It’s been a watershed moment on the horizon for some time, but new figures from Ofcom confirm subscription numbers for streaming services have overtaken the ‘traditional’ pay TV market in the UK.

July 18, 2018

It’s been a watershed moment on the horizon for some time, but new figures from Ofcom confirm subscription numbers for streaming services have overtaken the ‘traditional’ pay TV market in the UK.

The Media Nations Report claims there are now more subscriptions in the UK to Netflix, Amazon and Now TV than there are to ‘traditional’ pay TV service providers. Traditional pay TV subscriptions totalled 15.1 million, while it was 15.4 million for the streaming subs. While this is a moment we have been anticipating for a while, the change will only accelerate as more streaming services develop partnerships to ease access for the consumer.

“Today’s research finds that what we watch and how we watch it are changing rapidly, which has profound implications for UK television,” said Ofcom CEO Sharon White.

“We have seen a decline in revenues for pay TV, a fall in spending on new programmes by our public service broadcasters, and the growth of global video streaming giants. These challenges cannot be underestimated. But UK broadcasters have a history of adapting to change. By making the best British programmes and working together to reach people who are turning away from TV, our broadcasters can compete in the digital age.”

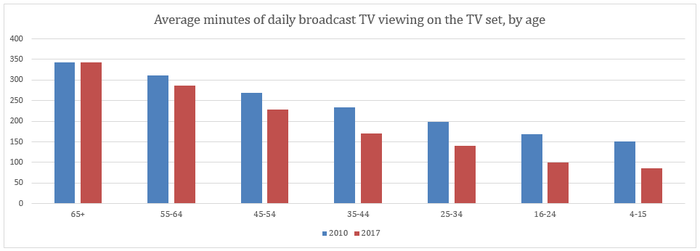

As you can see from the chart below, younger generations are spending less time on broadcast television, preferring online formats, a trend which will compound the decline.

With the more attractive demographics accelerating the decline, the traditional pay TV is going to become even less popular. Consumer habits are shifting online, and advertising revenues always follow consumer habits. With less advertising money being received, these providers will have less budget to compete with quality programming. It’s a self-fulfilling prophecy which ultimately leads to the death of traditional formats.

After several years of attractive growth, pay TV providers saw a 2.7% decrease in total revenue last year to £6.4 billion, while the spending on original programming is also declining. The BBC, ITV Channel 4 and Channel 5’s £2.5 billion combined network spending on original UK-made programmes in 2017 is 28% less than the 2004 peak of £3.4 billion. Admittedly this is not a direct representation of the pay TV subscription market, it does demonstrate the pressures faced by traditional content providers.

This is a change over which we have been expecting for a while, but perhaps this is another reality check needed by the telco industry to improve infrastructure.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)