LTE is the fastest-growing wireless technology yet and it comes at a time when even the world’s poorest people have access to smartphones. However the global LTE picture remains highly fragmented, with no consensus on LTE bands, so is it desirable or even possible to make an LTE world phone?

September 1, 2014

As LTE’s global reach spreads, so does the feeling that a ‘world phone’—one that is compatible with all global LTE bands—would be a useful thing. Having to create separate Stock-Keeping Units (SKUs) for different countries and regions is especially inefficient for device vendors, but multinational operators, distributors and retailers would also benefit from knowing that a single device can be sold anywhere.

That such a clear win-win proposition for all mobile stakeholders, including consumers, has yet to yield an actual product betrays the harsh technical reality of creating an LTE world phone; it’s just not very easy to do. That’s not to say it’s impossible, but as with most technological challenges it has to be worth the effort—there needs to be some clear return on investment.

The core challenge involved in creating an LTE world phone is the fragmented state of the world’s LTE spectrum, with around 30 bands in total currently in use. While harmonization around, say, 5-10 bands would theoretically benefit everyone, the technology industry has a rich history of fragmenting to a self-destructive extent, as local considerations, financial vested interests and competing egos all combine to make everyone pull in different directions.

A good place to start the search for global LTE unity might be the leading mobile chipset provider. “The technical challenge of designing a universal LTE phone has been solved with the combination of our world mode modems/transceivers,” says Peter Carson, director of marketing for Gobi Modem and RF at Qualcomm, before putting the ball firmly in the operators’ court. “The absence of one simply reflects the lack of global LTE band harmonization among carriers, which in part will be driven by LTE roaming agreements.”

So while Qualcomm has technical solutions, as you would expect, they are still at the mercy of forces beyond their control, which is healthy. Sooner or later we all run into immutable laws of physics, no matter how big and influential we are, although Qualcomm does seem to be meeting this challenge head-on. “With every new generation of global LTE product, OEMs are designing in more bands,” says Carson. “Some QTI customers now have designs with 15 LTE bands or more, plus 4-bands of 2G and 5-bands of 3G.”

There seem, therefore, to be two disparate factors at work here: the will of the world’s operators to standardize around a small number of LTE bands and demand from device vendors to produce the mythical LTE world phone. “A device with all world LTE bands supported is a positive goal to look to achieve,” says Graham Wheeler, director of commercialization product management at smartphone specialist HTC. “When designing a device, while the chipset can usually support a number of bands, to enable all world LTE bands in one device creates significant challenges for antenna and hardware designers.”

And here we come to the nub of the matter from a device vendor’s perspective: nice idea, but is it worth the hassle? Of course it would make life easier for device vendors if they didn’t have to produce unique SKUs to cater for every different LTE environment they operate in, but if the cost of producing a world phone exceeds the savings it generates then it’s a hard thing to justify. Yes, it would be nice for consumers to know they could theoretically roam anywhere in the world, but that’s unlikely to register as a key differentiator.

The 9th annual LTE Asia conference is taking place on the 23rd-25th September 2014 at the Marina Bay Sands, Singapore. Click here to download a brochure for the event.

Phil Kendall, executive director at industry research house Strategy Analytics, is acutely aware of the challenges surrounding the ‘long tail’ of LTE bands. “We have a situation where the economics of supporting the long tail of frequency bands on an LTE phone are not great,” he says. “Bands 3, 7 and 20 (in particular, band 3) have become quite popular globally for networks, but there is also a very strong need to support the somewhat fragmented picture of band configurations at 700MHz and also the AWS band for some of the Americas. Beyond that, there is not going to be the critical mass of operators placing orders for more “niche” bands.”

Does Kendall agree with Qualcomm, then, that it’s the operators that hold the whip-hand in this matter? “There are certainly players with enough scale to warrant the near-unique support (China Mobile, AT&T and Verizon Wireless have all influenced specific device configurations), but that does not necessarily mean even those requirements make it into a universal world phone. As such, it would really take the device vendors in the middle of the value chain to set the agenda on an LTE world phone—using economies of scale in ordering one chipset supporting a larger number of bands, rather than multiple chipsets supporting fewer bands.”

So, to summarize the story so far: the component guys think it’s an operator problem, the device vendors identify components as a technical bottle-neck and the analysts think it’s down to the device vendors to set the agenda. Clear enough?

