It’s quarterly season again and if that wasn’t exciting enough it’s Q4, which means we get the full calendar year – lucky us. In the case of the big US tech companies we are presented with a Twilight Zone-like parallel reality where the accumulation of unimaginable riches is often greeted with indifference or even disdain.

January 30, 2015

By The Informer

It’s quarterly season again and if that wasn’t exciting enough it’s Q4, which means we get the full calendar year – lucky us. In the case of the big US tech companies we are presented with a Twilight Zone-like parallel reality where the accumulation of unimaginable riches is often greeted with indifference or even disdain.

“ACME Widgets made a disappointing $10 zillion profit in the fourth quarter of 2014 as supply constraints and currency concerns ate into margins,” would be a typically doleful report as observers discuss where it all went so wrong. Outraged shareholders might then call for radical action in a desperate bid to rescue their floundering company while contrite execs grovelingly apologise for presiding over such a debacle.

Moralising commentators also seem to be thrown by successful tech companies as they can’t quite work out whether they deserve their profits. It’s not like with banks, consigned to the role of pantomime villain since they so spectacularly arsed everything up eight years ago. Any profit made by a bank is by definition dirty, sullied and immoral. They sit atop their ivory towers stroking over-fed cats and plotting how they might inflict even further suffering on society in the name of Mammon.

Tech companies, however, actually make things – and fun ones at that. They invest billions in R&D to create products we use every day to make our lives easier, more entertaining and more productive. What’s not to like? So even when Apple banks 18 billion big ones in a single quarter our response tends to be more along the lines of: “fair play to ‘em – they deserve it for making such cool gadgets.”

This isn’t the first quarter of handsome profit for Apple, in fact it has been accumulating cash to an obscene extent from pretty much the day it launched the iPhone. Apple will have tipped that $18 billion into the big warehouse full of cash it already has, bringing the value of the pile to a mind-blowing $178 billion.

In keeping with the spirit of mainstream media commentary around this matter, the Informer decided to do some research on arbitrary comparisons with Apple’s heaving mound of wedge. Wikipedia reveals Apple has more put aside than the GDP of Ecuador, but less than Ireland. Were Apple to donate its entire stash to the UK government it would still only pay off a tenth of our national debt.

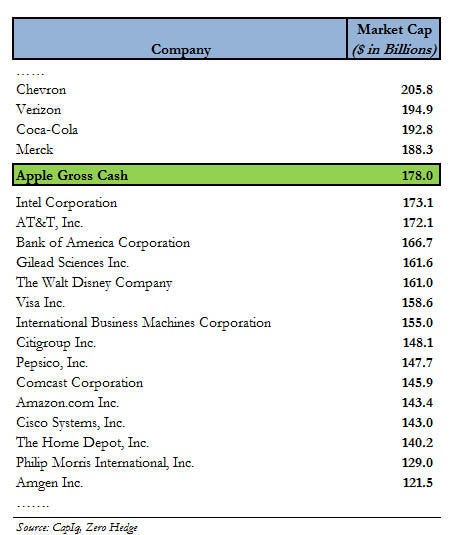

Apple famously isn’t a fan of major acquisitions, but if it changed its mind it could theoretically buy AT&T or Intel without even having to call its bank manager, as illustrated in the table below, originally published by ValueWalk.

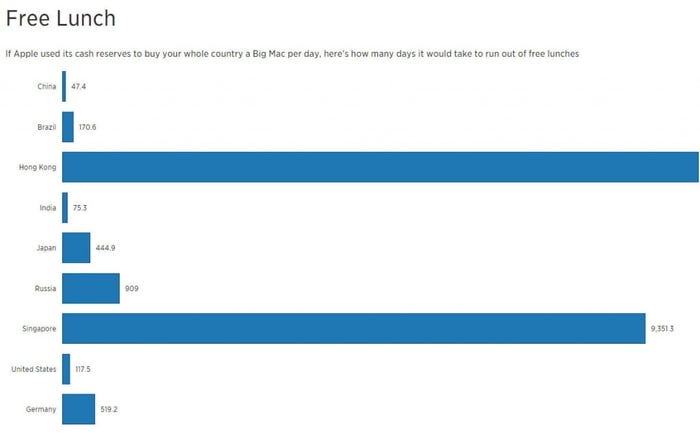

But the winner of ‘best arbitrary illustration of how much cash Apple has’ goes to CNBC, home of the absurdly theatrical, sleeve-rolling equity pundit Jim Cramer. CNBC calculated Apple could hand over $556 to every American, or just buy every homeless American a three-bedroom house in New Jersey. More importantly Apple could bankroll over 100 Rupert Murdoch divorces, but the crowning arbitrary metric from CNBC, illustrated below, is that Apple could buy every person in China a Big Mac for 47 days.

Take care.

The Informer

Read more about:

DiscussionYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)