CB Insight has released its latest quarterly report on venture capitalist funding claiming new records are being spent in terms of total cash, but trends are leaning towards the bigger players.

January 9, 2019

CB Insight has released its latest quarterly report on venture capitalist funding claiming new records are being spent in terms of total cash, but trends are leaning towards the bigger players.

Over the course of the last 12 months, US venture capitalists spent a total of $99.5 billion funding businesses, though the number of deals stood at 5,536, the lowest since 2013. Later-stage mega-deals pushed annual funding to its highest level since 2000, though you have to wonder whether there will be any material impact on innovation, a worrying though when you consider the emerging potential of 5G for disruption.

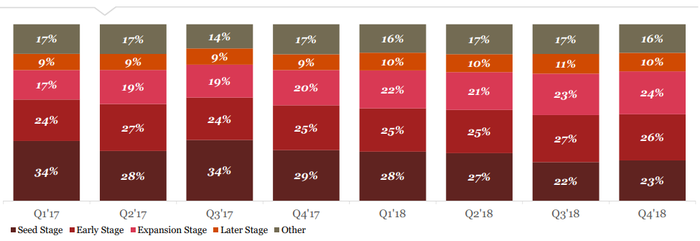

Although the majority of the segments are relatively stable, as you can see from the graph below seed-funding has been gradually eroding for some time.

For those with the cash to spend, these trends make a lot of sense. Why would you take a risk on a start-up which might fail in the next couple of months when you could invest in a company which has scaled, secured customers and revenues and has a stable foundation? There are so many medium sized technology companies out there looking for financial fuel to go to the next level makes perfect sense.

For those with the cash to spend, these trends make a lot of sense. Why would you take a risk on a start-up which might fail in the next couple of months when you could invest in a company which has scaled, secured customers and revenues and has a stable foundation? There are so many medium sized technology companies out there looking for financial fuel to go to the next level makes perfect sense.

However, the impact on the future might be damaging for the US on the whole if it wants to maintain its position at the top of the technology rankings table.

Here’s our point; not all innovation comes from start-ups or garages hidden away in suburbia, but a notable number of the significant disruptions do. If funding is being more prominently directed towards the established players, is a trick being missed?

Let’s dissect that point for a second. The larger companies certainly do search for innovation, but the search is for a purpose. Nokia, for instance, wouldn’t allow their researchers to run wild without any tethers whatsoever as there are limited R&D funds available and commercial considerations have to be factored in. The search for innovation is almost certainly tied to a current commercial objective or with specific ambitions to exploit an emerging segment.

This is not a bad way to do business of course. R&D has to be conducted with a purpose; these organizations have a responsibility to investors and shareholders to spend money reasonably, with the objective of making more money in the future. It certainly is sensible, but it is a restricted approach to innovation. Start-ups don’t necessarily have these burdens of responsibility, they can explore the unknown.

5G has been billed as a revolution. It will change the ways businesses operate and open a host of new connectivity possibilities to everyone in society. But like 4G, the best ideas are ones we haven’t thought of yet. They are probably businesses which do not exist. How many people would have thought of an idea such as Uber before 4G was a reality. This idea only came to be because the right conditions were in place and a creative inventor thought of it. Throughout the 4G era many of the better ideas emerged from start-ups which either scaled or were bought by one of the major players.

The world of 5G is not upon us quite yet, therefore it is a bit of a pre-emptive point right now. Innovation needs to be encouraged at every level if the US is to hold off the Chinese challenge to its technology leadership position. The trends are currently leaning away from seed-funding, which is certainly sign.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)