Australia’s incumbent fixed and mobile operator, Telstra, is targeting the health sector with services to be deployed in the next year or two. Its strategy has been formulated by a cross-company team that aims to deepen the operator’s involvement in the health sector and incorporate all of its core telecommunications products, in particular expanding on the existing customer relationships owned by Telstra Enterprise & Government and Telstra Business.

July 4, 2011

By joanne lowe

Australia

Australia’s incumbent fixed and mobile operator, Telstra, is targeting the health sector with services to be deployed in the next year or two. Its strategy has been formulated by a cross-company team that aims to deepen the operator’s involvement in the health sector and incorporate all of its core telecommunications products, in particular expanding on the existing customer relationships owned by Telstra Enterprise & Government and Telstra Business.

As the dominant player, Telstra is an early mover in the slowly developing Australian e-health market. But its competitors are increasingly aligning with the same strategic partners to offer services and the operator faces competition not only from other telecommunications companies but also from IT suppliers.

In July 2010 Telstra signed a memorandum of understanding with the Royal Australian College of General Practitioners to make a suite of national e-health services available to more than 17,000 GPs. It announced the first service as a web-hosted service, offering a range of health-specific applications, including clinical software and decision-support tools, aimed at preventing GPs from having to purchase different applications separately.

Target markets include a variety of healthcare providers and enterprises and, potentially, consumers. According to Telstra, products developed for one sector are often requested by another: MyGlucoHealth, a Bluetooth-enabled blood-glucose meter and application, was originally developed for the consumer market but, according to Izaak du Plooy, who is responsible for Telstra’s mobile health services, “it has found its home in the private health market, which identified the product as a key enabler for their healthcare plans for their members.” But reliability is essential. “The delivery of any product will only be successful if the products being delivered allow connectivity and communication between all the key participants,” du Plooy says.

The operator purports to meet a need that exists in the Australian health sector to stretch finite resources for an increasingly demanding, ageing population. “E-health has the potential to deliver significant productivity gains and improve patient outcomes,” says du Plooy.

Telstra is using proof-of-concept projects and trials, sometimes with technology partners, to demonstrate the capability and benefits of services to key industry decision-makers, such as state governments, the federal government and private-health-fund firms. Government incentives will heavily influence the scale and timing of the adoption of e-health, m-health and telehealth services and the operator is targeting these where there is an opportunity to pursue a widespread deployment and accelerate time-to-market.

According to Informa Telecoms & Media, Telstra is in a strong position to partner with key health players and deploy services, especially with its increased focus on content and services over network management, but it faces challenges in the e-health and m-health market at large.

Although the passing of the Health Identifiers Bill in 2010 (giving a unique ID to patients and providers) and the MoU between Telstra and RACGP suggest progress toward a workable e-health system, in reality the supporting structures behind, for example, electronic clinical consultation are not yet established. In fact, the RACGP has run a survey on its website to gather insight into how GPs think they might be remunerated for such services in order to “inform the College’s submission to the Department of Health and Ageing regarding the 2011-2012 federal budget.”

Yet the health sector presents an opportunity to deploy a range of core and innovative telecommunications services with large, long-term enterprise customers. The opportunity for services is timely, because, like its European and US counterparts, the Australian health sector is facing the problem of unmanageable demand by an aging and increasingly chronically ill population.

As a result, with its fixed and mobile assets and dominant market position, Telstra is in good shape to capitalise on any new revenue opportunities that exist in the health-enterprise sector. But although challenges such as remuneration structures are still not ironed out, such opportunities are unlikely to amount to a quick return on investment; they are more of a long-term proposition.

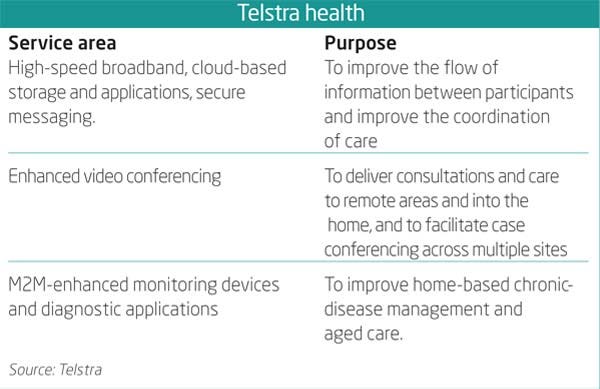

Telstra_health_chart

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)