The first major update of Ericsson’s cunning plan since CEO Ekholm first unveiled it back in March painted a gloomy short-term picture.

November 8, 2017

The first major update of Ericsson’s cunning plan since CEO Ekholm first unveiled it back in March painted a gloomy short-term picture.

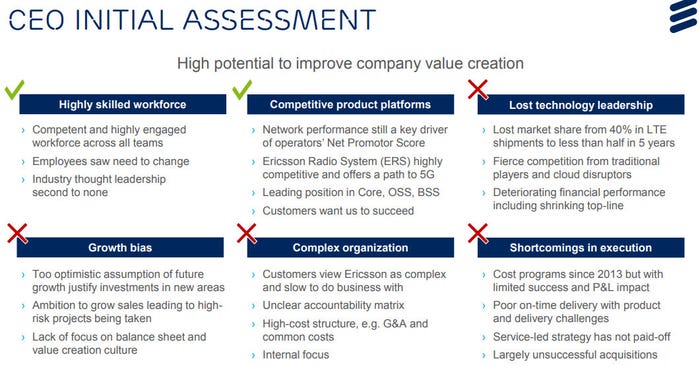

One thing you certainly have to give Ekholm credit for is his bluntness. So many companies make the mistake of trying to placate internal and external stakeholders by setting unrealistically bullish targets. When they inevitably miss these the resulting repercussions are usually far greater than if they’d just been honest in the first place.

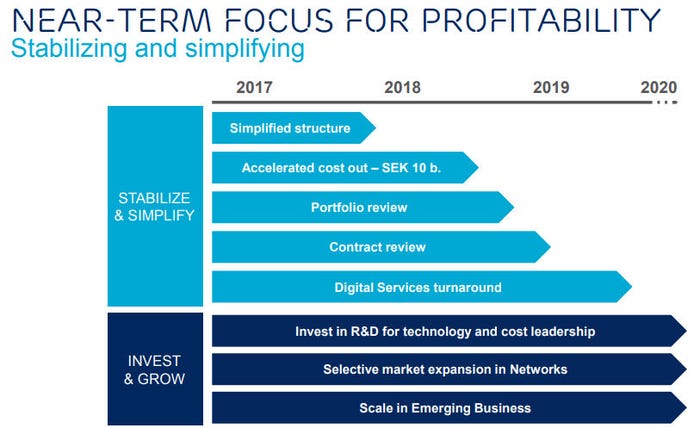

Ekholm seems determined not to make this mistake so he sensibly used his company’s Capital Markets Day to serve up all the crappy news in one go. The top line is that trading conditions for this year have been even worse than he feared previously, so as a consequence most of his other targets are being revised downwards.

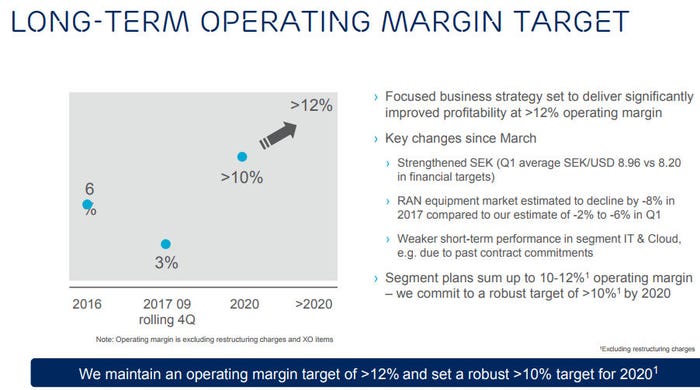

A headline March target was to reach a sustainable operating margin level of 12% by the end of 2018. Since the 2017 rolling margin is 3% that’s clearly not going to happen, so now Ericsson is aiming for 10% by 2020, with 12% a more vague, long-term target. The sales targets are pretty modest too, with an emphasis on profitability over growth meaning Ericsson is actually forecasting sales declines through to 2020.

