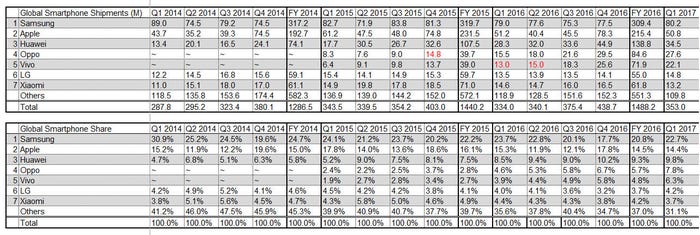

The Q1 2017 global smartphone shipment numbers are out and they show solid growth with nearly all coming from Chinese vendors, largely from their domestic market.

May 3, 2017

The Q1 2017 global smartphone shipment numbers are out and they show solid growth with nearly all coming from Chinese vendors, largely from their domestic market.

As a result the two big players – Samsung and Apple – continue to see stagnation in their shipments numbers. This is probably as good as Samsung could have hoped for given the Note7 disaster and it probably resorted to heavy discounting of other devices to keep the numbers up. Apple continues to struggle to match its 2015 highs, with intense competition in China from the likes of Oppo and Vivi probably the main reason.

LG overtook Xiaomi for the first time in a couple of years, reflecting its insulation from the Chinese market as well as solid products across the price tiers. Samsung is likely to put in a stronger performance from Q2 onwards thanks to the well-regarded Galaxy S8, but Apple is likely to continue to decline, putting extra pressure on its big Autumn launch.

Linda Sui, Director at Strategy Analytics, added, “Oppo shipped a healthy 27.6 million smartphones and maintained fourth position with a record 8 percent global marketshare in Q1 2017,” said Linda Sui of analysts Strategy Analytics. “Oppo grew 78 percent annually in the quarter, outperforming all its major rivals. Oppo is now just two percentage points of marketshare behind Huawei and closing in fast. If current trends continue, Oppo could soon be battling Huawei for third position in the global smartphone market.

“Vivo held fifth place, capturing a record 6 percent global smartphone marketshare in Q1 2017, leaping from 4 percent a year ago. Vivo’s range of Android models, such as the V3 and X7, are proving wildly popular in China, taking share from rivals such as Xiaomi, Samsung and Apple. Meanwhile, LG returned to 6th place with 4 percent global smartphone share, as it performed well in North America and leapt ahead of ZTE, Xiaomi and others.”

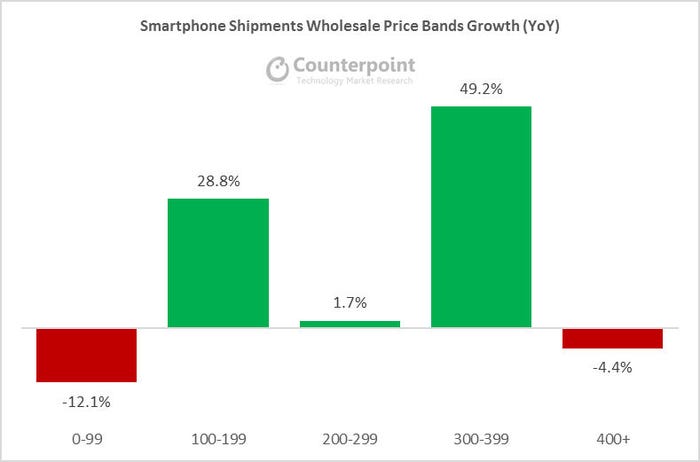

The $300-$399 average selling price band was the main growth driver according to research firm Counterpoint, with Oppo and Vivo especially strong in that area. It’s increasingly possible to get 90% of the functionality of a flagship Android phone for a fraction of the price and that is what continues to drive shipment growth.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)