The numbers kept coming this week as more quarterly results rolled in—but the biggest number of all was the value attached to Facebook. The firm set the share price for its impending IPO at between $28 and $35, valuing it at between $85bn and $95bn.

May 4, 2012

By The Informer

The numbers kept coming this week as more quarterly results rolled in—but the biggest number of all was the value attached to Facebook. The firm set the share price for its impending IPO at between $28 and $35, valuing it at between $85bn and $95bn.

For most of the industry that’s just not the real world. Motorola Mobility chalked up a loss of $86m for the first quarter of this year, $5m worse than its performance for the same period a twelvemonth back. There was a slight upside in a two per cent improvement in net revenues to $3.1bn and a three per cent hike in device revenues to $2.2bn, with 8.9 million devices shipped in the quarter, 5.1 million of which were smartphones.

Google’s acquisition of MoMo (a deal the handset vendor describes as a merger, which is a bit like saying the Informer merged with three slices of toast this morning) is still on for completion before the end of the first half, according to CEO Sanjay Jha.

But all the focus in the Android space this week was on South Korea’s Samsung, which unveiled the latest addition to its superphone portfolio, the Galaxy SIII. Word from the Informer’s analyst chums is that the new unit delivers its innovation in the way it integrates familiar functions, rather than with any new capabilities.

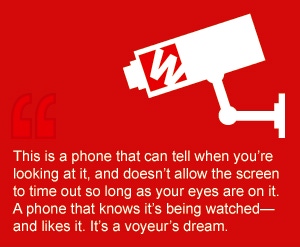

This is a phone that can tell when you’re looking at it, and doesn’t allow the screen to time out so long as your eyes are on it. A phone that knows it’s being watched—and likes it. It’s a voyeur’s dream. Take a photo of a friend and it can recognise that person from other images from a variety of environments and tag and store it accordingly. It will also offer one-click options to send or post it to a person or feed.

This is the handset vendor’s view of what users want, but anticipation and disappointment are frequent bedfellows and some analysts suggested that encouraging enthusiasm for the phone’s intuitive interface will be more of a struggle than its creation.

“If users try these features once or twice and they don’t work – they will say it’s useless,” said Informa handset specialist Malik Saadi. “That’s the risk Samsung is taking, as does any company that tries to be innovative. Added intelligence in the phone is very good, but it comes with risks.”

Saadi likened the concerns to the reasons that hindered the take-up of “predictive text”, noting that when predictive text was first introduced, many users opted to turn the feature off, and it only became popular when the technology was fine-tuned and became more intuitive.

Tony Cripps, Saadi’s oppo at Ovum agreed that the challenge that lies ahead for Samsung is how it is able to get users acquainted with the new functionalities.

“These are new types of features that people aren’t really used to – it’s going to depend on how Samsung is going to walk people through the out-of the-box experience,” he said. “You’d hope there’s some sort of wizard that helps people understand what these functions are about otherwise they could easily be lost.”

However, he added that, despite that, the phone will “almost certainly turn out to be the biggest-selling smartphone Samsung has ever produced”.

The Informer’s had a few out of the box experiences in his time—although he’s never had a wizard appear and help him through them, more’s the pity.

Samsung wasn’t the only handset vendor having a bash this week, as RIM’s Blackberry World event kicked off in Orlando. RIM dished out thousands of prototype versions of handsets built on the new Blackberry 10 platform to developers in a bid to get them busy on a range of services to complement the commercial iterations of the phones when they arrive. The firm also said it would give developers a minimum payout of $10k for any app that gets certified and meets a number of conditions, including generating $1,000 of income in its own right.

The obvious question is whether all of this enthusiasm and commitment is too little too late. It’s a brand new direction for the company. The new platform is not backwards compatible with the old one (the new phone doesn’t even have a hard keypad) and such a sweeping reposition is not easy when things are going well, let alone when they’re not.

