With the telco industry constantly trying to recoup lost revenues the multi-play business model has become a hot industry trend, but is this diluting the service for the customer?

March 29, 2017

With the telco industry constantly trying to recoup lost revenues the multi-play business model has become a hot industry trend, but is this diluting the service for the customer?

It’s no secret that the telcos are swimming against the tide. OTT players such as WhatsApp and Signal are stealing the once lucrative business that was SMS and voice calls, and the broadband market is becoming cheaper for customers and more expensive for operators every day. Diversification is key, and one of the more popular routes is the content game.

A play for the content market can make sense, Sky after all has shown it can work the other direction. But the price to play is expensive. BT spent £960 million to show 42 Premier League games a year, for three years, and this is content which they don’t own. In three years’ time they could be out bid by Sky and be back to square one.

Aside from a cool billion for rights to distribute the content, they actually have to distribute the content, but also add value to the customer to ensure brand credibility doesn’t take a hit. This is where one of the most significant problems lies for Antenna Hungaria’s Henrick Schnieder; getting into the content game and doing it properly is an expensive bet.

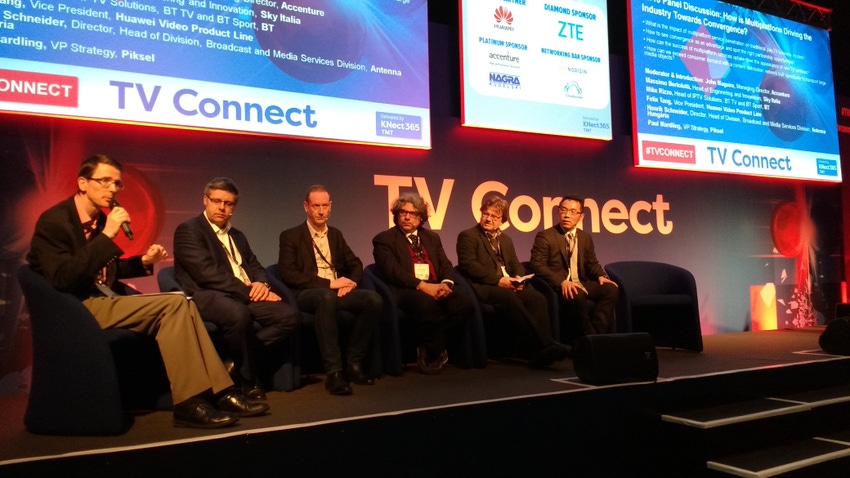

To play the content game right, you have to move away from the linear TV experience, according to Schnieder, speakling on a panel at TV Connect. You have to add value to the customer by providing the same experience across multiple platforms, while also adding in localization and interactivity. Interactivity can be varied depending on the device, and localization can be wasteful depending on cut-through. The technologies which underpin these strategies are complex and pricey.

So the question remains, where do you find the money? Advertisers are spending less, as platforms become more competitive and OTTs offer a more personalized solution. Consumers are fast becoming used to free content and unlikely to react well to increased subscriptions. Shareholders are also unlikely to be thrilled taking another hit on profit margins to fund these projects either.

True interactivity, localization and personalization still haven’t made a significant mark on the industry to date, but they aren’t that far away. For a convergence strategy to work, top service has to be offered through every aspect. If a customer drops TV, the price competitiveness of broadband and mobile doesn’t make as much sense when you add a Sky bill on top. They’ll probably just end up going to Sky.

The question remains as to whether the telcos are prepared to stump up the cash to ensure customer experience allows the products to compete with the digitally native alternatives. If not, this could be a very expensive mistake.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)