2012 sees LTE continuing to gain momentum as the fastest growing mobile technology of all time—and the move by several operators to re-farm 1800MHz spectrum represents the beginning of another key trend.

October 29, 2012

2012 sees LTE continuing to gain momentum as the fastest growing mobile technology of all time—and the move by several operators to re-farm 1800MHz spectrum represents the beginning of another key trend.

By Alan Hadden, chairman, GSA.

The Global Mobile Suppliers Association (GSA) has been tracking the commercialisation of LTE and market developments, confi rming progress with the latest facts, trends and developments in its Evolution to LTE report.

The trends that we have identifi ed in 2012 are accelerating LTE network deployments and service launches across the world, in both FDD and TDD variants.

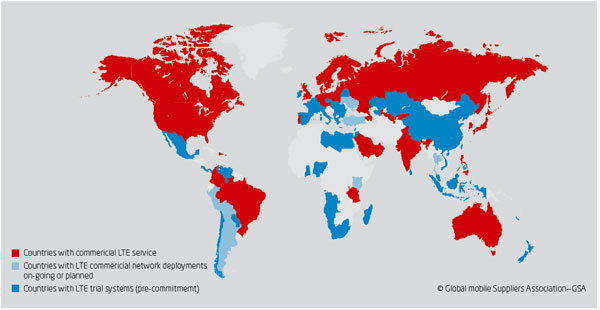

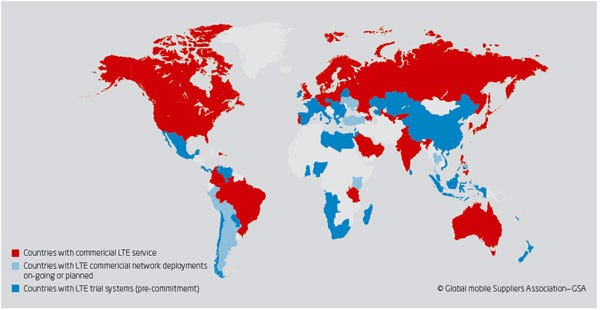

The September 11, 2012 issue of the report confi rmed that 347 operators were investing in LTE in 104 countries, including 96 commercial networks launched in 46 countries. At that time there were 292 fi rm LTE network deployments in progress or planned in 93 countries, with a further 55 operators in 11 additional countries engaged in pre-commercial LTE technology pilot trials, tests or studies. Taken together, it means that 347 operators in 104 countries are investing in LTE.

By the end of 2012 GSA forecasts that there will be 152 commercial LTE networks delivering advanced high speed mobile broadband services.

GSA has acknowledged LTE as being the fastest developing mobile communications system technology ever. The number of operator commitments to deploy LTE networks which were announced in the 12 months following the fi rst commercial LTE network launch was higher than for any other mobile communications technology in the same stage of development.

The pace of development and market introduction of LTE user devices is impressive. An update to the ‘Status of the LTE Ecosystem’ report published by the GSA on July 3rd, 2012 confi rmed that 67 manufacturers have announced 417 LTE-enabled user devices, with the number tripling year on year.

Compared to HSPA+, which is already a mainstream technology and the “workhorse” delivery system for mobile broadband, the pace of introduction of LTE user devices is faster. The total number of models of LTE terminals today is around 15 per cent higher than exists for HSPA+ despite the fi rst commercial LTE network going live ten months after launch of the fi rst commercial HSPA+ services.

It is encouraging to see how the LTE devices ecosystem already supports all market segments and form factors. However the main growth trend in 2012 is the launch of LTE-capable smartphones and tablets. The number of smartphones has increased by 73 per cent this year.

