South Korea is one of the world’s most advanced mobile markets, with all three operators running LTE and the race to LTE-A already underway. It serves as an interesting pilot for the promises and pitfalls many other operators will experience in the future.

September 5, 2013

In January 2012, Korea Telecom (KT) became the last of the country’s three big carriers to introduce LTE. The company’s two leading rivals, South Korea Telecom (SKT) and LG U+, had already introduced commercial 4G services several months before. South Korea, like Japan, has always been ahead of the curve in terms of technology adoption. While Scandinavian operator TeliaSonera was the first in the world to switch on its LTE operation, South Korea was one of the first countries, if not the first, to see all national operators offer LTE.

Market leader SKT launched LTE in July 2011 and within 18 months had seen 37 per cent of its user base migrate to the technology. As of June 2013 that number is closer to 40 per cent with Informa’s WCIS+ reporting that over 11 million of SKT’s 28 million – strong subscriber base is on LTE. In fact, South Korea counts around 23 million LTE users as of June, out of its 55 million total, suggesting that SKT’s numbers are a fair representation of the nation.

In a keynote presentation at the LTE World Summit in Amsterdam in June, Dr J W Byun, CTO of SKT, highlighted the significant appetite not just for faster technologies, but for newer technologies. “Customers migrated to LTE mainly because it’s different,” he said, although higher speeds clearly had their attraction. “Download speeds for LTE are six to seven times faster than 3G in metropolitan areas and people feel that difference. But they also consume more bandwidth every month,” he says. ”Average data consumption has gone from 1.1GB per month to 2.1GB per month in the shift from 3G to 4G.”

In this sense South Korea benefits from many unique characteristics, not least of which is 100 per cent smartphone penetration. Pretty much everyone in the country who has a mobile phone has a smartphone, so it’s not even dongles generating the traffic that Byun is talking about.

In fact, South Korean users are unusually familiar with the industry vocabulary. Just as Western Europe is beginning to see the first uses of ‘LTE’ in consumer marketing, while the USA has been using ‘4G’ for some time, South Korean users are already very familiar with the term ‘LTE’ and what it means, according to Mark Thompson, sales and marketing director at Korean handset manufacturer Samsung.

Thompson argues that the end user experience on LTE is so much better than what has come before that, when asked whether operators are actually delivering on their promises with LTE, the answer is “yes”.

The numbers certainly add up according to SKT’s Byun, who said that 4G LTE ARPU comes in at $43, while 3G smartphone ARPU comes in at $31, a 28 per cent difference between generations, and significantly higher than the ‘legacy’ feature phone ARPU of $18.

The LTE Asia conference is taking place on the 18th-19th September 2013 at the Suntec, Singapore. Click here to download a brochure for the event.

After launching Korea’s first LTE service in July 2011, the company saw its LTE subscriber base expand rapidly thanks to its premium service quality and customer care. With the spread of LTE, the company shifted its focus to developing and providing diverse services specially designed to match the needs of LTE users, allowing them to get the most out of the LTE network.

The operator has already commercialised RCS (Rich Communications Service) with an offering named joyn.T. Launched in December 2012 the number of joyn.T users reached 1.57 million in April, 2013. According to Byun, the strong growth of joyn.T is attributable to the fact that it: enables users to send free messages (SMS, MMS) to anyone including those who have not downloaded the joyn.T application; offers differentiated features such as live video sharing and location sharing; and is interoperable with the RCS services of other mobile carriers throughout the world.

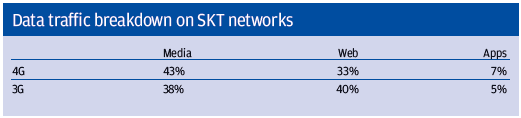

SKT is already seeing the type of traffic it carries switch, and over time Byun expects that service delivery will be more skewed to multimedia than web browsing.

Because it’s a very demanding market, South Korea has become something of a test bed for LTE technologies. SKT became one of the first operators worldwide to launch voice over LTE (VoLTE) under the ‘HD Voice’ brand in August of 2012 as it sought to cut ties with legacy voice networks as well as better compete with over the top VoIP services.

The company had more than 4.5 million active users of the technology at the end of May and Byun reiterated his claim that VoLTE dramatically improves audio quality, relying on high quality audio codecs that are able to handle 2.2 times wider frequency bandwidth as 3G voice. He also made much of improved call setup time which ranges from 0.25 to 2.5 seconds on LTE, compared with a five second setup time on 3G.

Rival LG U+ has since introduced VoLTE services too, and Byun was quick to confirm that, since commercialising LTE and its associated services, all operators in South Korea have seen an increase in ARPU, especially LG U+ as the smallest competitor. Although Byun claims that SKT has successfully defended its dominant market position against similar offerings from rivals, he readily acknowledges that, with the same network equipment available to all carriers, it is increasingly difficult to find ways of differentiating services.

One solution was to launch what SKT says is the world’s first commercially available elements of an LTE-Advanced offering, which it will make available at no extra cost to consumers. To date, just 13 operators across eight nations, including Verizon, AT&T, NTT Docomo and Telenor, have announced plans to launch LTE-Advanced, according to research from Wireless Intelligence, the market research arm of the GSMA. Among them Sprint, Telstra, 3 Italia and Yota have said that they will launch this year.

