Almost every Latin American mobile operator launched 3G services in 2008, as the region's carriers scrambled to push data services in order to offset falling voice revenues and satisfy consumers' growing hunger for value added products.

June 26, 2009

Almost every Latin American mobile operator launched 3G services in 2008, as the region’s carriers scrambled to push data services in order to offset falling voice revenues and satisfy consumers’ growing hunger for value added products, new research has revealed.

According to statistics released by industry analyst Informa Telecoms & Media this week, there were more than 6.8 million active WCDMA connections across Latin America at the end of March 2009, an increase of 50 per cent in just one quarter.

Possibly the most striking growth of all has been in Brazil, where there were 3.8 million WCDMA subscriptions at the end of March 2009, up from 2.2 million three months earlier.

“We can expect that number to continue to accelerate, because America Movil has made it clear that its investment priority in the region for 2009 concerns its 3G network,” said Eva Benguigui, senior research analyst at Informa.

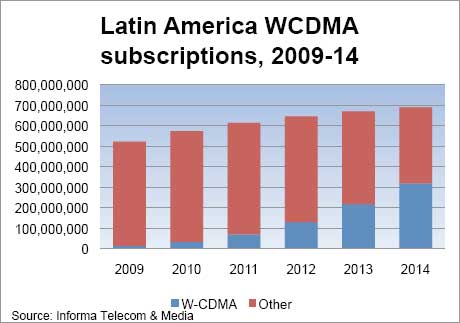

The analyst predicts that there will be more than 15 million WCDMA subscriptions in Latin America at the end of 2009, or less than 3 per cent of the total 522 million mobile subscriptions in the region. However, WCDMA subscriptions are forecast to grow to 320 million at the end of 2014, or 46 per cent of the region’s 689 million predicted total mobile subscriptions at that time.

“As more high-speed mobile networks are deployed and customers gain access to a wider variety of compatible devices, value-added data services will become increasingly important to mobile operators’ bottom lines,” said Tammy Parker, principal analyst at Informa.

While the region’s operators are focused primarily on 3G today, mobile broadband technologies such as HSPA, HSPA+ and LTE will be on their technology migration paths as they continue to expand next-generation services in order to offset falling voice revenues with higher data revenues, Parker said.

However, LTE deployments in Latin America are expected to be a challenge since spectrum is congested in many areas. “In Latin America, spectrum caps on operators and an overall lack of suitable spectrum for wireless broadband threatens to hold back mobile broadband deployment in some markets,” said Parker.

latamstats

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)