As rumoured mobile chip giant Qualcomm has decided to accelerate its diversification by dropping $47 billion on Dutch chip-maker NXP.

October 27, 2016

As rumoured mobile chip giant Qualcomm has decided to accelerate its diversification by dropping $47 billion on Dutch chip-maker NXP.

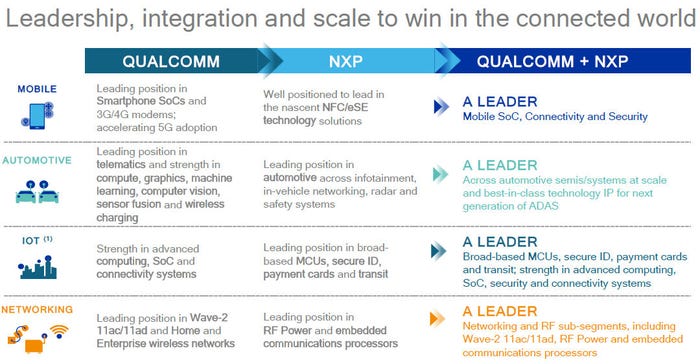

Generally associated with NFC chips, NXP also has solid positions in automotive, microcontrollers and a bunch of other embedded applications. Qualcomm is saying this acquisition – its biggest ever – will give it a leg up in the IoT world in general. It’s probably safe to say the Qualcomm account manager at ARM is now in a strong position to ask for a pay-rise.

“The NXP acquisition accelerates our strategy to extend our leading mobile technology into robust new opportunities, where we will be well positioned to lead by delivering integrated semiconductor solutions at scale,” said Steve Mollenkopf, CEO of Qualcomm.

“By joining Qualcomm’s leading SoC capabilities and technology roadmap with NXP’s leading industry sales channels and positions in automotive, security and IoT, we will be even better positioned to empower customers and consumers to realize all the benefits of the intelligently connected world.”

“The combination of Qualcomm and NXP will bring together all technologies required to realize our vision of secure connections for the smarter world, combining advanced computing and ubiquitous connectivity with security and high performance mixed-signal solutions including microcontrollers,” said said Rick Clemmer, CEO of NXP.

“Jointly we will be able to provide more complete solutions which will allow us to further enhance our leadership positions, and expand the already strong partnerships with our broad customer base, especially in automotive, consumer and industrial IoT and device level security.

“United in a common strategy, the complementary nature of our technologies and the scale of our portfolios will give us the ability to drive an accelerated level of innovation and value for the whole ecosystem. Such a strong fit will bring opportunities for our employees and customers, as well as provide immediate attractive value for our shareholders, in creating the semiconductor industry powerhouse.”

The trial balloon leak at the end of September may have given Qualcomm the positive market vibes it needed but may also have been expensive. The leak talked about a buying price of around $30 billion, which did seem cheap at the time. NXP shares have been trading at close to the eventual buying price ever since and Qualcomm’s are up a couple of percent since the announcement. Here’s why they think it’s such a great move.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)