Most LTE user devices additionally support other widely available mobile communications technologies to ensure service when outside of LTE coverage. Typically this means support for WCDMA-HSPA or HSPA+ and GSM/EDGE, and/or CDMA EV-DO, and for TDD markets support for TD-SCDMA is becoming more common. Referring again to the July 3rd “Status of the LTE Ecosystem” report, 267 LTE devices also operate on either HSPA, HSPA+ or 42 Mbps DC-HSPA+ networks (as well as GSM/EDGE). Within this fi gure, 109 LTE devices support 42 Mbps HSPA+ technology. A total of 126 LTE devices support EV-DO networks.

mainstream-lte

Support for “fallback” technologies is necessary in most markets for an acceptable customer mobile broadband experience. In North America, for example, devices used on the Verizon Wireless LTE network are also required to operate on the fi rm’s EV-DO network. According to GSA’s research (July 18th, 2012), every WCDMA operator today has invested in HSPA in their networks and almost 50 per cent of them have launched commercial HSPA+ networks. There are 472 commercial HSPA networks launched in 183 countries; this fi gure includes HSPA+ investments and 234 commercial HSPA+ networks are now in service in 112 countries.

In parallel to the signifi cant investments now being made in LTE roll outs, 90 operators have commercially launched 42 Mbps DC-HSPA+ technology on their networks, and GSA forecasts that at least 115 DC-HSPA+ networks will be in commercial service by end 2012. Can some conclusions be drawn? It is true that LTE is arriving into a globally successful and rapidly developing mobile broadband market. It is also true that past investments, for example in HSPA and HSPA+ systems, won’t be discarded.

Many operators are investing in both HSPA+ and LTE technologies together. CDMA operators, especially in North America, are investing heavily in LTE as the mobile broadband technology of choice and currently claim the majority of the world total of LTE subscriptions. The balance will change as the pace of network deployments outside North America quickens— primarily in Europe and Asia—as substantial amounts of new spectrum for LTE come into use.

Key factors in the more limited progress of LTE in Europe have been the widespread coverage and availability of very efficient HSPA and HSPA+ systems, the economics and vast choice of HSPA user devices (almost 4,000 products) and the piecemeal way in which new spectrum has been allocated in the region. This is in stark contrast with the USA for example, where the early transition of broadcast TV services from analogue to digital transmission technology and the subsequent auctioning of new spectrum as the digital dividend, in a desirable part of the spectrum (700MHz), secured their headstart with LTE rollouts.

In Europe, the switchover to digital TV service is almost complete. The UK will be the last of Europe’s major economies to auction and allocate new spectrum for LTE, which is expected to be completed by end 2012. New spectrum in 2.6 GHz (3GPP band 7) which is ideal for high-capacity requirements in dense urban environments, and 800MHz (band 20 Digital Dividend) with its excellent long-range and building penetration capabilities, has now been auctioned and allocated in several European countries which will drive forward LTE deployments and investments in the region.

Many operators are seizing the opportunity to use 1800MHz spectrum (band 3) for LTE deployments (LTE1800). In all regions except North America, this band was originally allocated for GSM. It is often contiguous and partially under-utilized, meaning that operators typically have sufficient bandwidth to secure the full benefits of LTE. Providing initial widespread coverage with LTE in the 1800MHz band can be as much as 60 per cent cheaper than covering the same area using higher frequency bands. Its use can mean a faster time to market.

Operators will typically want to deploy LTE across a range of bands in order to maximise coverage and capacity, and to optimise cost structures. GSA joined in industry efforts with the GSMA, Telstra and others over a year ago to explain the benefits of using 1800MHz for mobile broadband—and LTE in particular. The campaign is aimed at device manufacturers, encouraging them to include LTE1800 in their roadmaps, and to regulators to allow re-farming for LTE deployments. New white papers from many manufacturers helped to explain the benefits and availability of solutions.

GSA published a report last November “Embracing the 1800MHz opportunity: Driving mobile forward with LTE in the 1800MHz band” which incorporated the insights of GSA member companies Ericsson, Nokia Siemens Networks and Qualcomm and pioneer LTE1800 network operators CSL Limited, Deutsche Telekom, Elisa, Qualcomm, StarHub, Teliasonera and Telstra. The situation today is positive: 32 LTE1800 networks are in commercial service, with many more deployments and trials in progress. 98 LTE1800 user devices are announced, giving ample choice and LTE operators in Europe are increasingly demanding support for LTE terminals in 800/1800/2600 MHz as well as HSPA/HSPA+ and GSM/EDGE.

With LTE heading towards the mainstream and infrastructure widely deployed by year-end, the focus will shift to return on investment, increasing efficiencies, developing new business models and generating revenue and profit growth.

Read more about:

DiscussionAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)