Swedish kit vendor Ericsson is determined to make life difficult for journalists these days by delivering solid but unspectacular quarterly numbers.

July 17, 2019

Swedish kit vendor Ericsson is determined to make life difficult for journalists these days by delivering solid but unspectacular quarterly numbers.

Gone, it seems, are the heady days of quarterly high drama that accompanied the end of the Vestberg era and the start of the Ekholm one. For the past year or so Ericsson has just boringly hit its numbers, sometimes beating them, sure, but never spectacularly so. Where’s the story in that?

We chatted to Head of Networks Fredrik Jejdling, who has stepped into the void left by the departure of Helena Norrman to handle the hacks at quarterly time. His core narrative was that Ericsson is laser-focused on hitting its 2020 target numbers and remains on course to do. We noted that a share-price fall of 5% indicates investors expected more and Jejdling, reasonably, declined to speculate on the workings of investors’ minds.

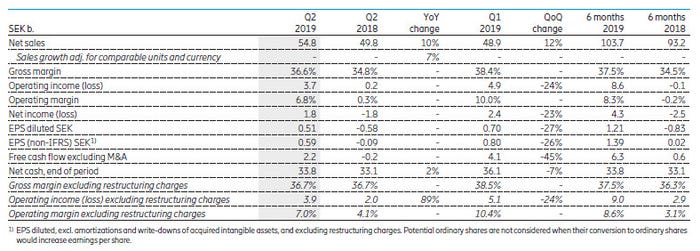

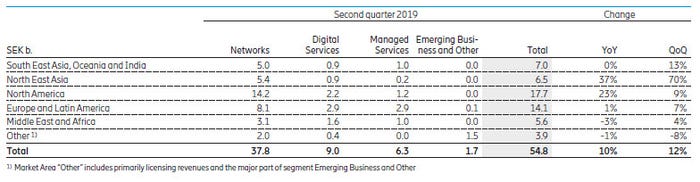

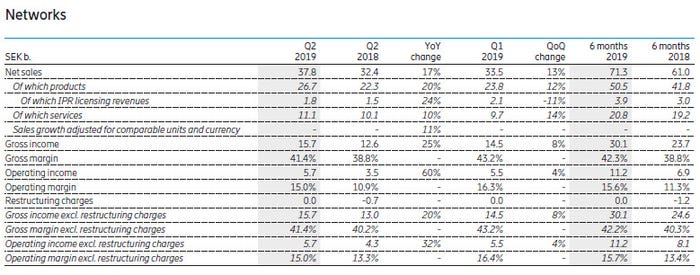

As ever Ericsson’s numbers are all about the networks division, which we focused on since Jejdling is in charge of it. As you can see from the tables below Networks accounted for the majority of the revenue and pretty much all of the growth. While North America continues to be by far its biggest region, Jejdling was keen to bring attention to North East Asia, which includes China and Korea, as a significant source of growth. He also echoed his CEO’s regular comments that global regulators could do a better job of making more spectrum available.

The big macro driver for this growth was, of course, 5G. Jejdling said client conversations are much more focused on upgrading to 5G than they were only recently and indicated that interest in is more globally ubiquitous than is was for 4G at a similar stage. He did stress however, in classic Ericsson style, that it’s still early days and nobody’s getting too carried away. “As long as we feel we’re meeting the key milestones on the 2020 track then we’re quite happy,” said Jejdling.

We didn’t really get into the other business units, so here’s some of CEO Börje Ekholm’s statement accompanying the quarterly report. “We see strong momentum in our 5G business with both new contracts and new commercial launches as well as live networks. To date, we have provided solutions for almost two-thirds of all commercially launched 5G networks.

“5G momentum is increasing. Initially, 5G will be a capacity enhancer in metropolitan areas. However, over time, new exciting innovations for 5G will come with IoT use cases, leveraging the speed, latency and security 5G can provide. This provides opportunities for our customers to capture new revenues as they provide additional benefits to consumers and businesses.

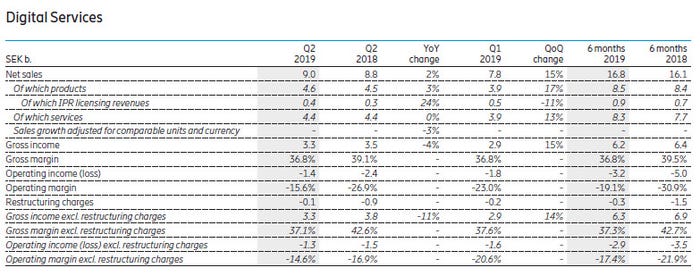

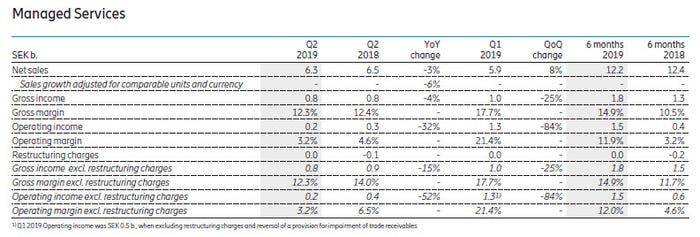

“In Digital Services we continue to execute on the plan to reach low single-digit margins for 2020. In Managed Services the strategy is to enhance the customer offering by relying more on automation, machine learning and AI, which will longer-term change and improve the margin profile of the business. Near-term margins are negatively impacted by the increase in R&D investments.

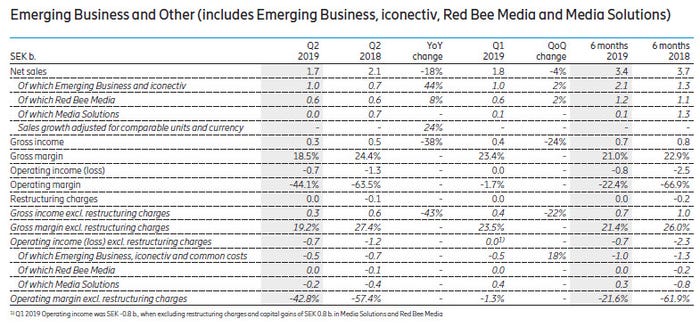

“Organic sales growth in Emerging Business and Other was 24% driven by a continued growth in iconectiv. In this segment we invest in initiatives that aim to scale and help create future business for Ericsson. With the exception of iconectiv, the portfolio is still in an early investment phase.”

Ericsson’s share price was down 6% at time of writing, which seems a bit harsh, but that probably reflects disappointment from investors that all the early 5G hype hasn’t translated into even bigger gains and a more bullish outlook. But 5G was never going to result in sudden massive spikes in investment and, however difficult it may find it to do otherwise, Ericsson is probably sensible to caution against too much exuberance at this stage.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)