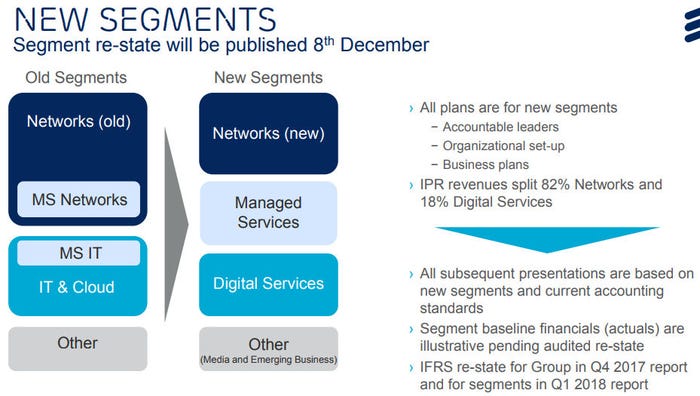

The table below breaks this down by group, including the newly-created Digital Services and Managed Services groups. It also seems to be leaving out the Broadcast & Media Services group entirely from its 2020 target, a part of the business Ericsson is increasingly trying to distance itself from.

2020 targets and planning assumptions

(see below under heading New financial reporting structure for details on new segment structure)

SEK b. | Networks | Digital Services | Managed Services | Other | Total | |

Target 2020 | Net sales | 128 – 134 | 42 – 44 | 20 – 22 | 3 – 5 | 190 – 200 |

Operating margin 1) | 15 – 17% | Low single digit | 4 – 6% | Breakeven | >10% | |

Baseline 2017 Q3 rolling 4Q unaudited and preliminary | Net sales | 133 – 135 | 41 – 43 | 24 – 26 | 7 – 9 3) | 211 |

Operating margin 2) | 13 – 14% | -15 to -17% | -4 to -6% | -57% to -62% | 3% |

1) Excluding restructuring charges

2) Numbers are excluding restructuring charges and extraordinary items

3) Including Media Solutions and Broadcast & Media Services

Note: All financial targets are based on USD/SEK at 8.20. USD to SEK movements has a direct impact on reported sales and income. If the USD to SEK weakens by -10% it has approximately 5% negative impact on topline and 1 percentage point on operating margin.

“Our job and commitment is to rebuild Ericsson to be successful long-term. Near term we will prioritize profitability over growth,” said Ekholm. “Healthy profitability is the base for long-term success and will give us the freedom and resources to invest for the long term.

“We have plans in place for all segments that combined sum up to an operating margin of between 10 – 12% by 2020, but since there are execution risks in all plans and we start from a weaker starting point than originally planned for, we prefer to be cautious and commit to the lower end of the range. Beyond 2020, we will drive continued improvements and capture upsides from innovation and emerging business to reach our ambition of at least 12% operating margin for the Group.”

You can see selected slides from the company’s presentations below. Having told investors not to get their hopes up for the next few years, Ekholm wanted to stress that if they sit tight, Ericsson’s focus on 5G should pay dividends in the long term.

“5G is not just another G,” he insisted. “Even though we are not planning for significant 5G sales before 2020, we are convinced it will create value for our customers in their mobile broadband business, enabling them to manage very high traffic growth.

“But even more important, it has the potential to create new businesses and revenue streams for service providers based on use cases such as industrial applications. With the combination of products and capabilities that we have in Networks and Digital Services combined, we are well positioned to support our customers’ network evolution to 5G.”

In an era dominated by quarter-to-quarter short-termism Ekholm deserves credit for daring to lay it on the line and say ‘this is going to take a while’. But he does seem to have fallen into the old corporate trap of ‘profit now, investment later’. The main problem with this is that when ‘later’ arrives, profit expectations have been heightened such that increased investment is resisted. It’s a delicate balancing act and Ericsson shares were down 3-4% at time of writing.

UPDATE – 09:00 9/11/17: In a further symbolic gesture towards the pariah broadcasting business unit, Ericsson has changed its name back to Red Bee Media, which was what it was called before Ericsson acquired it. This is supposed to symbolise a greater independence for the division but it’s hard to imagine Ericsson will permit it to deviate from the overwhelming strategic priority of getting flogged ASAP. We imagine morale within the embattled unit has received a boost from the news.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)