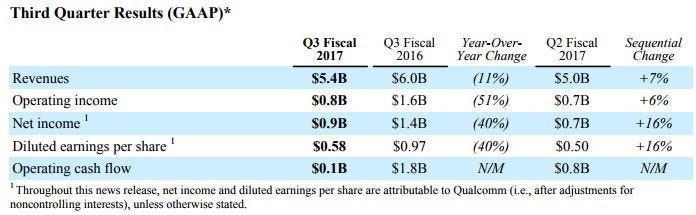

Legal aggro with Apple and BlackBerry contributed to a revenue decline of 11% and a profit plunge of 40% in Qualcomm’s latest quarterlies.

July 20, 2017

Legal aggro with Apple and BlackBerry contributed to a revenue decline of 11% and a profit plunge of 40% in Qualcomm’s latest quarterlies.

As you would expect Qualcomm accentuated the positive, dwelling on data points that exceeded expectations and trying to sound bullish about the Apple litigation. “We delivered better than expected results in our semiconductor business this quarter, which drove EPS above the midpoint of our expectations versus our April updated guidance,” said Steve Mollenkopf, Qualcomm CEO.

“Our products and technologies continue to enable the global smartphone industry, and we are expanding into many exciting new product categories, including automotive, mobile computing, networking and IoT. We believe that we hold the high ground with regard to the dispute with Apple, and we have initiated new actions to protect the well-established value of our technologies.”

Qualcomm accounted for $940 million refunded to BlackBerry for overpaid royalties and the payment of a $927 million fine imposed by South Korea. There was also reference to an unspecified licensee – probably Samsung – that withheld some royalty payments due to an ongoing dispute.

But the elephant in the room was Apple, which is not only withholding royalties itself but has managed to get its contract manufacturers to join the party. Reuters reports that Foxconn, Wistron, Compal and Pegatron have all filed antitrust actions against it.

“It is clear that Apple is controlling all of the contract manufacturers’ statement and actions in the litigation,” said Qualcomm President Derek Aberle on the earnings call. “If Apple hadn’t interfered with the licenses and instructed the contract manufacturers to take these actions, the contract manufacturers would not be contesting the licenses now.

“It is important to remember that in most cases our license agreements were negotiated and entered into with the contract manufacturers before Apple ever entered the smartphone market. And then Apple decided to rely on them for a decade, before now trying to disrupt them.”

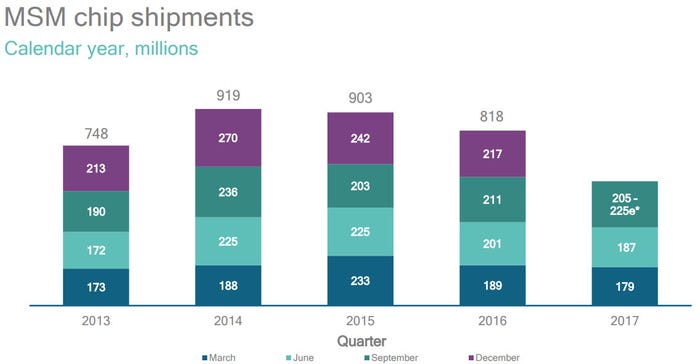

It’s hard see a timely end to this dispute between two of the most lavishly-lawyered companies in the world. Investors seem fairly sanguine about the situation, with Qualcomm shares down a couple of percent on the news, but it’s hard to avoid a sense of growing litigation risk for the world’s dominant mobile chip maker and, as you can see below, its underlying chip business seems to be headed in the wrong direction too.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)