent months perhaps owing to the gluttony of data which it offers customers. Three doesn’t look to be one of the best performers when it comes to performance, but perhaps that doesn’t matter when it comes to the ‘bigger is better’ generations. In its recent earnings announcement, Three highlighted it has crossed the 10 million customer threshold, and while it is down in fourth in terms of total customers, it easily leads the way in terms of data usage across the network.

“Our data concurs with Three’s recent announcement that they have experienced customer growth in the last quarter, in fact, our data suggests that they have gained market share every month, for the last 4 months where all other operators have lost some share in at least one month,” said Tom Luke, VP at Tutela.

With the 5G revolution just around the corner, such trends will prove of interest to Three. Many of the 5G usecases so far have focused on speeds, but one which is gathering momentum is the cheaper delivery of data. Should Three be able to hold onto its customer base and reduce the cost of data delivery through 5G upgrades, the ‘bigger is better’ generation could be satisfied and Three could become quite profitable at the same time.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)