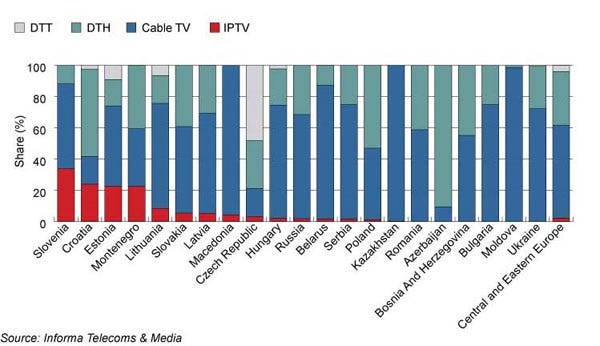

Ex-Estonian Prime Minister and historian Mart Laar once wrote a book entitled Estonia: little country that could. And it seems that his countrymen have taken this to heart when it comes to adopting IPTV. While one almost feels sorry for the technology in other Eastern European markets – it has a paltry 2 per cent share of multichannel TV in Hungary and a pitiful 1 per cent in Poland – in Estonia, incumbent Elion’s rollout already has 23 per cent of the market. The question is: why this discrepancy?

March 18, 2010

By Steve Wilson

Ex-Estonian Prime Minister and historian Mart Laar once wrote a book entitled Estonia: little country that could. And it seems that his countrymen have taken this to heart when it comes to adopting IPTV. While one almost feels sorry for the technology in other Eastern European markets – it has a paltry 2 per cent share of multichannel TV in Hungary and a pitiful 1 per cent in Poland – in Estonia, incumbent Elion’s rollout already has 23 per cent of the market. The question is: why this discrepancy?

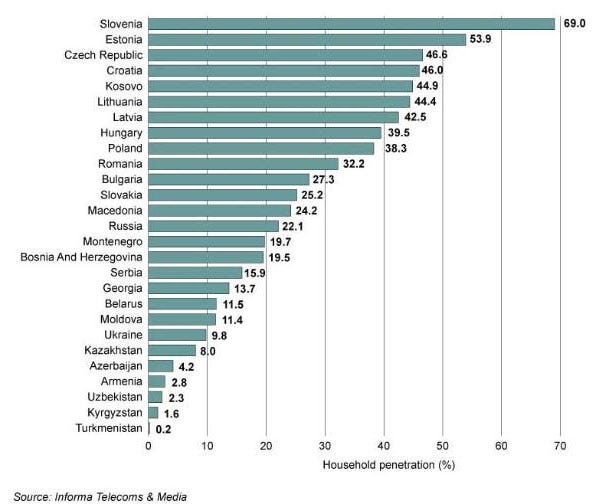

Part of the answer lies in the very spirit of Laar’s book: Estonia is a forward-thinking, confident country looking to break free from the past. It prides itself on its e-readiness with broadband penetration of households behind that of only Slovenia in Eastern Europe. Clearly this means more potential customers to which the incumbent telecoms operator Elion can sell its IPTV service. But it is more than that. Estonians see the Internet as a very positive development, and thus believe that TV should also be delivered by this means.

eastern-europe-tv

In the few other countries where IPTV has been successful – I am thinking of Croatia – the absence of other multichannel platforms, and cable in particular, is apparent. This is not quite true in Estonia where there are two relatively large cable players in STV and Starman. But the cable networks have weaknesses, according to industry insiders; having been built in Soviet times, they carry a negative connotation from the past. IPTV also benefits because the subscribers of the cable players are largely using analog services, which means that in most locations the quality is worse. In addition, the content offered by the cable TV operators and Elion is generally similar and there is nothing that, on its own, the subscribers are willing to pay more for. The Estonian national football league is not quite the same as the English Premiership, for example.

