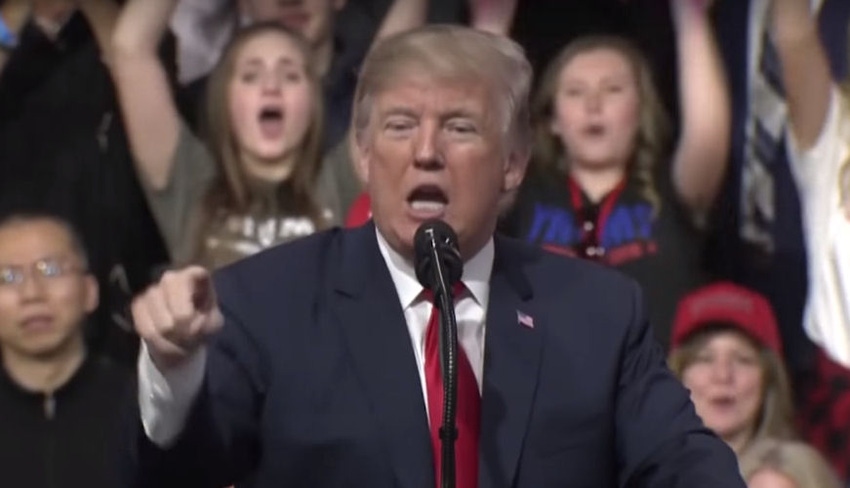

US President Trump is increasingly living up to his name by poking his nose into business deals, and has blocked Broadcom’s attempted acquisition of Qualcomm.

March 13, 2018

US President Trump is increasingly living up to his name by poking his nose into business deals, and has blocked Broadcom’s attempted acquisition of Qualcomm.

We previously reported that Qualcomm’s board seemed to have played a blinder by getting the Committee of Foreign Investment in the United States (CFIUS) involved in Broadcom’s hostile takeover bid for it. You didn’t have to be Niccolò Machiavelli to note that protectionism was a cornerstone of Trump’s Presidential campaign and, to be fair to him, he has followed through on that rhetoric.

The sudden stampede by various governmental agencies to be nice and protectionist and treat anyone who doesn’t have an American accent with sullen suspicion has served as a reminder of the power of patronage. If you want to keep your nice public sector position and maybe even get promoted, then you can do a lot worse than bang on about China stealing our jobs and generally playing dirty.

But it must surely have been beyond Qualcomm lobbyists wildest dreams for the Trumpmeister himself to decide to get involved. The US President has issued an Executive Order declaring “The proposed takeover of Qualcomm by the Purchaser is prohibited.” In the US an Executive Order is effectively an instant law, imposed by the President without having to bother with Congress, Senate, etc. It seems to be a legal fait accompli that is almost impossible to appeal.

The stated reasons for taking such strident action was that CFIUS advised Trump that the move “…might take action that threatens to impair the national security of the United States.” Furthermore Trump doesn’t reckon current law gives him sufficient authority to intervene, so he decided to play the Executive Order card.

On top of prohibiting the move the Order disqualifies any of the people Broadcom put forward for the Qualcomm board, which it was hoping Qualcomm shareholders would vote for at its AGM as their way of showing they approve of the acquisition bid, from standing for election. And just to make sure Qualcomm is also banned from accepting their nominations and CFIUS will be keeping a close eye on them both to make sure there’s no funny business.

And that, ladies and gentlemen, appears to be that. At time of writing Broadcom had restricted its response to the following statement: “Broadcom is reviewing the Order. Broadcom strongly disagrees that its proposed acquisition of Qualcomm raises any national security concerns.” It can review the order all it wants but short of going to legal war with Trump, it’s not obvious what options are available to Broadcom .

Scratching under the surface of the broad ‘national security’ issue reveals widespread concerns that Broadcom would have significantly cut back on R&D spend as part of its strategy to get maximum ROI from the acquisition. In turn it was feared that Chinese chip-makers such as MediaTek may have taken advantage of that.

There does seem to be some validity to this concern. Broadcom would have to borrow a silly amount of money to complete this acquisition as it does have a track record of aggressively cost cutting after an acquisition. Furthermore, if some reports from China are to be believed, even China Mobile had reservations about the potential loss of innovation resulting from the deal.

With Trump’s involvement, much of the commentary will now move in the inevitable partisan political direction. Buried under the noise will be some very legitimate questions around use of Executive Orders, what constitutes a national security threat and whether or not the US President has too much autonomy.

The delayed Qualcomm AGM has now been ordered to take place ASAP and it could get interesting. This whole situation seems to have been engineered by a Qualcomm board that didn’t fancy working under Broadcom, but there are bound to be Qualcomm investors who wanted to cash out. The board has won this game of M&A chess, but will now be under significant additional pressure to deliver value to its shareholders sharpish.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)