In a recent analyst briefing Indian telecoms market disruptor Reliance Jio revealed cornering the market in mobile data is the main plan.

March 6, 2017

In a recent analyst briefing Indian telecoms market disruptor Reliance Jio revealed cornering the market in mobile data is the main plan.

The briefing hasn’t been published by plenty of local media reported on it. The Economic Times said Jio expects India’s mobile market will expand by 50% over the next five years, during which time it expects to increase both its share of total market revenue and its EBITDA margins to 50% too.

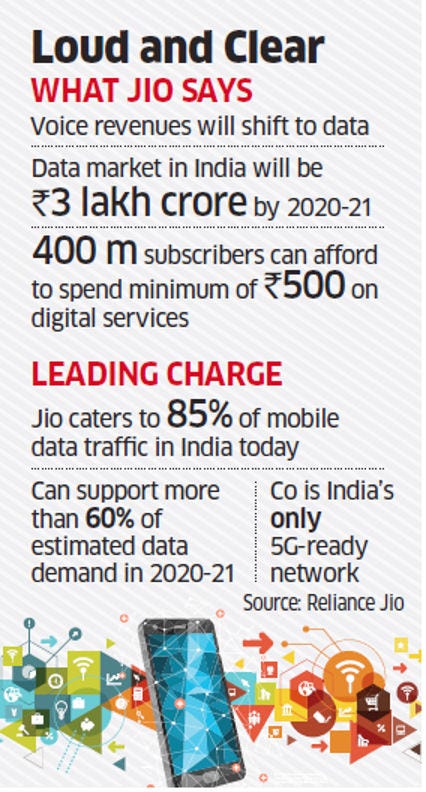

All this will come from dominating the Indian mobile data market, which is why Jio has been giving data away for free so far. This internet-style approach of acquiring traffic now then worrying about monetisation later has apparently given the company 85% of Indian mobile data traffic, as indicated in the Economic Times infographic below.

Forbes India has a detailed analysis of the briefing. It confirms that Jio is betting the Indian market will follow the trend in more mature mobile markets, with voice giving way to data as the primary commercial commodity. While it’s currently giving the stuff away, that will soon stop and Jio expects plenty of people to pay top rupee for more generous data plans.

There was apparently also a reiteration of the multiplay strategy Jio is adopting to extract more cash from its mobile data captive market. On top of content, financial services, etc mentioned late last year it looks like Jio plans to go big on consumer IoT propositions such as smart home, connected cars, etc. This is proper long-term thinking in a country where much of the population is still relatively impoverished.

Incumbent Indian operators, of course, are paying very close attention to everything Jio does. The Economic Time reports that Netflix has just signed deals with Jio competitors Airtel and Vodafone covering distribution and payment integration. It’s very possible that pressure from Jio is making deals like this happen more easily than they might have previously.

Ultimately Jio’s strategy looks like the freemium model on a very large scale. Very few people have deep enough pockets to give stuff away to over a billion people, then leave worrying about how to make money out of it later. Reliance Jio boss Mukesh Ambani is one such person and he looks set to dictate the nature of the Indian telecoms market for the foreseeable future.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)