Another quarter, another pretty average set of results, but Ericsson’s CEO insists there are signs of encouragement to be found if you look hard enough.

October 20, 2017

Another quarter, another pretty average set of results, but Ericsson’s CEO insists there are signs of encouragement to be found if you look hard enough.

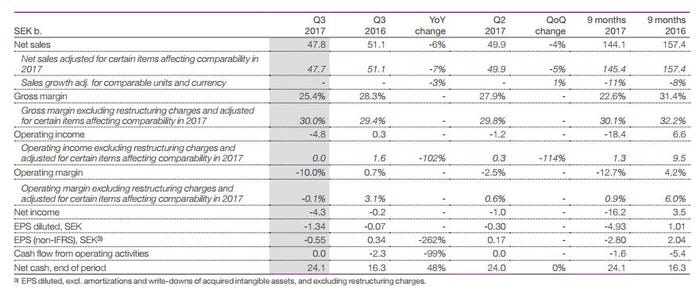

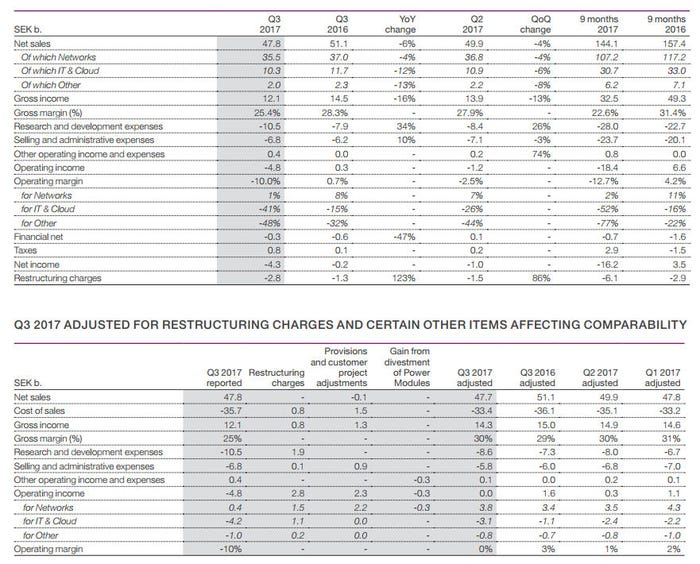

Overall sales declined -6% year-on-year, or -3% if you adjust for things. Networks sales were down -4% YoY but again, if you adjust for things, they actually grew! A lot of these adjustments, as you can see in the second table below, were for either restructuring (again), or a ‘rescoped managed services contract’ in North America, meaning that without them the company actually broke even in terms of operating income.

There seemed to be no such mitigation for another rubbish set of numbers from the IT and Cloud division, which saw sales decline -12% YoY and served up an operating margin of -41%. Other, which includes things like the media division that Ericsson is keen to offload, told a similar story, albeit with a fifth of the sales of IT and Cloud.

Unsurprisingly Ericsson CEO Börje Ekholm was keen to focus on the underlying positives from the networks division. “We continue to execute on our focused business strategy,” he said. “While more remains to be done we are starting to see some encouraging improvements in our performance despite a continued challenging market.

“Networks showed a slight sales growth year over year, adjusted for the rescoped managed services contract in North America and for currency. Networks adjusted operating margin was 11%. While losses continue in IT & Cloud, we see increased stability in product roadmaps and projects.

“We remain fully committed to our focused business strategy. We continue to invest to secure technology leadership and year to date we have recruited more than 1,000 R&D employees in Networks. Customers give positive feedback on both our long-term strategy and on our current 5G-ready portfolio.”

The market seems to be mildly encouraged by the underlying positive numbers in the Networks division, boosting Ericsson’s share price by 3% at time of writing. That’s fair enough because if Ericsson doesn’t get that division heading in the right direction everything else is irrelevant. The plight of IT and Cloud remains a major concern, however, as is Ericsson’s apparent inability to find a buyer for its Media interests.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)