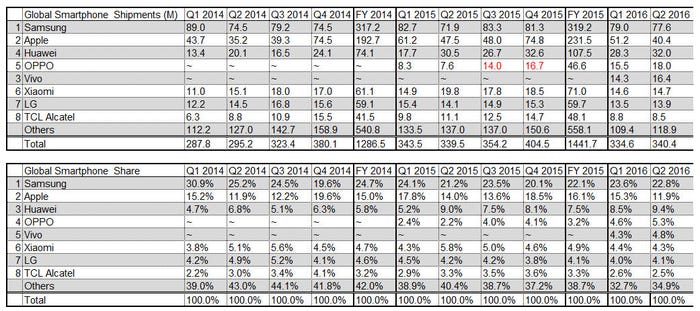

The global smartphone market just about dragged itself back to growth on the second quarter, according to Strategy Analytics, and now that the dust has settled here are the full collated vendor numbers.

August 9, 2016

The global smartphone market just about dragged itself back to growth on the second quarter, according to Strategy Analytics, and now that the dust has settled here are the full collated vendor numbers.

The Samsung Galaxy S7 devices are clearly faring better than their predecessors and as the owner of an S7, your correspondent can confirm it deserves this success. It’s a strong all-round device with an excellent screen and all the bells and whistles you’d expect. Of particular note, however, is the camera, which makes even the most dilettante photographer look like a pro.

SA reckons the premium Galaxy S7 Edge was the world’s top-selling Android device in the first half of this year with 13.3 million shipped, and the Korean giant accounted for the top three.

“The Samsung Galaxy J2 shipped 13.0 million units worldwide for second position in the Android category during H1 2016, followed by Samsung Galaxy S7 in third place with 11.8 million units,” said SA’s Woody Oh. “Samsung remains dominant and it currently accounts for the three most popular Android smartphone models worldwide. However, Samsung cannot rest on its laurels, because it continues to be chased hard by emerging rivals, such as the Huawei P9, OPPO R9 and Vivo X7 devices.”

Samsung’s gain seems to have been Apple’s loss, with the company experiencing another quarter of double-digit shipment declines. The iPhone seems to have hit one of its innovation plateaus, with the move to larger screens being its last throw of the dice for the time being. The next iPhone is rumoured to be another minor tweak, with the potentially divisive removal of the headphone jack the only noteworthy tweak.

The other major challenge faced by Apple is a significant decline in its Chinese fortunes, with revenues there down a third, year-on-year, which will have been mainly down to declining iPhone sales. Local vendors such as OPPO and Vivo are going from strength to strength, relegating even the mighty Xiaomi to fourth among the Chinese vendors globally.

OPPO shipped 15.2 million smartphones and captured a record 14 percent market share in China in Q2 2016,” said SA’s Neil Mawston. “OPPO’s smartphone shipments grew an impressive 108 percent annually. OPPO’s R and A series models have been well received in second-tier cities and rural areas of China. OPPO’s latest technology innovations, such as ultra-fast battery-charging, have also helped it gain more attention in top-tier cities such as Shanghai.”

“Vivo nudged up to third position for the first time ever with 12 percent smartphone market share in China during Q2 2016, up significantly from 7 percent a year ago,” said Oh. “The success of Vivo lies in good hardware designs, robust product quality, strong retailer penetration, and rising brand awareness among mass-market consumers. In contrast, Xiaomi had a weak quarter, falling 34 percent annually and shipping 12.8 million smartphones in China in Q2 2016. It slipped to fourth position with 12 percent marketshare, down from 19 percent one year ago. Xiaomi is facing tough competition in mid-tier segments from Huawei, Gionee, LeEco and others.”

“Apple posted a soft quarter in China, maintaining fifth position with 7 percent smartphone marketshare in Q2 2016, down from 9 percent a year ago,” said SA��’s Linda Sui. “Mixed demand for the iPhone 6s, overstocked volumes in channel from previous quarters, as well as stronger competition from Huawei, OPPO and others were among the key factors for its lackluster performance.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)