For years the Huawei message has been we’re better, but its MWC tag-line might have a slightly different look to it this year.

February 20, 2019

For years the Huawei message has been we’re better, but its MWC tag-line might have a slightly different look to it this year.

With security concerns continuing to rage around the world, the vendor has to prove itself more than worthy to be considered in 5G plans. And it seems to be doing that quite effectively. As of today, Huawei claims to have shipped more than 40,000 5G base stations to customers around the world, and has signed 18 5G commercial contracts in Europe, nine in the Middle East and three in Asia Pacific. But with the US on an anti-China road-trip, what is convincing these telcos to buddy up with the Chinese vendor?

Simpler, faster and cheaper

Simpler, in terms of ease of deployment, faster, in terms of speed of deployment, and cheaper, in terms of running a 5G business. These are the promises for the new products and business model undertaken by Huawei.

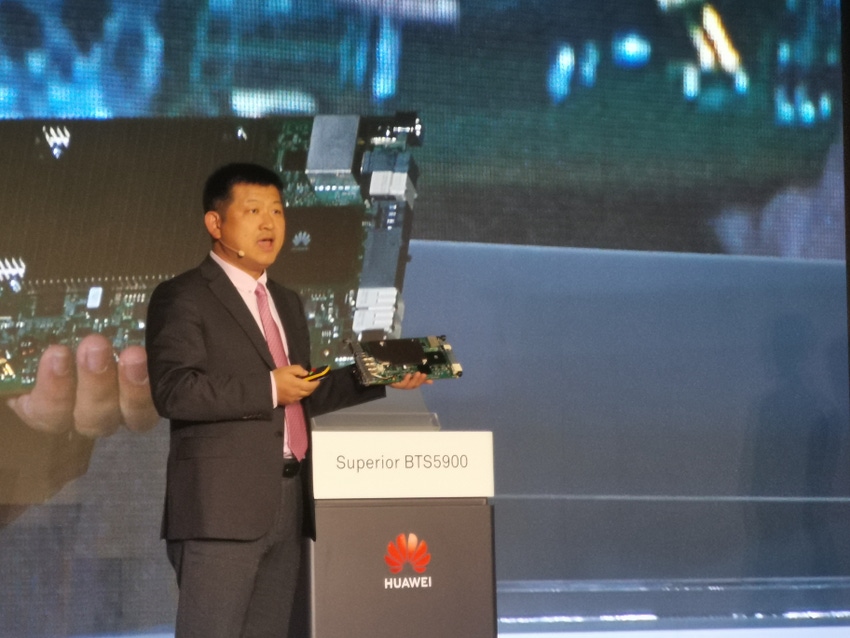

The 5G base stations which were paraded around the conference room this morning certainly fit the bill. A 64T64R 5G base station on display was roughly 40% of the size of its 4T4R 4G counterpart, and when you combine the weight of 32kg, Ryan Ding, CEO of Huawei’s Carrier Business Unit, claims the kit can be installed by two people in a matter of hours. No need for expensive cranes anymore.

Another interesting factor to consider is the power consumption of this kit. Huawei claims the kit is much more energy efficient than previous generations, when you factor in the increase in capacity and performance, generating a much more compelling business case. Ding was also bold enough to insist Huawei equipment is 30% more energy efficient than anything else on the market. While it might not sound like the most glorious of statements, it fits into the message which was booming off the stage this morning.

For Ding and co. the aim over the next couple of years is to reduce the cost-per-bit for telcos. With the pressure on for telcos to rollout 5G at a faster pace than 3G and 4G, this could come as a very important consideration. When you also ponder the network densification requirements of tomorrow’s world of connectivity, the boring arguments of energy consumption and ease of deployment become much more significant. Ding’s claim here is Huawei can reduce cost-per-bit for connectivity by 80-90% compared to 4G.

There are many around the world who would consider Huawei the leader in terms of innovation, but when combined with ease of deployment and an attractive reduction in OPEX, the Huawei machine could keep churning forward despite the security concerns. In fact, this doesn’t seem to be too much of a bother for Ding.

Looking at the revenues of the Carrier Business Unit, Ding pointed to the last two years as some of the toughest the business has faced. Huawei is not alone here, though Ding suggested revenues were only growing by 2-3% for the unit over 2017 and 2018. With 5G spending expected to ramp up, Ding expects the business to hit attractive growth numbers once again.

Coming back to the elephant in the room, the security concerns will have an impact, but only marginally. Ding suggests the markets where Huawei has been snubbed are not traditionally its most successful.

“In regard to security concerns, there will be some impact in some countries, but not in 95% of their markets,” said Ding.

Korea is an excellent example of this point. It is the world leader in the 5G race, and of course it would have been of interest to Huawei, but you have to consider the competition. Samsung, as a domestic technology champion, was always going to have home-field advantage over the competition.

While the security accusations directed towards Huawei will remain for years to come, the tides do seem to be turning. The US might have found some early success in turning governments against Huawei, but recent months have not been as fruitful. The UK and Germany are seemingly insistent on welcoming the business, while US Secretary of State Mike Pompeo’s propaganda tour of Eastern Europe was met with an icy hello. Perhaps the statesman should not accuse the bloc of a susceptibility to corruption before arriving next time.

For those who have been predicting the downfall of Huawei, now might be time to reconsider. It certainly won’t have the same tsunami of success it experienced in the 4G world, but trends suggest it will maintain its leadership position not only built on a booming portfolio, but also a more tender consideration of telcos bank accounts.

Simpler, faster and cheaper.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)