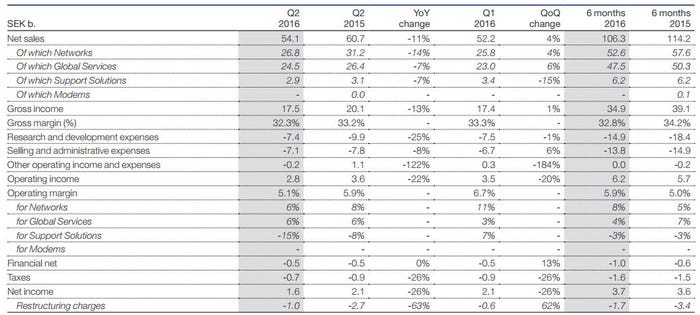

Swedish networking giant Ericsson has reported Q2 results that yielded an 11% annual fall in net sales. CFO Jan Frykhammar spoke to Telecoms.com to explain the results and what’s being done to improve them.

July 19, 2016

Swedish networking giant Ericsson has reported Q2 results that yielded an 11% annual fall in net sales. CFO Jan Frykhammar spoke to Telecoms.com to explain the results and what’s being done to improve them.

The underlying message was that it’s tough out there. We’re at a quiet phase of the network roll-out cycle in developed economies and in others, where there should still be growth, macroeconomic factors continue to work against Ericsson. With that in mind the company is looking to intensify its cost-reduction programme even further, mainly by cutting R&D spend.

“We had a quarter where we saw an acceleration of some of the negative industry trends we started to see in Q1, which are mainly related to mobile broadband investment in countries that have had major macroeconomic impact from oil price reduction, lack of hard currency, or both,” said Frykhammar. “You can take a basket of countries that are building 4G now that are all dependent on US dollar availability and so forth, and it’s tough in those countries at the moment.

“We are delivering on the cost reduction activities, but considering we think the kind of trends we saw in this quarter will prevail over the second half of this year we have initiated more actions to reduce the cost base and have doubled the existing operating expense reduction programme. On the more positive side we saw a recovery of the services business, where we had a weak Q1. We have been working hard to turn the project around and right-size the organisation and that has paid off.

With every passing quarter in which the numbers go in the wrong direction the pressure increases, especially on CEO Hans Vestberg, and there is growing media speculation about the security of his position. Frykhammar, however, insists the key right now is to consolidate and ride out the storm ahead of hopefully better times to come.

“Both Hans and I work 24/7 around the clock and give all our effort to make sure the company performs as well as it can,” he said. “We are not happy with the overall earnings level of the company, as we have stated many times, and that is also why we have taken the measures we have.

“Then, from time to time, you need to reflect on where the industry is at the moment and in that context 2016 is obviously a challenging year for mobile broadband, and therefore we have to take measures and actions. Our focus is for the business to be both strong today and strong tomorrow.

“If we set aside the fact that you can always have a challenging year, our strategy is to make sure we’re a leader in mobile broadband, whether it’s 4G, 5G, 6G, 7G or 8G. So we try to maintain a leadership position but, of course, we have competent competitors in Huawei, Nokia and so forth and that doesn’t come for free – we have to work hard on R&D and so forth in that space.

“We also try to improve the revenue we get from operators in their transformation new types of IT networks. In many parts of the world they have already built their 4G networks and now they’re into the transformation of the IT environments that support the networks – i.e. OSS/BSS – and we’re trying to create a leading position there, where we see Amdocs as one of our main competitors.”

Investors seem to be relatively sympathetic to this argument, with Ericsson shares only falling slightly despite missing analyst estimates. If trading conditions are tough it’s perfectly reasonable to ask investors to be patient, but the strategic transformation process has been underway for several years now and they will expect that patience to be rewarded eventually.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)