The problems for cable go a little deeper than this, however. The cable operators are said to have a bad reputation with customers who view them with a real lack of trust. The same could be said of the broadcasters, which are anxious to collect their carriage fees in a market where advertising revenues simply are not sufficient for profits to be made. There is a problem in that the cable operators are not entirely open in disclosing their subscriber numbers to the broadcasters, leading to conflict. Nevertheless, I have entered this unknown zone and have formulated data on the top four players in Estonia’s multichannel pay TV market. The lack of trust among consumers towards cable operators has allowed a telecoms operator with a conservative and utility-oriented brand to prosper in the multichannel TV market. All this means that, although Elion’s IPTV service is more expensive than those of the cable players, this has not proved a handicap in acquiring subscribers.

eastern-europe-penetration

The need for broadcasters to supplement incomes with carriage fees from pay TV operators has also meant that the digital terrestrial TV (DTT) platform has stayed weak. On the free-to-air platform offered by Levira, the number of channels is very limited. Broadcasters are wary, particularly after the collapse of the Kalev Sport channel, which was available for free, and the move of the popular TV6 from being a free-to-air channel to pay TV. The Estonian public broadcaster, ETV, did launch a second channel but funds are tight, particularly given the economic crisis afflicting the Estonian government. As a result, the channel is filled with repeats and not even available throughout the day.

In total, there are only five local channels on the free-to-air DTT platform, an important point because Estonian consumers do consider the number of channels important, say insiders. Cable operator Starman operates the pay DTT multiplex but again the number of channels cannot compete with that offered by Elion. This leaves the incumbent in prime position to take any subscribers converting away from analog terrestrial. Analog switch-off is scheduled for July 1, so there is the possibility for Elion to take more subscribers in the next few months.

With regard to direct-to-home (DTH) satellite TV in Estonia, Viasat does operate a platform. However, it could face problems in the near future resulting from a marketing campaign that led subscribers to believe that the only way to be able to continue to receive TV signals after the imminent analog switch-off was to take out a satellite subscription. This campaign had some effect with the operator’s subscriber base increasing, but it was then investigated and banned by the Estonian Consumer Protection Board. The negative publicity this will accrue could lead to a decline in trust in the operator, a position similar to that of the cable players. In addition, Viasat does not have a telecoms arm and thus cannot bundle TV with broadband and telephony, which is where much of Elion’s marketing has been focused, say those familiar with the situation.

So, in a country that prides itself on looking to the future, what might the next few years hold for Elion’s IPTV platform? A big positive factor is the Estwin initiative to bring a fiber backbone to all parts of Estonia by the end of 2012. This project is being funded by the Estonian government, Elion and the mobile players in the Estonian market, with support from European Union funds. Although the final business model and how the last-mile connections will be provided remain undecided, there is the potential for Elion to cover more homes with its IPTV service. For example, existing copper or newly-built fiber may be used, although there could be a possibility of deploying IPTV via a wireless last mile.

Elion has another advantage because it is concentrating on rolling out its fiber-to-the-building (FTTB) network to individual new-build homes. The cable players would struggle to convince any such household to have their home passed by a coaxial network due to a lack of trust, insist insiders. Indeed, Elion already had around 37,000 FTTB subscribers at the end of June 2009 and these customers would have no problem in receiving a service untainted by bandwidth constraints.

Elion can also benefit from video on demand given that it already has its own service. The Estonian public broadcaster has put part of its archives (although not those with copyright problems) online, with material older than 30 days available on a paid-for basis. Although initial uptake of the service was low, sources state that rapid growth is expected if the public service broadcaster finalizes the digitalization of the archive. Elion offers the service on its IPTV platform and the ability to watch the archived material on the TV set should encourage a further increase in the number of viewers, to the benefit of the operator’s platform.

While Estonia is a small country, as the title of Laar’s book shows, in terms of the success of the incumbent’s IPTV offering, it puts many bigger markets to shame.

Digital TV Central & Eastern Europe 2010, Bucharest, June 22-23

Digital TV Central & Eastern Europe 2010, Bucharest, June 22-23

Read more about:

DiscussionYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)