A RIM shareholder has called on the Blackberry maker to begin a “value maximisation process” that may include the sale of the firm. The call comes from Jaguar Financial a Canadian merchant bank. The call comes from Jaguar Financial a Canadian merchant bank that holds shares in the firm, which said that process could involve either the sale of the company or a monetisation of the RIM patent portfolio by a spin-out to RIM shareholders.

September 8, 2011

A RIM shareholder has called on the Blackberry maker to begin a “value maximisation process” that may include the sale of the firm.

The call comes from Jaguar Financial, a Canadian merchant bank that holds shares in the firm, which said that process could involve either the sale of the company or a monetisation of the RIM patent portfolio by a spin-out to RIM shareholders.

The company cited various reasons as drivers for transformational change, such as RIM’s poor share price performance. There has been a decline in its share price since 2008, from $149.90 in June 2008 to $29.59 on September 2, 2011, representing a drop of around 80 per cent.

Jaguar also noted that RIM’s competitors have seen a significant increase in market share at RIM’s expense, both in the enterprise and consumer markets.

“While its rivals have demonstrated an ability to develop and market products with features that inspire consumer enthusiasm and drive higher adoption rates, RIM has clearly fallen short,” the company said in a statement.

“Its failure to offer products with innovative features, combined with its limited selection of applications, has resulted in RIM losing market share to its competitors.”

Another reason the bank wants fundamental change is because RIM has “failed to develop the multi-purpose device that meets the requirements of today’s consumer landscape.”

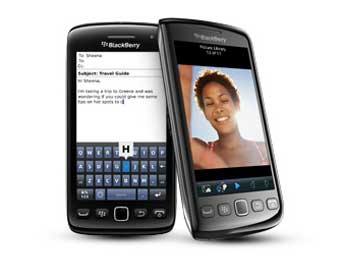

While the BlackBerry was once a market leader, it has now been relegated to number 3 in terms of market share behind Apple’s iPhone and Google’s Android phones. Jaguar attributes this decline in the company’s standing to execution delays, inadequate mobile applications, and the lack of a competitive product that addresses the needs of the consumer marketplace.

“The status quo is not acceptable, the company cannot sit still. It is time for transformational change. The directors need to seize the reins to maximise shareholder value before more market value is lost,” said Vic Alboini, chairman and CEO of Jaguar.

Malik Saadi, principal analyst at Informa Telecoms and Media, had words of advice for RIM, warning that the firm has become confused between value and volume.

“RIM has recently shifted its strategy towards low-end smartphones, such as the Blackberry Curve, targeting different segments and regions of the world. Its shift from a value to a volume manufacturer means that the company needs to gain better control of its manufacturing chain in order remain competitive in this low-margin landscape. In a region with relatively high labour costs, such as Canada, it is becoming increasingly hard to ensure large-scale production without affecting the overall cost of the device and time to market,” he said.

He added that a number of RIM’s partners are disappointed with the company as it struggles to honour its contracts both in a timely fashion and with the agreed scale.

“In short, the company needs to shift its manufacturing facilities to lower-cost and higher-scale regions in order to return to making good margins, while making sure it is timelier at getting its expected products and features to its partners,” said Saadi.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)