Research firm Strategy Analytics reckons Apple managed to shift 16 million units of its flagship smartphone last quarter, defying pessimistic reports.

May 4, 2018

Research firm Strategy Analytics reckons Apple managed to shift 16 million units of its flagship smartphone last quarter, defying pessimistic reports.

At the start of this week we reported on a rumour that Apple had significantly cut order for the X with its manufacturers because it was struggling to shift what it already had. That rumour turned out to be pretty much rubbish when Apple announced solid numbers a couple of days later and SA’s estimate serve to reinforce that impression.

“We estimate the Apple iPhone X shipped 16.0 million units and captured 5 percent market share worldwide in Q1 2018,” said Juha Winter of SA. “For the second quarter running, the iPhone X remains the world’s most popular smartphone model overall, due to a blend of good design, sophisticated camera, extensive apps, and widespread retail presence for the device.

“Apple has now shifted almost 50 million iPhone X units worldwide since commercial launch in November 2017. The Apple iPhone 8 and iPhone 8 Plus shipped 12.5 and 8.3 million units, respectively, for second and third place. The previous-generation iPhone 7 shipped a respectable 5.6 million units for fourth place. Combined together, Apple today accounts for four of the world’s six most popular smartphone models.”

You might expect the rest of the list to be occupied by the Samsung but you would be sorely mistaken. The fifth best-selling smartphone model globally was the Xiaomi Redmi 5A, which is not a bad effort considering that’s mainly direct (as opposed to operator-subsidised) sales. Let’s see if Xiaomi’s strategic alliance with Hutchison helps it climb the table further. Then, finally, comes the Samsung Galaxy S9 Plus which, to be fair, hasn’t been shipping for long.

Linda Sui, Director at Strategy Analytics, added, “Xiaomi has become wildly popular across India and China,” Said SA’s Linda Sui. “Xiaomi is selling a huge volume of smartphones through online channels, with key retail partners including Flipkart and JD.”

“Samsung’s new flagships, Galaxy S9 and S9 Plus, only started shipping toward the end of the first quarter, but shipments are already off to a very good start,” said SA’s Woody Oh. “We expect the S9 Plus to become the best-selling Android smartphone globally in the second quarter of 2018.”

Global Smartphone Shipments by Model (Millions of Units) | Q1 ’17 | Q1 ’18 |

1. Apple iPhone X | 0.0 | 16.0 |

2. Apple iPhone 8 | 0.0 | 12.5 |

3. Apple iPhone 8 Plus | 0.0 | 8.3 |

4. Apple iPhone 7 | 21.5 | 5.6 |

5. Xiaomi Redmi 5A | 0.0 | 5.4 |

6. Samsung Galaxy S9 Plus | 0.0 | 5.3 |

Rest of Total Market | 332.3 | 292.3 |

Total | 353.8 | 345.4 |

Global Smartphone Marketshare by Model (% of Total) | Q1 ’17 | Q1 ’18 |

1. Apple iPhone X | 0.0% | 4.6% |

2. Apple iPhone 8 | 0.0% | 3.6% |

3. Apple iPhone 8 Plus | 0.0% | 2.4% |

4. Apple iPhone 7 | 6.1% | 1.6% |

5. Xiaomi Redmi 5A | 0.0% | 1.6% |

6. Samsung Galaxy S9 Plus | 0.0% | 1.5% |

Rest of Total Market | 93.9% | 84.6% |

Total | 100.0% | 100.0% |

Total Growth YoY (%) | 6.2% | -2.4% |

Source: Strategy Analytics |

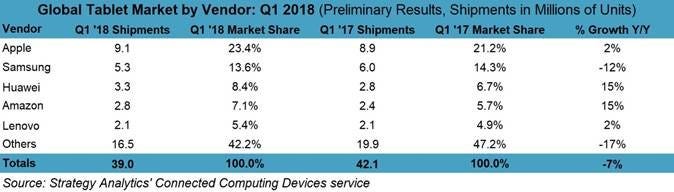

SA is having a busy week, having published its Q1 2018 tablet shipment numbers too. Apple is doing nicely in that area too, shifting almost twice as many units as second-placed Samsung in a declining market.

“Leading vendors are bouncing back with new hardware and value-added features such as improved stylus capabilities, AR, and digital assistants to support new use cases and double down on their appeal consumer and enterprise markets,” said SA’s Chirag Upadhyay. “Our interactions with computing devices are rapidly changing and companies like Apple, Amazon, and Huawei are staying ahead of the curve with targeted product improvements.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)