In other handset news, a cross platform developer called Xamarin has announced that it has ported Android to C#. When Google built Android, the application environment was designed in Java, the language first developed by Sun Microsystems and now owned by Oracle. But in building the virtual machine called Dalvik that actually runs the application inside the host OS, Oracle claims that Google infringed upon some of its Java-related patents.

The court case is grinding on and could get very inconvenient and expensive for Google. Meanwhile Xamarin has spent nearly a year porting much of the Android foundations to C#, an alternative object-oriented programming language developed by Microsoft. The big difference is that C# and the .Net runtime are covered by strong patent commitments preventing Microsoft from suing anybody that implements the technology.

The result, which Xamarin has made available this week, is a C# version of the Android OS called XobotOS. However, the developer said that XobotOS is only a “research project” and it does not intend to maintain it as a standalone project. So the OS is not likely to make it any further than the developer community any time soon. Xamarin said its research has yielded many tools necessary to replace some chunks of Java code with C# code where performance is critical and when C# can offer better solutions than Java has. The result is that much of the hard work is done should anyone want to fully develop a Java-free and potentially patent-infringement–free version of the Android OS.

Let’s have a look at some personnel news now, and Vodafone’s head of Europe is off to take the helm at second-placed French carrier SFR. Michel Combes will join SFR in August at a time when the French market is commanding a reasonable amount of attention because of the growth in popularity of punk MVNO Free Mobile, which does exactly as its name suggests.

Meanwhile Telenor chairman Harald Norvik has resigned following criticism of the sale of the country’s main commercial television channel from a Norwegian government minister. Telenor subsidiary A-Pressen held half of TV2 and sold it in January to Danish group Egmont, which already owned the other half. The Norwegian G, apparently, was unhappy that the stake didn’t go to a domestic organisation.

The Informer thinks it likely that Telenor’s travails in the Indian market might have contributed to the pressure on Norvik as well, with the firm forced to write down its Indian assets last month.

This week Telenor said that it is making plans to get out of the Indian market, as it is “almost impossible” for the firm to participate in the auction that the Indian regulator TRAI has planned to redistribute 2G wireless spectrum in the wake of the high profile licensing scandal. It may just be hot air, as a spokesman told Telecoms.com that it was waiting for information on the final design of the auction.

Sticking in India Bharti Airtel reported a 29 per cent drop in quarterly net profit to $189m for the three months to end March 2012. The firm blamed the costs of its 3G deployment as well as tax charges for the period.

For the UK operator of the T-Mobile and Orange brands, Everything Everywhere, the bogeyman was downward regulatory pressure on mobile termination rates. The firm’s service revenues dropped by 2.5 per cent to £1.5bn for the first quarter of 2012. CEO Olaf Swantee kept things upbeat, though, claiming industry-beating churn of 1.2 per cent.

In any case, the firm is far more focused on LTE, which it wants to launch ahead of the rest of the market later this year by refarming its 1800MHz spectrum. This will require Ofcom approval, and has already got a bristling response from EE’s competitors in the UK market.

The firm launched a publicity campaign to back its cause this week, publishing research that it commissioned from Capital Economics that 4G rollout will attract private investment worth £5.5bn into the UK economy, create or safeguard 125,000 jobs and add 0.5 per cent to UK GDP by the end of the decade (or £7.5bn.year). The Informer has no idea how these figures were reached. What jobs? What investment? Can the findings of this research that EE commissioned to support its bid to steal a march on competitors actually be verified or cross checked?

“The research shows that rolling out 4G will kick start a new cycle of investment and innovation in internet services and mobile devices for consumers, and productivity benefits for businesses,” said Mark Pragnell of Capital Economics, the report’s author, in accordance with his commission. “It also shows how giving Britain a world class digital infrastructure will make it more globally competitive and attract new business start-ups.”

It’s nothing to do with tax, then.

Take care

The Informer

Read more about:

DiscussionYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)