The Q4 2018 numbers for Ericsson are out and they represent the third quarter in a row of modest recovery for the networking vendor.

January 25, 2019

The Q4 2018 numbers for Ericsson are out and they represent the third quarter in a row of modest recovery for the networking vendor.

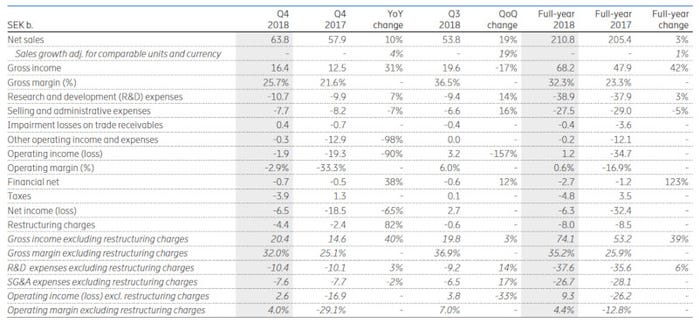

Net sales for the quarter, when adjusted for adjustments, were up 4% year on year, resulting in a full-year improvement of 1%. Apparently this is the first time Ericsson has managed full year revenue growth since 2013. On the down side it had to account for a bunch of restructuring charges thanks to pulling the plug on its BSS business.

“Our focused strategy has yielded clear results,” said CEO Börje Ekholm. “Ericsson is today a stronger company. Increased investments in R&D for future growth, managed services contract reviews, combined with efficient cost control have proven to be successful, with improved competitiveness and profitability as a result. As the industry moves to 5G and IoT, we will now take the next step, focusing on profitable growth in a selective and disciplined way.”

We spoke to departing marketing head Helena Norrman about the numbers and that’s the core narrative as far as Ericsson is concerned. Ekholm’s strategy was to be profitable first and then look at growth. Three quarters in a row of heading in the right direction would appear to demonstrate that it’s paying off so fair play to him.

Ericsson uses data from Dell’Oro to both size its total available market and track its share of it. For the first nine months of 2018 Ericsson’s share of the RAN equipment market was 29.4% according to Dell’Oro, up from 28.2% in the same period a year earlier. They also reckon the RAN market is set to grow by 2% this year.

As Ekholm recently discovered, the world is curious to know how much, if any, of Ericsson’s improved fortunes are down to Huawei becoming a pariah among the US and some of its allies. We didn’t expect Norrman to be any keener to talk directly about a competitor but had to ask. She made the good point that the market share growth has been gradual, so it probably isn’t the result of geopolitical stuff.

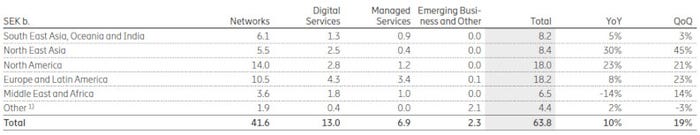

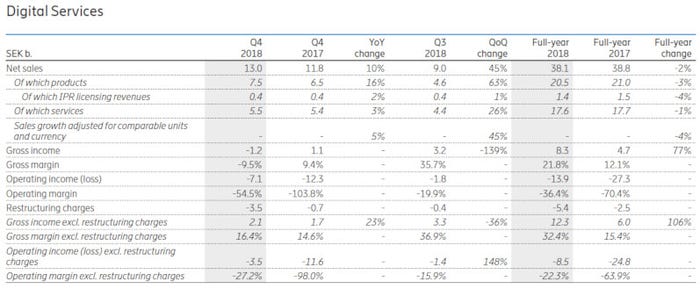

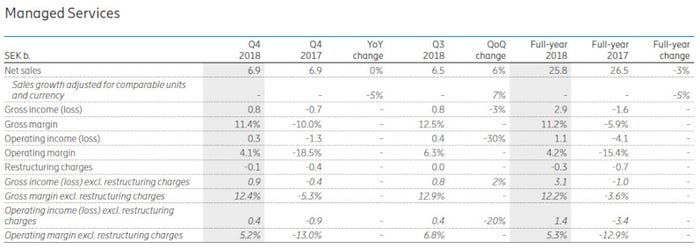

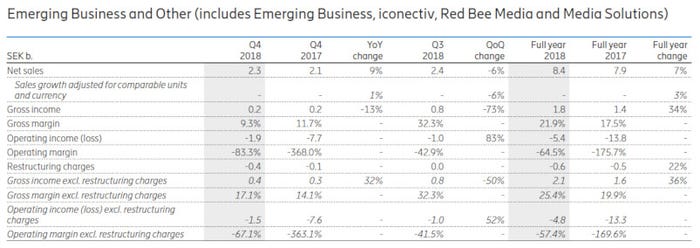

Here are some tables.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)