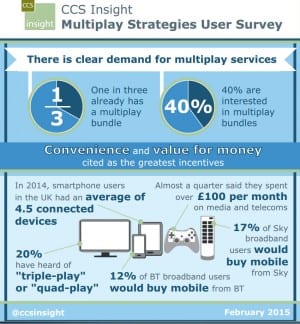

A survey of 1,000 UK consumers conducted by industry analyst CCS Insight has found two fifths of punters are considering subscribing to a multiplay communications service bundle, with a third already having done so.

February 3, 2015

A survey of 1,000 UK consumers conducted by industry analyst CCS Insight has found two fifths of punters are considering subscribing to a multiplay communications service bundle, with a third already having done so.

This implies a potential doubling of the market in the near future and confirms what UK telcos and content providers already strongly suspect – that multiplay is the strategic way forward. Sometime more specifically described as ‘triple-play’ or ‘quad-play’, mutliplay describes the bundling together of several previously distinct communications services such as fixed voice, broadband, mobile and TV.

The survey comes at a time of heightened M&A activity in this space, with BT looking to buy EE, Three looking to merge with O2 and Sky getting into the mobile game. The race is on to be the default multiplay provider, with BT in pole position from a fixed-line perspective, EE currently the largest mobile operator and Sky the dominant premium content provider. The BT move looks especially ominous for competitors since it has started acquiring premium content too.

“Companies are scared of missing out on a huge opportunity,” said Paolo Pescatore, analyst at CCS Insight. “With consumers telling us that it is more convenient and better value to buy broadband, mobile, TV and land-line access from one company, incumbent providers that can offer all these services are in the perfect position – it’s little wonder we’re seeing a frenzy of M&A activity as leading players scramble to secure these assets.

“Our research indicates that new entrants in the broadband market face a significant challenge in winning customers. Networks selling only mobile telephone services must take careful notice of this trend and should quickly offer their customers a broadband product to avoid being left behind. If they don’t move quickly they could haemorrhage customers to broadband providers offering a competitively priced mobile service within their bundles.”

“While most people who have multiplay bundles today are happy, there’s a significant minority – about one in five – who feel they aren’t getting sufficient value for money. This suggests that providers need to do a better job of explaining the cost benefits of multiplay services. We believe they should also be clearer about the tariff bundles they offer.”

Here are some other stats from the CCS survey. Keep an eye out for the imminent publication of the 2015 Telecoms.com Annual Industry Survey, which features the opinions of over 2,000 telecoms influencers on a wide range of industry topics.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)