Samsung’s smartphone shipments have declined for the past four quarters and the overall market has followed.

November 2, 2018

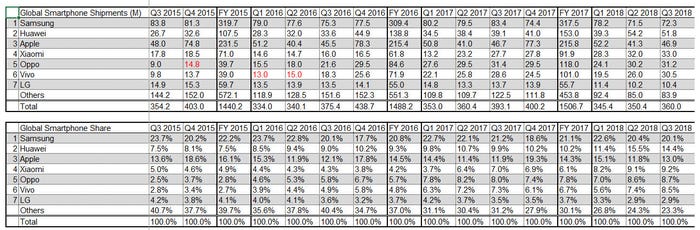

Samsung’s smartphone shipments have declined for the past four quarters and the overall market has followed.

At the same time Huawei continues to go from strength to strength. Annual smartphone shipment growth of 41% allowed Huawei to take second place in the global rankings last quarter and 32% growth this quarter was enough to keep Apple at bay once more. Samsung’s shipments declined by 13% this quarter and if these trends keep up Huawei could grab the top spot before long – a previously unthinkable event.

“Global smartphone shipments tumbled 8 percent annually from 393.1 million units in Q3 2017 to 360.0 million in Q3 2018,” said Linda Sui of analyst firm Strategy Analytics. “The global smartphone market has now declined for four consecutive quarters and is effectively in a recession. The smartphone industry is struggling to come to terms with heavily diminished carrier subsidies, longer replacement rates, inventory buildup in several regions, and a lack of exciting hardware design innovation.”

“Samsung is losing ground to Huawei, Xiaomi and other Chinese rivals in the huge China and India markets,” said Neil Mawston of SA. “Samsung must solve its China and India problems before it is too late. Huawei remains the world’s second largest smartphone vendor with 14 percent share. Huawei has little presence in the valuable North America market, but its Android models are wildly popular in most of the rest of the world, particularly Asia and Europe.”

One interesting twist to the numbers was Apple’s decision to stop reporting shipment numbers from next quarter onwards. Since this is always its strongest quarter you have to wonder what Apple is playing at. “Starting with the December quarter, we will no longer be providing unit sales data for iPhone, iPad and Mac,” said Apple CFO Luca Maestri on the earnings call. “As we have stated many times, our objective is to make great products and services that enrich people’s lives, and to provide an unparalleled customer experience so that our users are highly satisfied, loyal and engaged.

“As we accomplish these objectives, strong financial results follow. As demonstrated by our financial performance in recent years, the number of units sold in any 90-day period is not necessarily representative of the underlying strength of our business. Furthermore, a unit of sale is less relevant for us today than it was in the past, given the breadth of our portfolio and the wider sales price dispersion within any given product line.”

Fair enough but the market will be the judge of how relevant Apple’s unit shipment numbers are. Companies like Strategy Analytics will still publish estimates and journalists will still write about them. Apple was one of the few smartphone vendors that still published its numbers so maybe it has decided, as has LG, to get in line with its competitors on this, with the overall declines in the smartphone market possibly contributing to that decision. But the weak reasoning offered above will leave many unanswered questions in the minds of investors.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)