The European Commission has formally announced its widely expected decision to block the proposed acquisition of O2 UK by Hutchison (Three UK).

May 11, 2016

The European Commission has formally announced its widely expected decision to block the proposed acquisition of O2 UK by Hutchison (Three UK).

At a press conference in Brussels EC Competition Commissioner Margrethe Vestager pretty much reiterated her previous public stance that effectively removing an MNO from the market is bad for competition and consumers and that the resolution of the two companies’ respective network sharing deals would be problematic.

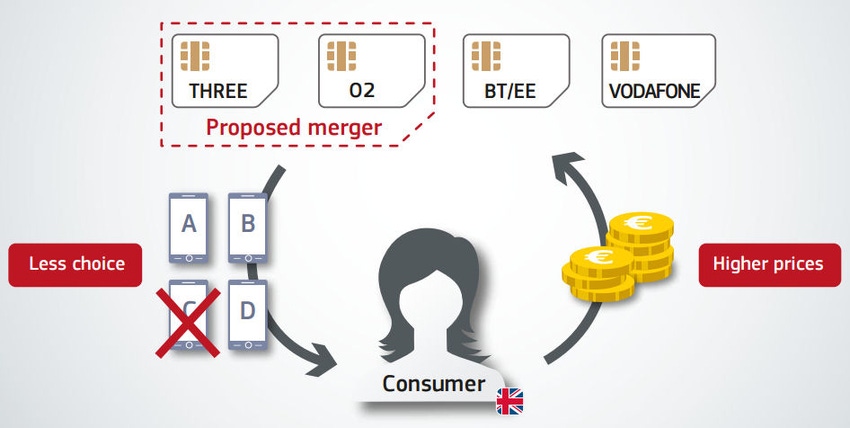

“Allowing Hutchison to takeover O2 at the terms they proposed would have been bad for UK consumers and bad for the UK mobile sector,” said Vestager. “We had strong concerns that consumers would have had less choice finding a mobile package that suits their needs and paid more than without the deal.

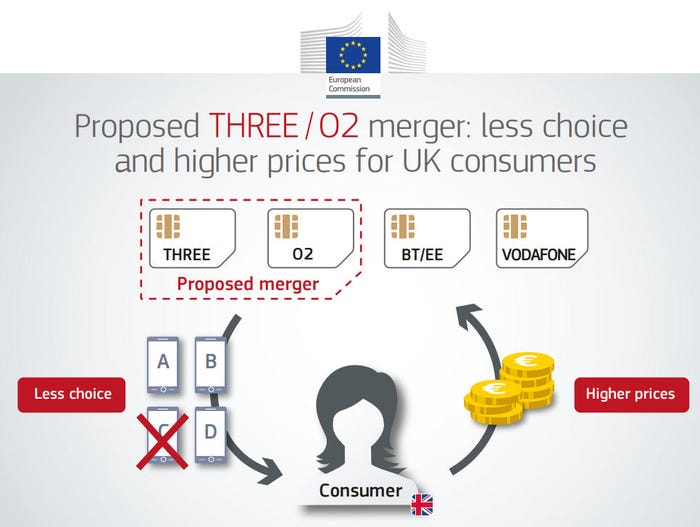

“It would also have hampered innovation and the development of network infrastructure in the UK, which is a serious concern especially for fast moving markets. The remedies offered by Hutchison were not sufficient to prevent this.”

Vestager was repeatedly asked if this decision reflects a broader stance that four MNOs are the optimal number in a given market, but she insisted this wasn’t the case and that she judges each case on its individual merits. “There is no magic number,” she said, and stressed this decision offers no precedent for the Three/Wind investigation. The EC even provided a couple of handy graphics for anyone still struggling with its rationale, which you can see below.

CK Hutchison was predictably displeased. “We are deeply disappointed by the Commission’s decision to prohibit the merger between Three UK and O2 UK,” it said in a statement. “We will study the Commission’s decision in detail and will be considering our options, including the possibility of a legal challenge.

“We strongly believe that the merger would have brought major benefits to the UK, not only by unlocking £10 billion of private sector investment in the UK’s digital infrastructure but also by addressing the country’s coverage issues, enhancing network capacity, speeds and price competition for consumers and businesses across the country and dealing with the competition issues arising from the current significant imbalance in spectrum ownership between the UK’s MNOs.”

Ofcom, however, was pleased. “We believe this is the right outcome for mobile customers, who have always been our priority,” said the UK regulator in a statement. “Three and O2 are important and effective competitors in the UK, helping to deliver innovation, investment and competitive prices over many years. Competition must be sustainable, and regulation should support it. We will aim to do so through tools such as market reviews or auctions of mobile airwaves.”

