Ericsson reported a healthy jump in profits for Q4 2015, despite flat revenue growth, which owes a lot to the lump sum Apple paid it to settle their patent dispute late last year.

January 27, 2016

Ericsson reported a healthy jump in profits for Q4 2015, despite flat revenue growth, which owes a lot to the lump sum Apple paid it to settle their patent dispute late last year.

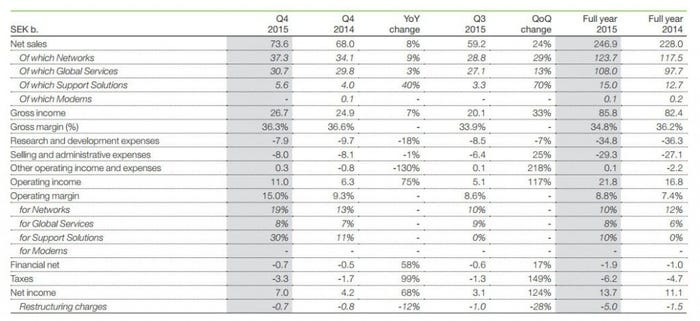

Reported sales were up 8% but after adjusting for currency and comparable units were down 1%. However operating margin improved and net income was up 68% year-on-year to SEK 7 billion. Other than the IPR win Ericsson pointed to a rebound in its mainland China business from its Q3 dip.

Overall it’s been a pretty strong quarter and the highlight is of course the licensing business,” Ericsson CFO Jan Frykhammar told Telecoms.com. “We have also had good traction in our cost-reduction and efficiency programme.”

Ericsson is not allowed to reveal the details of the Apple settlement so we asked Frykhammar if they break out the IPR business in their public reporting. “We break out the licensing business for the full year and in 2015 it came to SEK 14.4 billion compared to SEK 9.9 billion in 2014,” said Frykhammar. “In the quarterlies the majority of the business is in the networks and then there is a portion to support solutions. I don’t think we’ve ever changed the allocation keys and we have previously stated 75% to networks and the rest to support solutions.”

As you can see from the table below networks revenue was up by around SEK 3 billion and support solutions was up by around SEK 1.5 billion YoY. Frykhammar advised that part of that support solutions increase was down to a North American TV and media software deal. The jump in full year licensing revenue needs to be adjusted for currency and may not be entirely down to the Apple payment, so we’re probably looking in the SEK 2-3 billion range for Apple’s payment, which would equate to around US$300 million in today’s money.

To conclude we asked to what extent Ericsson is being affected by the current macroeconomic turbulence in China. The theme with our business in 2014 and 2015 has been the coverage deployments of 4G in mainland China,” said Frykhammar. “The slowness in Q3 was more related to management changes in our customers and from that point of view it recovered in Q4.

“We still think the theme will be 4G coverage in 2016 and you don’t necessarily see an impact on these kinds of projects from macro factors. Capacity types of investments are more linked to things like consumer demand.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)