Reliance Jio Infocomm has revealed its long-awaited digital services portfolio and it looks set to seriously disrupt the Indian market with aggressive pricing and compelling multiplay packages.

September 2, 2016

Reliance Jio Infocomm has revealed its long-awaited digital services portfolio and it looks set to seriously disrupt the Indian market with aggressive pricing and compelling multiplay packages.

The company is part of Reliance industries, a massive conglomerate run by India’s richest man Mukesh Ambani. It was formed in 2010 and as a pan-India telecoms license as well as more spectrum than any of the incumbents. It has already invested over $20 billion on its nationwide network and is entering the market as a 100% 4G player.

The network is already live but won’t launch commercially until the end of the year. In the meantime the company has been selling millions of Lyf branded smartphones that can already access the network, entirely for free, effectively creating a massive beta test prior to commercial launch.

As well as the network itself, which initial reports indicate offers superior performance to any of the incumbents, the other major competitive advantages held by Jio are its pricing and its multiplay bundles. Telecoms.com spoke to Counterpoint Analyst Neil Shah, who is based in India, to get a sense of the significance of this development.

“India is one of the very few markets in the world with hyper-competition between more than ten mobile operators,” said Shah. “Reliance Jio enters the market as the twelfth, but as a greenfield LTE-only operator with an ecosystem of platforms, networks (mobile, fiber), devices, content and services, Jio comes with a complete vertically integrated play.

“This vertically integrated play with India’s largest hoarding of 4G spectrum, disruptive pricings for tariffs, 4G Lyf branded devices (sub-$40 to $400) and Jio branded apps, services bundle (Jio Chat, Jio News, Jio Play, Jio Moneyetc) and Reliance digital stores makes Jio truly disruptive compared to the current 11 operators.

“The tariff Jio has proposed is much lower than the incumbents – undercutting them – pushing the competition into a tough spot to even engage in a price war as they are already reeling under billions of dollars in debt.”

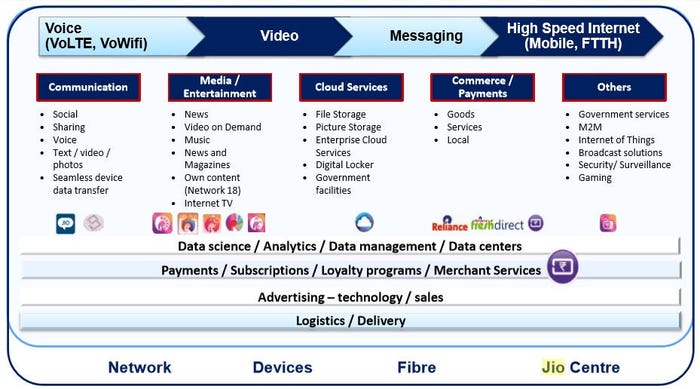

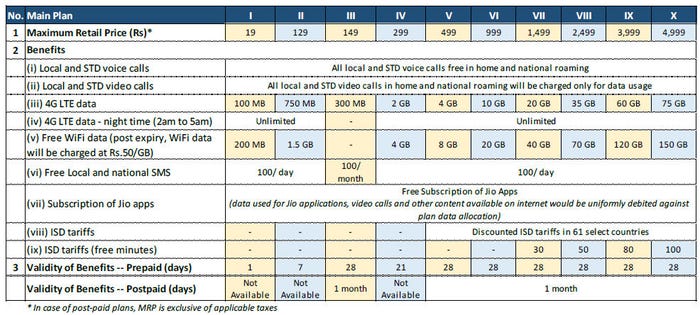

The tables below show first the Jio ecosystem of products and services and second the launch tariff table. Note voice will remain free even after the commercial taps are turned on and with the exchange rate of 67 rupees to the dollar even 10GB per month of data will only cost you $15. Jio is expected to be an aggressive bidder in the eventual 700 MHz auction which will allow it to operate in rural markets currently underserved by mobile.

This seems like a perfect competitive storm for the Indian telco incumbents, including current market leader Bharti and second placed Vodafone. Jio seems to offer a better network, with more added services at significantly lower prices than anyone else and, as Shah concluded, they’re going to have to drop their prices dramatically.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)