Some of the biggest IPOs of recent years have been social media companies and Snapchat will be no exception, but it may be one dotcom gamble too many.

February 3, 2017

Some of the biggest IPOs of recent years have been social media companies and Snapchat will be no exception, but it may be one dotcom gamble too many.

Snapchat is hard to define. It’s essentially an instant messaging app that deletes messages soon after they’ve been sent, hence reducing inhibitions and encouraging frivolity. A signature feature of the app is the ability to easily manipulate images prior to sending, especially by cleverly superimposing cartoon characteristics on top of selfies.

This has made it very popular, with 161 million daily active users (DAU) visiting on average 18 times per day, but that doesn’t necessarily translate to revenue, let alone profitability. In 2016 holding company Snap managed $404 million in revenue, which was up an impressive 500% year-on-year. But acquiring that revenue seems to have cost over a billion bucks as the company made a loss of $514 million over the same period, despite only employing 1,859 people.

Investing in unprofitable dotcoms is far from unprecedented – just look at the late 1990s – but the recent experience of Twitter, which has failed to sufficiently turn its huge DAU numbers into hard cash, may result in this IPO falling short of expectations.

For this not to be the case Snapchat needs to demonstrate what the point of it is. It’s not a social media hub like Facebook, it’s not a public discussion forum like Twitter and it’s not a professional networking tool like LinkedIn, so what is it? And furthermore how much money is there to be made from helping teenage girls send each other pictures of themselves with bunny ears coming out of their head?

Quite a lot, is Snapchat’s insistence, especially as we move inexorably towards video communication. A big revenue stream is apparently serving video ads and, while the teenage market has some appeal, before long those will be young, salaried adults. There also seems to be some optimism that the platform can evolve into an ephemeral version of YouTube, with premium video content available at a price.

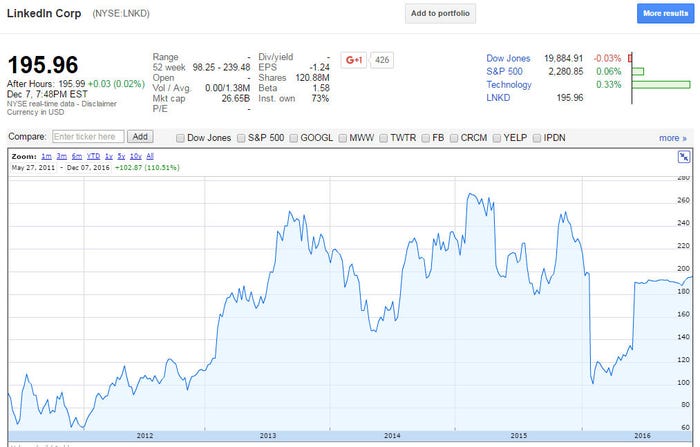

Below are the charts showing the performance of the major social dotcom IPOs so far. Facebook has done very well, in spite of disingenuous moaning from initial investors that the IPO price was too high. LinkedIn had more sedate progress until Microsoft grabbed it last year, but Twitter has proven a bad investment so far.

As ever with these big dotcom IPOs, especially for companies currently making a loss on not very big revenues, investment requires a bigger than usual leap of faith. The biggest danger of all is that Snapchat loses momentum as easily-distracted kids move on to the next cool IM platform, leaving Snapchat’s popularity looking just as ephemeral as its messages.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)