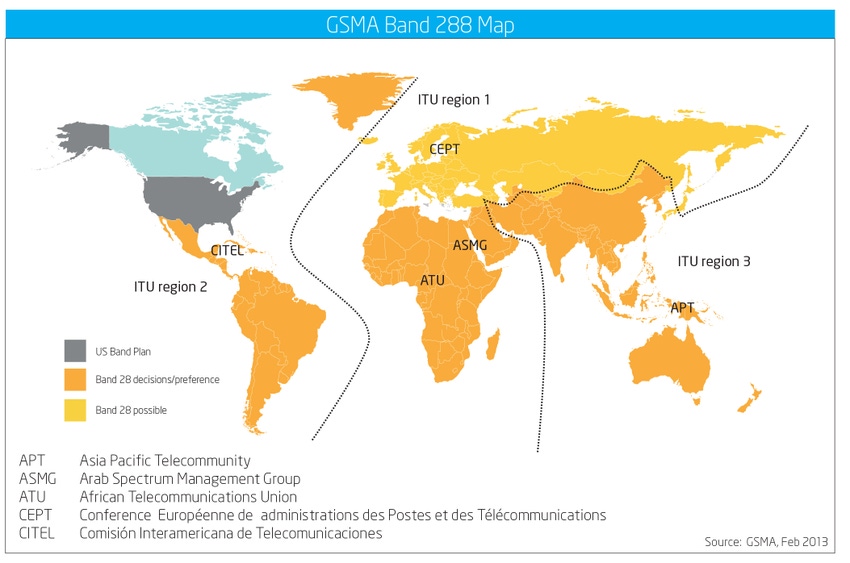

One solution to this problem that has been in discussion for several years now is APT700 (band 28)—an initiative promoted by the Asia Pacific Telecommunity (APT) that aims to harmonize LTE services around the 700MHz band. Put simply, if every country/territory supported the APT700 band, then a phone that also supported 700MHz would therefore be an LTE world phone.

“Over the past 12 months industry and market support for the APT700 band plan has been building and great progress is being made,” says Alan Hadden, president of the Global Mobile Suppliers Association. “700MHz is an excellent frequency for wide area coverage in regional and rural environments, and for penetrating homes and buildings, and is an important digital dividend arising from the shift by TV broadcasters from analogue to digital transmissions. More needs to be done in those markets where the transition to digital TV has not yet been completed, to overcome regulatory delays. APT700 is the clear direction and goal for achieving near-global spectrum harmonisation for LTE, the greatest economies of scale, the lowest user terminal costs, and the broadest mobile broadband access.”

If history is any guide, efforts to get the entire world to pull in the same direction are likely to be, at the very least, challenging. Not only are there the inevitable competing interests, disparate entrenched habits, and cultural barriers, there’s the small matter of whether or not this spectrum is even available. In many cases 700MHz spectrum has been made available when legacy, analogue TV signals, which were broadcast over that frequency, were turned off.

But each country has a unique agenda and timetable for that process so, even if you got everyone in the world to agree that APT700 is a good idea, we might still have to wait several years for the spectrum to become globally available. Latin America, for example, has also shown a keen interest in the APT700 concept, but it will be a few years before some Latin American countries switch of their analogue TV signals and free-up the requisite spectrum.

Qualcomm’s Carson concedes that quite a few LTE bands are likely to be necessary for the foreseeable future. “These [roaming] agreements and the ensuing global band harmonization will take at least a couple of years. Given that many LTE operators have deployed 2-3 LTE bands already and perhaps more in the future, global roaming devices will not necessarily need to support all ~30 LTE bands, but the number is likely to be above 20.”

This just adds to the challenges faced by device vendors, especially those that focus on smartphones.

The 2nd annual LTE Africa conference is taking place on the 11th-13th November 2014 in Cape Town, South Africa. Click here to download the brochure for the event.

Right now the global smartphone industry is dominated by two players: Apple and Samsung. Since the launch of the iPhone back on 2007, Apple has done a great job of owning the highest price tier of the smartphone market by exploiting its strong brand, unique software and superior app developer ecosystem to convince many consumers the premium price of an iPhone is worth paying. Much of the current global smartphone growth, however, is coming from developing markets where the majority of the population simply can’t afford an iPhone.

This is where Samsung has performed especially well, combining an extensive device portfolio covering all price tiers with a massive marketing budget and blanket distribution to ensure they have a smartphone for everyone.

Apple and Samsung’s two-pronged attack has left few crumbs on the table for the other smartphone vendors, despite most of them consistently producing very high quality hardware. One consolation for the chasing pack is potentially China—the world’s largest smartphone market and its growth engine for the past couple of years—where neither Apple nor Samsung are as dominant as they are elsewhere. However, local vendors such as Huawei, Lenovo, Coolpad and Xiaomi have been growing sales rapidly in China on the back of close ties with local manufacturers, good distribution and localized content.

Between them Apple and Samsung account for nearly all of the profit generated by the global smartphone industry and most global growth is currently being grabbed by lean Chinese vendors such as Lenovo and TCL Alcatel. Traditional smartphone powerhouses such as Nokia, Sony, HTC and LG have to concern themselves first and foremost with generating a profit, and only then with the complexities of international standards arrangements.

“When we launch a device in EMEA, we need to tune the sensitivity of the European bands so that they are able to hold calls and signal for all conditions and this requires physical space on the device,” says HTC’s Wheeler. “If we were to add more LTE bands it would either mean more physical antenna space needed in the structural design or reduced sensitivity of the bands supported ( i.e. losing LTE signal more easily).” In short; there’s no point in covering more bands if that’s to the detriment of the overall user experience.

The 7th annual LTE North America conference is taking place on the November 18th-20th 2014 at the InterContinental Hotel, Dallas, Texas, USA. Click here NOW to download a brochure for the event.

Before your average smartphone vendor can allow itself to worry about the LTE roaming capabilities of its devices it needs to work out how to sell a few more of them and how to avoid making a loss in so doing. Things are moving in the right direction in terms of components and LTE band harmonization, but if the rest of the industry wants that crucial device vendor buy-in it looks like they need to make it even easier to produce an LTE world phone.

Read more about:

DiscussionAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)