Android really is shaking up the smartphone space, if the latest figures from analyst house Gartner are anything to go by. The operating system took a significant chunk out of Symbian’s market share during the third quarter of 2010 and steamed ahead of the iPhone and BlackBerry platforms.

November 11, 2010

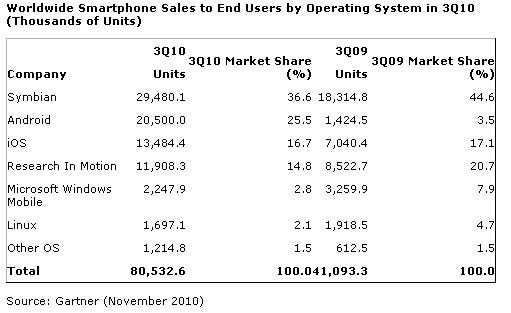

Android really is shaking up the smartphone space, if the latest figures from analyst house Gartner are anything to go by. The operating system took a significant chunk out of Symbian’s market share during the third quarter of 2010 and steamed ahead of the iPhone and BlackBerry platforms.

The definition of a smartphone can be a little vague, but nevertheless, Gartner said that the third quarter of 2010 produced record sales of more than 81 million devices based on open operating systems – smartphones. Android accounted for 25.5 per cent of worldwide smartphone sales, making it the number two OS behind Symbian and particularly dominant in North America.

Gartner estimates Android phones accounted for 75 per cent to 80 per cent of Verizon Wireless’s smartphone trade in the third quarter. Android benefits from appeal across a range of high end devices like the Samsung Galaxy S down to those targeted at lower prices like the sub-£100 Android phone from ZTE and Orange in the prepay UK market.

“Google is maintaining a fast pace of OS updates. Each version brings new features and polish to Android, and the level of innovation is a major differentiator,” Roberta Cozza, principal research analyst at Gartner.

Apple however, also performed extremely well thanks to the iPhone 4. Relationships with multiple partners gave Apple wider channel reach internationally, and the strong ecosystem around iTunes and the App Store continued to help. Apple’s share of the smartphone market surpassed RIM in North America to put it second behind Android. In Western Europe, iPhone sales doubled year-on-year, making Apple the third-largest vendor behind Nokia and Samsung in the overall devices market.

“Smartphone OS providers have entered a period of accelerated platform evolution, stimulated by more regular product releases, new platform entrants and new device types,” said Cozza. “Any platform that fails to innovate quickly — either through a vibrant multi-player ecosystem or clear vision of a single controlling entity — will lose developers, manufacturers, potential partners and ultimately users.”

In general, worldwide mobile phone sales to end users totalled 417 million units in the third quarter of 2010, a 35 per cent increase from the third quarter of 2009, with smartphones accounting for 19.3 per cent of overall mobile phone sales.

Although the top three worldwide mobile device manufacturers Nokia, Samsung and LG remained the same – albeit with reduced market share – the third quarter saw Apple rise into the top five manufacturers, surpassing RIM for fourth place.

According to Carolina Milanesi, research vice president at Gartner, the rise of white box manufacturers from Asia has also helped the ‘Others’ section of the handset leaderboard, as a proportion of overall sales, increasing its market share to 33 per cent in the third quarter of 2010.

“This is having a profound effect on the top five mobile handset manufacturers’ combined share that dropped from 83 per cent in the third quarter of 2009 to 66.9 per cent in the third quarter of 2010,” said Milanesi.

In the third quarter, Nokia sold 110.4 million units into the channel. This resulted in a market share decline of 8.5 percentage points from the third quarter of 2009. Samsung had a strong third quarter, as mobile phone sales reached 71.7 million handsets in the third quarter of 2010, up 18.2 per cent from the third quarter of 2009. However, its market share experienced a slight decline to 17.2 per cent in the third quarter of 2010. LG sold 27.5 million mobile devices, as its global market share dropped to 6.6 per cent. Apple delivered a stellar performance, selling 13.5 million units. It could have sold more but for its ongoing supply constraints and is now in fourth place worldwide. RIM meanwhile, sold 11.9 million devices, and its global share of the smartphone market fell to 14.8 per cent and the company lost its leading smartphone market position to Apple.

3q10-smartphones

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)