Touchscreen handsets are driving a decline in the value of the UK’s mobile market, according to research released this week.

November 4, 2009

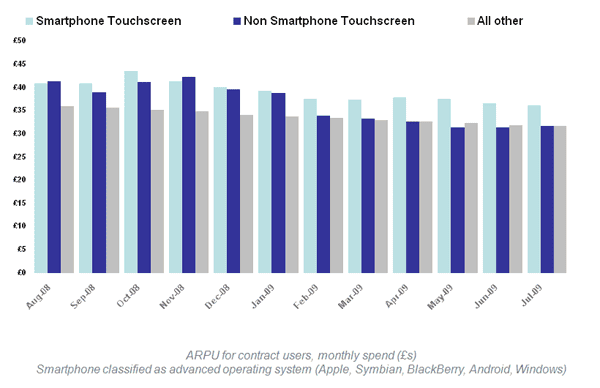

Touchscreen handsets are driving a decline in the value of the UK’s mobile market, according to research released this week. A new generation of non smartphone touchscreen mobile phones have brought about a significant drop in the value generated from UK bills, according to research from TNS ComTech, with users of non-touchscreen handsets spending 12 per cent less per month than they were last year, while the comparable decrease amongst users of non-smart touchscreen handsets is almost double at 23 per cent.

Since the launch of the original iPhone in 2007, touchscreen technology has taken the mobile market by storm and today touchscreen phones account for almost half (43 per cent) of all UK sales. However, the technology has filtered down the value chain and non-smart cheaper touchscreen devices like the Samsung Tocco and the LG Viewty are accelerating the decline in contract average spend per user (ARPU), which is now 13 per cent lower than it was this time last year, the height of the recession.

Users of non-touchscreen handsets are spending 12 per cent less on using their mobile per month than they were last year, but the comparable decrease amongst users of non-smart touchscreen handsets is 23 per cent, according to TNS. The result is severely squeezed margins for both carriers and handset manufacturers.

In stark contrast, ARPU among touchscreen phone users with advanced operating systems, such as Apple’s iPhone and BlackBerry’s Storm, is up by an average of £5 per month.

The research house’s study reveals that consumer misunderstanding is to blame, with consumers not aware of the difference between a phone with an advanced operating system and a touchscreen phone with a basic operating system. As long as a phone looks like a high end smartphone, the average Brit will think that it is one and go for the cheapest deal they can find.

While this may mean operators are able to grow their customer base, by offering touchscreen handsets, they will be doing so at the expense of their margins.

Paul Moore, director at TNS ComTech, said: “Although it is all too easy to attract value driven customers with non-smart touchscreen phones, carriers and manufacturers alike need to think long and hard about their handset portfolio and the effect that handset types are having on customer value. They should take care to educate consumers about the differences between operating systems and not simply punt phones that drive volume sales but contribute negatively to value. Conditions in the mobile market are tough and will remain so for some time. It is up to the industry to find long term solutions to better engage consumers rather than quick fixes that will escalate the drop in the value of the market.”

tns-touch

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)