Chinese smartphone vendor Xiaomi’s rollercoaster ride took another positive turn in Q3 2017 with shipments increasing by 73% year-on-year.

November 3, 2017

Chinese smartphone vendor Xiaomi’s rollercoaster ride took another positive turn in Q3 2017 with shipments increasing by 73% year-on-year.

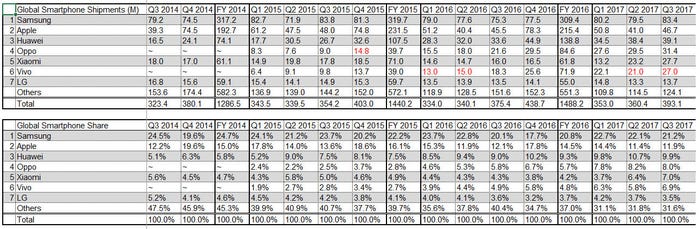

The overall market is looking surprisingly buoyant, thanks mainly to the Jio-inspired rush to smartphones in the massive Indian market, which currently has much lower smartphone penetration than China and developed markets. Strategy Analytics reckons the global smartphone market grew by 5% to 393 million units shipped in the quarter.

Among the vendors the biggest beneficiary of this growth seems once more to have been Xiaomi, which experienced is second quarter running of rampant growth. The big Chinese vendors – Huawei, Oppo and Vivo all experienced double-digit growth, Samsung seems to have recovered its mojo after the trials of the past year or so and Apple put in a solid performance, considering loads of people are probably waiting to get hold of the iPhone X. The big loser seems to be the long-tail as the global smartphone market increasingly consolidates itself around the top six vendors.

The global smartphone market has settled into a steady rhythm of single-digit growth this year, driven by first-time buyers across emerging markets of Asia and upgrades to flagship Android models in developed regions such as Western Europe,” said Linda Sui of SA.

“Xiaomi soared 91 percent annually, taking fifth place with 27.7 million shipments for a record 7 percent global smartphone marketshare in Q3 2017, up from 4 percent a year ago. Xiaomi’s range of Android models, such as the Redmi Note 4, is proving wildly popular in India, snatching volumes from competitors such as Lenovo and Reliance Jio. Xiaomi is outgrowing almost everyone, and if current momentum continues, Xiaomi could catch or overtake Oppo, Huawei and Apple to become the world’s second largest smartphone vendor in 2018.”

“Samsung shipped 83.4 million smartphones worldwide in Q3 2017, rising an impressive 11 percent annually from 75.3 million in Q3 2016,” said SA’s Neil Mawston. “This was Samsung’s fastest growth rate for almost 4 years. Samsung’s growth is being driven by strong demand for its A, J and S series models across Latin America, India and elsewhere. Apple grew a below-average 3 percent annually and shipped 46.7 million smartphones for 12 percent marketshare worldwide in Q3 2017, holding steady from the same level a year ago. Despite a delayed launch of the flagship iPhone X model, the new iPhone 8 portfolio was relatively well received in major countries such as Germany and China.”

One of the reasons the vendor picture is so fluid is that a lot of the volume seems to be coming from mid and lower-tier Android devices in developing markets like India. There you still have so much latent demand for smartphones that if a vendor is in the right place at the right time it can shift as many devices as Foxconn can churn out.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)