SKT’s enhanced service is operational in Seoul and central areas of Gyeongg-do and Chungcheong-do and SKT plans to expand coverage to 84 cities nationwide using a combined total of 20MHz from the 800MHz and 1800MHz bands.

But the enhancements don’t stop there. In order to keep service differentiation alive and meet the intense demands of the market, other features employed by SKT include Multi Carrier, LTE femtocells, Downlink CoMP (Coordinated Multi-Point) and SON (Self Organising Network) ahead of a full-fledged opening of the era of LTE-Advanced.

Multi Carrier enables operators to choose one frequency band from multiple carriers to provide more seamless and reliable LTE services at faster speeds – by building 1.8GHz base stations. Going forward, these MC capable base stations can be easily turned into CA-capable equipment through software upgrades so as to support LTE-Advanced from the second half of 2013.

SKT says that the service enhancements offer network speeds of up to 150Mbps, which is twice as fast as LTE and ten times faster than 3G speeds with users able to download an 800MB movie in just 43 seconds. Carrier Aggregation and CoMP are just the first elements of the LTE-Advanced suite that SK Telecom has deployed and the firm said that it plans to introduce Enhanced Inter-Cell Interference Coordination in 2014.

“CA will be further advanced to realize up to 300Mbps speed by aggregating two 20MHz component carriers by 2015, and become capable of combining three component carriers by 2016,” SKT said. The current CA standards allow for up to five 20MHz carriers to be aggregated. In terms of handling the volume of data, Byun is currently developing a “dynamic scheduler” which gives SKT better traffic management capabilities. With data, voice and multimedia all travelling over LTE networks in such large quantities, management of the traffic is now of the utmost importance.

It’s interesting that SKT is developing its own scheduling solution, but perhaps more so in that the company is not alone. KT has something similar on the go, called LTE Warp, which it has actually commercialised under its Global Solutions division and pitches as the “World’s first commercial cloud-based LTE enhancement solution”.

The system’s network structure consists of a Cloud Communications Centre (CCC) in which Warp virtualisation servers and digital units reside, as well as small cells linked to the CCC via a fibre network. The key claims of the offering are an increase in cell capacity of up to 60 per cent; a decrease in opex of 20 per cent due to reduced maintenance, rent and electricity costs; and up to 66 per cent faster deployment due to small-sized radio units that can be installed in any location.

The Korean operators are clearly onto something and it’s likely the phenomenon driving them to develop off-3GPP-spec enhancements will be encountered by other LTE carriers down the line. Chinese manufacturer ZTE has recently been pushing its own commercial solution, after releasing research which found that inter cell interference is much higher than first thought and that proposed solutions built into the LTE specification might not be sufficient remedy.

Speaking to LTE Outlook about technical issues operators will face in the future, Lei Xue, director Europe CTO group at ZTE, said that 3G networks are already congested and 4G networks will be congested by 2017. Of more concern, Lei said, is the discovery that interference on those networks is actually much higher than was first thought. The big question now is whether operators can rely on the CoMP standard to solve the problem.

CoMP was pitched as an interference management technology first specified in LTE Release 11 and expected to be a major component of LTE Advanced. By coordinating and combining signals from multiple antennas, CoMP helps deliver a more consistent user experience for users on the cell edge or moving into new cells and instigating a handover. It can essentially turn the signal interference at the cell edge into a useful signal and help operators optimise their network.

A secondary part of the interference issue identified by ZTE is that the CoMP specification relies on significant backhaul assets being in place. But those assets are seldom available in real world environments. In response the company has developed a scheduling tool called Cloud Radio to help operators make the most of the huge investments they’ve made in fibre and backhaul in general.

Based on SDR (software defined radio) it uses existing backhaul assets to assist in interference control. The ‘cloud’ element is a reference to the solution’s elasticity – the ability to create a so called ‘super cell’ dynamically and give improved experience at the cell edge. The company claims that there is a big gap between standard backhaul found in situ and the requirements of CoMP that were set down to solve the problem. With insufficient inter-site coordination set out in live LTE environments, there is a risk of poor quality user experience.

So the implementation of a Cloud Scheduler, Lei said, should help cells coordinate with each other in order to provide better performance. The enhanced cell cluster (super cell) would actually follow the user as they move around the network, replacing the static clusters which often suffer with degradation of experience at the cell edge where there is most interference, or as the user is handing over to a new cell cluster. Not only does ZTE claim the system can provide a better experience on the cell edge, but it can also double cell edge capacity and reduce handover frequency by 50 per cent. It’s probably unfair to compare a super advanced market like South Korea to a relatively mature one like the UK, after all, UK LTE carrier EE is only seeing a ten per cent raise in ARPU from 4G, versus SKT’s 28 per cent. But South Korea should serve as an excellent pilot for all the trials and tribulations LTE operators elsewhere will experience in the years to come. This is one market worth keeping a close eye on.

Read more about:

DiscussionAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)