Kit vendor Nokia reported quarterly operating profit 42 percent lower than a year ago in Q2 2018 but reiterated its whole year target, pinning hopes on aggressive 5G rollout.

July 26, 2018

Kit vendor Nokia reported quarterly operating profit 42 percent lower than a year ago in Q2 2018 but reiterated its whole year target, pinning hopes on aggressive 5G rollout.

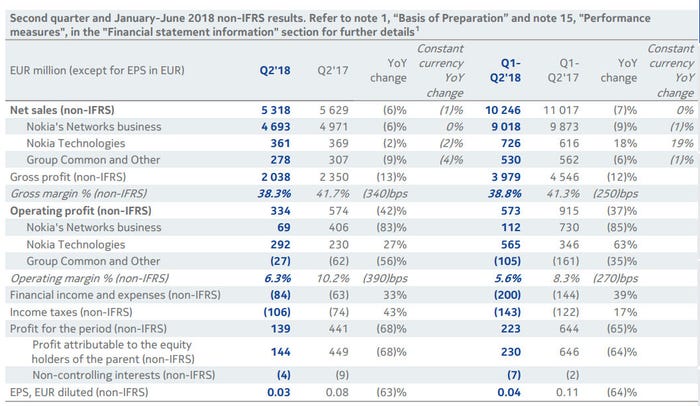

When the headline of the result release reads “First half 2018 as expected”, it is a sign that there is not much to write home about. Nokia reported quarterly net sales of €5.3 billion, 6 percent down from Q2 2017, while the operating profit, in non-IFRS measures, went down by 42 percent to €334 million, falling short of analyst mean forecast of €373 million. It would have been a €221 million operating loss if the costs related to the Alcatel-Lucent acquisition, goodwill impairment charges, intangible asset amortization, etc, were included. Share price fell by more than 7 percent by the time of writing, having recovered from a 9 percent drop earlier.

“Business and regional mix continued to have some impact on gross margin,” said Nokia CEO Rajeev Suri. The main year-on-year drops in its Networks business took place in Asia Pacific and Greater China. But Nokia maintained that it is still on track to achieve its full year targets, believing the rollout of 5G in key markets would come to the rescue. “Our view about the acceleration of 5G has not changed and we continue to believe that Nokia is well-positioned for the coming technology cycle given the strength of our end-to-end portfolio. Our deal win rate is very good, with significant recent successes in the key early 5G markets of the United States and China,” said Suri.

Nokia may be right that 5G is going to start to be rolled out in the US and in Asia later this year, but its success is not guaranteed. Although the Chinese vendors Huawei and ZTE, formidable competitors globally, have had their fortunes curtailed in the US market, Nokia is facing stiff competition from its northern European rival Ericsson. Nokia’s strategy to attack selected verticals in 5G is a smart move, to diversify its client base to go beyond telecom operators.

Another Nokia strategy to bear fruit is its high investment in R&D over the years. One bright point that stood out in the release was Nokia Technologies, the unit tasked to license Nokia’s IPR and brand. With less than 7 percent of the total net sales, it generated over 87 percent of the company’s operating profit, up by 27 percent over Q2 2017. You can read further analysis of Nokia’s numbers at Light Reading here, and here are they are in a table.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)