There were good arguments on both sides of the fence in this case. It’s undeniable that reducing the number of players in a market reduces competition, but less clear that, in this case, it would necessarily have been harmful to consumers. The extent to which the reduction in competition would have been offset by the greater investment power of the combined company is also unclear. The contrasting approval of the BT/EE acquisition, however, does imply a degree of dogma against reducing the number of MNOs, despite Vestager’s claims to the contrary.

Here’s a round-up of third party commentary on the decision, which is mainly critical.

Bengt Nordstrom, Northstream: “Today’s decision will not lead to the EU’s desired outcome for the UK mobile market. Continuing as things stand will not lead to more competitive prices and service choice for consumers. It also won’t encourage operators to continue investing in their mobile networks to deliver a high quality of service to customers.

“The market is heading in a direction where there will be two to three fully converged players per market, each offering fixed, mobile, broadband and TV services. Therefore the idea of Liberty Global acquiring O2 to merge with its Virgin operation makes sense.

“There are multiple synergies between fixed and mobile networks, which both rely on fibre for their underlying structure. By approving BT-EE but not Three-O2, the regulators – far from encouraging competition – are actually artificially skewing the market in favour of BT-EE.

“By maintaining a four operator national market, the EU is enforcing a law of diminishing returns for operators and investors – and also consumers, in terms of quality of service. At a time when operators and regulators should be working together in the build-up to 5G and the Internet of Things, the EU is only concerned with consumer pricing and preserving outdated market arrangements that don’t reflect commercial reality.”

Kester Mann, CCS Insight: “The collapse of the deal leaves both Three and O2 in a precarious position with uncertain futures in the UK. It also casts serious doubt over the future structure of a European telecoms sector that had banked on the tie-up paving the way to further consolidation.

“Although the Hong Kong company offered a range of concessions, its apparent preference to assist virtual providers or those with a heritage in fixed-line broadband or TV including Virgin Media, rather than facilitate a more mobile-focussed rival, may have been the undoing of the deal.

“After similar deals were waved through in Austria, Ireland and Germany, the European Commission has either been hugely inconsistent in its merger and acquisition policy or failed foresee the alleged negative impact in these markets that have already consolidated.”

Dan Howdle, Cable.co.uk: “When EE was formed from Orange and T-Mobile in 2010 it reduced the number of network operators in the UK from five to four, a number still regarded by Ofcom and the European Commission as able to provide a competitive enough marketplace to ensure reasonable pricing to UK mobile customers. Unfortunately, research by Ofcom has suggested that a reduction of four network providers to three will potentially send mobile contract prices skyrocketing.

“Likely, this will feel staggeringly unfair to O2 and Three, having watched as Orange and T-Mobile were allowed to do exactly what they are being denied, and then go on to become the dominant force in the UK mobile market. This ruling will almost certainly prevent any future merger attempts by UK network operators.”

Jonathan Bell, OpenCloud: “Later this summer, we’re expecting a similar decision from Brussels about the proposed merger of Hutchinson’s 3 Italia with VimpelCom Ltd.’s Wind Group in Italy. The European Commission is sending a clear message that such acquisition and market consolidation will not be allowed if it means reducing competition to less than four major players.

“Instead of relying on acquisitions, operators must work to better service their customers themselves. Consumers can expect to benefit from better network speed and coverage in the short term, but it is difficult to turn these into long-term differentiators. Operators will need to invest in the creation of unique value-added services for their business and consumer subscribers. This is a sustainable route to enhanced customer satisfaction and loyalty, as well as incremental revenue.”

Claire Cassar, Haud: “Despite the EU stressing its commitment to not overstretching licenses, the fact remains that if we want to boost investment, not to mention retain reliable and secure services, mergers such as this should be accommodated. However, despite Hutchinson making an extensive list of concessions to restore competition in the British mobile market, it wasn’t enough to dress the commission’s concerns.

“By rejecting this consolidation, the EU risks leaving operators exposed to reduced investment and as a result, a drop in the efficiencies in product research and development. Equally, fewer networks would ensure regulators can control the operator ecosystem more effectively, which could lead to fewer security breaches and better overall customer experience.”

Imran Choudhary, Kantar Worldpanel: “In the longer term the question of how sustainable a four-operator market structure is for the UK will be tested. As it becomes increasingly difficult for networks to generate revenue, the significant expenditure needed to facilitate growing data consumption is going to be more of a burden on both Three and O2. Customers are the ones who will suffer if the UK lags behind – the very opposite of what the regulators wanted.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)